Bitcoin

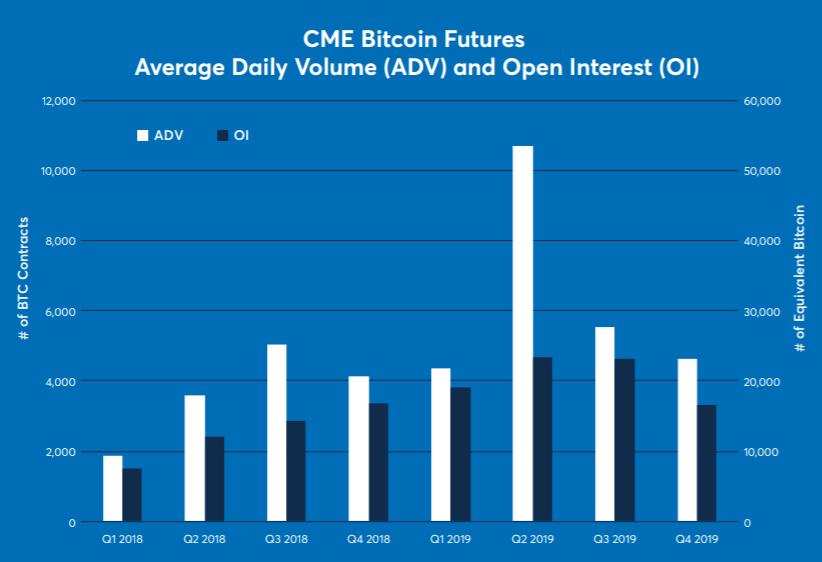

CME Bitcoin Futures reports ADV growth of 75% between 2018-19

Chicago Mercantile Exchange Group’s cash-settled Bitcoin Futures contract has been up and running for the last two years now and as it celebrated its second anniversary, the CME Group noted an increase in growth in volume and customer interest. As of 17 December 2019, approximately 2.5 million contracts had been traded on CME since its launch.

In a tweet, the CME Group said,

“Bitcoin futures [BTC)] celebrate second anniversary today. BTC has seen remarkable growth in volume and customer interest with nearly 2.5M contracts traded to date and 4.9K+ contracts traded daily”

Source: CME Group

The CME Group had revealed that its Average Daily Volume [ADV] increased by 75% between 2018 and 2019, with a record volume of 33,677 contracts on 13 May 2019. In an infographic released by the platform, Bitcoin’s [BTC] open interest increased by 66% between 2008 and 2009, with a record OI day of 6,128 contracts on 1 July 2019. This trend saw its first spike on 17 June, registering a high of 5,311 contracts.

Open interest [OI] essentially represents “the total number of contracts either long or short that have been entered into and not yet offset by delivery.” While each open transaction has a buyer and seller, in terms of the calculation of open interest, only one side of the contract is counted.

The CME Group’s study read,

“Since launch, bitcoin futures volume and open interest have seen strong growth. Compound annual growth rate in ADV is 109% from Launch to December 17, 2019.”

Source: CME Group | CME Bitcoin Futures Average Daily Volume by Hour

There has also been consistent growth in Bitcoin’s hourly volume. The derivative marketplace also noted that 9-10 AM CT, the CME CF Bitcoin Reference Rate calculation window, remains the highest volume hour since launch.

Additionally, new account additions picked up pace in Q2 and Q3 of 2019, with the number of unique addresses reaching over 3,600 from less than 500 in December 2018. The Chicago Mercantile Exchange recorded a higher number of contracts since May this year, around the time when the Bitcoin spot rate closed above a resistance level of $6,000. The platform had posted $1.3 billion worth of BTC Futures contracts as of mid-May.