Crypto-market’s maker-taker pricing system may not be actually profitable

The maker-taker fee structure is one of the underlying aspects of trading that determines profitability. In fact, many cryptocurrency exchanges like Binance and others operate on a maker-taker fee structure. While the general assumption is that this price system benefits traders in terms of switching to exchange with lower fees, a recent research report has argued that it actually burdens traders with a higher cost of trading, thus causing difficulties to long-term investors.

Digital assets derivatives exchange ZUBR, in a report published on 2 April, examined economic theory, incentives, and the real effects behind asymmetric fees on exchanges. The report noted that the asymmetric fee structure is diminishing traders’ profits. While maker rebates increase liquidity initially, the benefits diminish as more high-frequency traders compete against each other, reducing profitability which also further results in less effective markets. The report also pointed out that rebates prove to be more about market share grabs than about market effectiveness and efficiency.

Vitalik Buterin, Co-founder of Ethereum, sharing his thoughts on maker-taker pricing system had once stated,

“Maker-taker models seem more attractive to makers and reduce apparent spreads so it’s better marketing to display things that way, much like displaying prices with tax not included.”

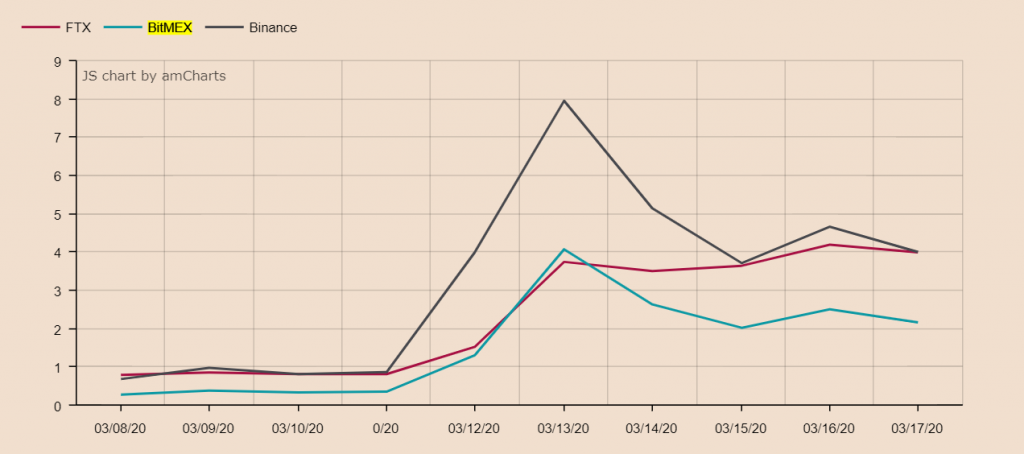

Source: Spread between Bid and Ask, zubr

The report also noted that the maker-taker model does not keep the ‘bid and ask’ spreads close during high volatility. For instance, BitMEX spreads went from an average of 0.28% to 4%, as seen in the above chart, during the high-volatile phase many have now dubbed ‘Black Thursday.’

Further looking into the negative effects of maker-taker rebates in cryptocurrency space, the report noted the following points,

- The length of exchange queues increases, making it less likely for other market participants to provide passive liquidity with optimal execution.

- Passive market participants are forced to trade more aggressively to access liquidity

- Liquidity is often fleeting – that is, it may disappear in times of market stress, particularly for less liquid

- Myriad order types, rebates, and fees proliferate as trading venues seek to capture market share, resulting in excessive fragmentation of order flow.

In conclusion, the report highlighted that as cryptocurrency markets advance, the industry will need to increase its efficiency to address an asset class like Bitcoin, which has limited supply and high volatility.