Bitcoin Futures market: Bakkt and CME traders bet against retail investors

Bitcoin markets, futures or otherwise, are suffering a dearth of volatility after dipping from $6,800 to $5,800. As price finds support at $5,900, there is a chance for Bitcoin to climb higher. With the traditional financial market in jeopardy due to the pandemic, liquidity has dried up. The same was observed with Bitcoin on March 13. The effects of this were seen even today in CME and Bakkt’s OI and volumes, which have plunged.

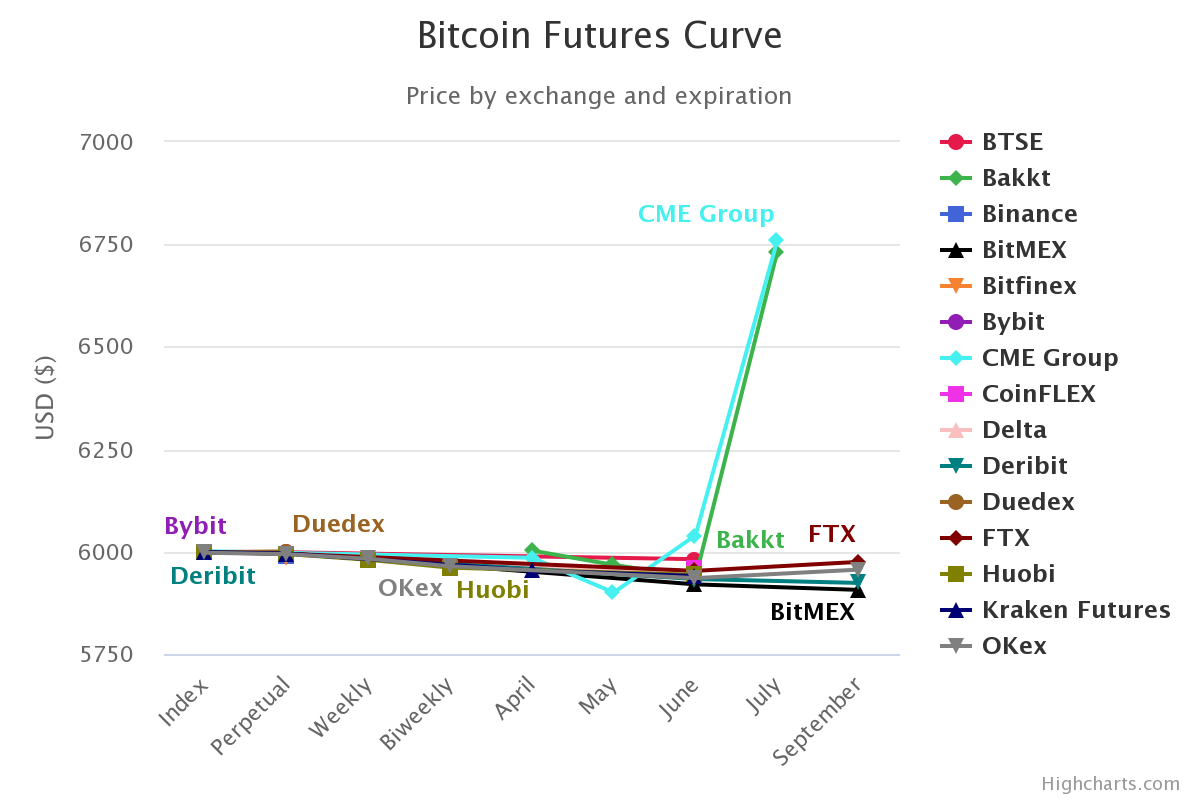

However, an interesting observation in Bitcoin’s futures market is that the institutions and retail are not in agreement with their orders. The institutions’ bets are skewed away from the retail players’ by $800.

Source: BitcoinFuturesInfo

Simply put, institutions are bullish on Bitcoin while retail players, not so much. The concern from the retail side is understandable, there is fear in the market, especially after the tragic collapse on ‘Black Thursday’.

Source: Alternative.me

At press time, the markets indicated extreme fear with the index pointing 10. In comparison with yesterday’s sentiment, the index has dropped 10 points, and perhaps it was due to the $800 drop. As it stands, Bitcoin is alternating at the $6,000 level.

State of Institutions

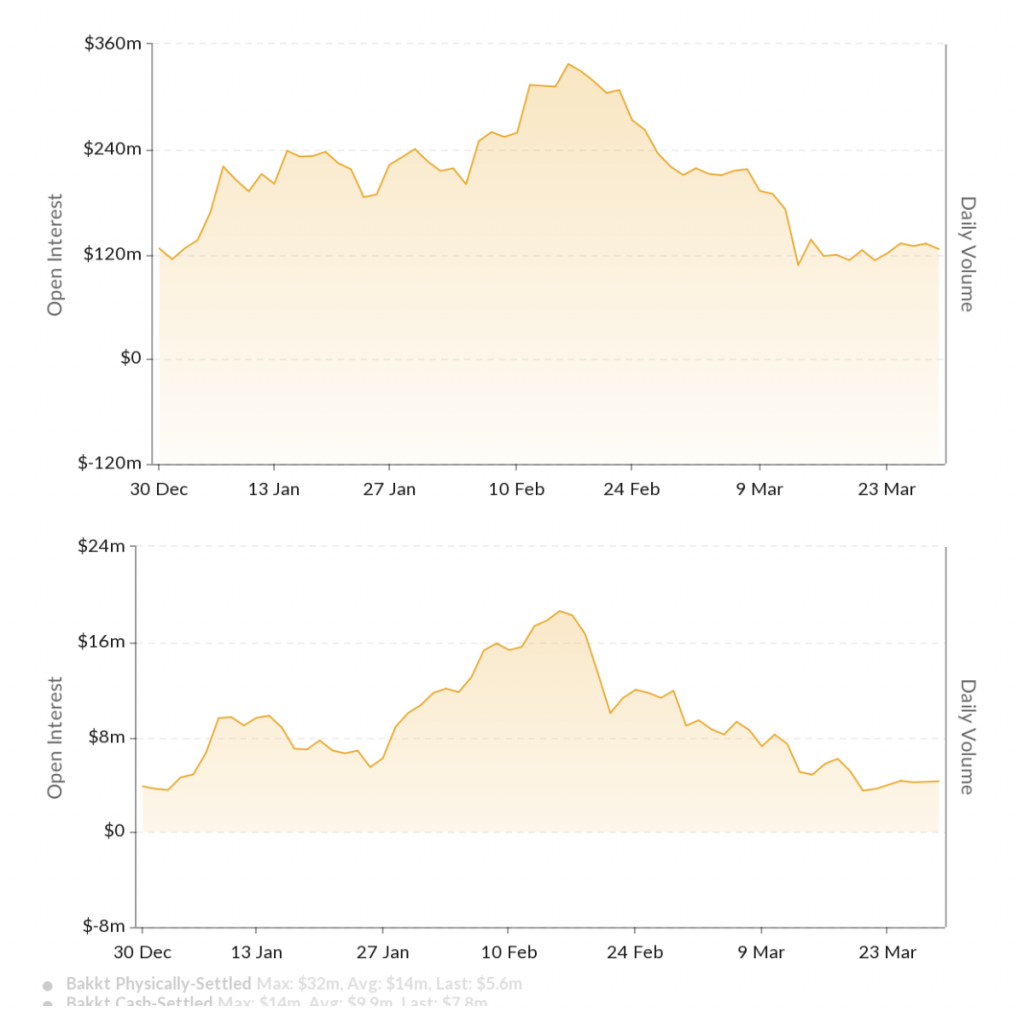

Source: Skew

With the recent sell-off, institutional investors feel safe holding cash and not Bitcoin, or even gold for that matter. The state of the markets can be summed up with the popular saying, “cash is king”. Cash is the most liquid asset and will help people get through tough times like these.

However, the fiscal stimulus by central banks across the world has alleviated the fear and panic and slowed down the sell-off. This could pave the way for investors to invest in equities or gold or Bitcoin. Perhaps, institutional investors know something that the retail has no idea about, which explains their futures positions. Then again, the markets are considered to be efficient and the price is, in a way, representation of the information available.

Source: BitcoinFuturesInfo

However, for futures on CME, there is a sky-high premium of $759 for the July contracts and $39 for June contracts. This could be a good way to capture the premiums, especially since the crypto markets lack “cash” alternatives.