Crypto markets likely to see increased ‘fragmentation’

Cryptocurrencies have, to a large degree, established themselves in the world of finance. What was once looked at with extreme skepticism is now being seen as a tremendous opportunity. As the crypto markets developed it has in turn seen increased interest from traditional and institutional investors. In light of the pandemic that has overwhelmed markets across the world, cryptocurrencies such as Bitcoin are now becoming go-to assets for investors.

In a recent episode of The Scoop podcast, crypto investor and founder of crypto investing firm Three Arrows Capital – Su Zhu spoke about the need for a robust prime brokerage ecosystem that can add value for crypto traders and investors and elaborated on some of the challenges that are likely to be faced with regard to neutrality in the prime brokerage world. Zhu pointed out that currently, the crypto market structure seems to be becoming similar to that of traditional markets, he said,

“In the FX markets, huge amounts of volume are traded by firms that are not that well-capitalized but use FX prime brokers to be able to rest huge amounts of orders in the markets. So I think ultimately you’re going to see crypto go toward that route.”

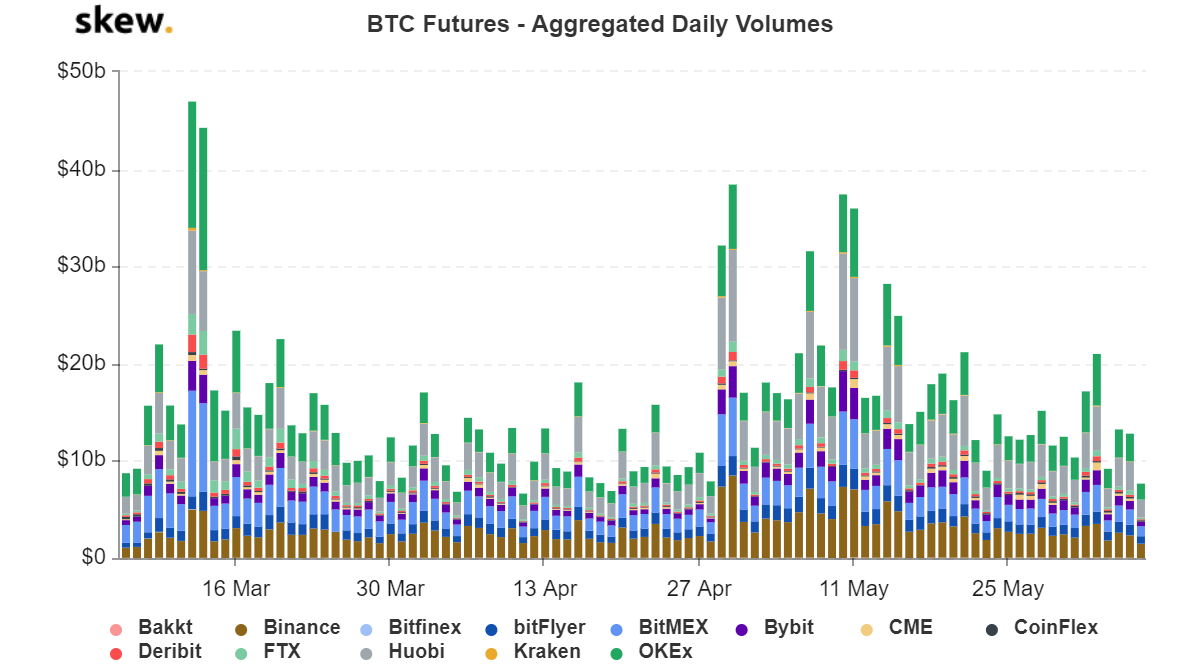

Source: skew

According to market data provided by skew, Bitcoin Futures volume across all exchanges have seen a drastic dip in the 3-month time frame after having registered significantly increased activity at the start of the previous month – May.

Zhu also noted that in the future there is likely to be greater ‘fragmentation’ in the crypto markets similar to the FX market structure. He noted that for crypto markets in the coming years there is going to be significant potential for regional exchanges and other entities are the markets diversify and get more efficient. Zhu argued that,

“I think it will definitely lead to more fragmentation in which volumes dissipating across wherever these prime brokers will support. You can have new exchanges come up that go on the prime broker network that has their own client base that like now you can show him prices that are an extremely good settlement. So I think it lends itself to this FX market structure.”