Chainlink may climb toward $16 once again, here’s why

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Chainlink has a bullish outlook on the higher timeframe charts.

- The consolidation of the past two weeks was yet to see a breakout in either direction.

Chainlink [LINK] announced the mainnet launch of the v0.2 upgrade on the 28th of November. When AMBCrypto reported on these developments, we noted that there had been a steady decrease in Open Interest.

While this could mean bearish sentiment in the lower timeframes, LINK was in an overall healthy position on the price chart.

Moreover, the range formation of the past two weeks was likely to have a strong influence on Chainlink’s price action in the coming days.

Coupled with Bitcoin’s [BTC] inability to convincingly scale the $38k mark, questions about LINK’s bearish reversal remain pertinent.

The $15 region was briefly flipped to support

On the 11th of November, LINK climbed above $15 and flipped it to a level of support. To the north, the next higher timeframe resistance sat at $18.32, with $15 also being a significant level on the one-week chart.

Yet, quickly after the ascent, LINK sank to $13.4.

The 12-hour chart above shows the range (dotted cyan) more clearly. It extended from $13.35 to $15.4. On the 26th of November, LINK bulls faced rejection from the range highs.

The RSI noted that the momentum was neutral with a reading of 51 and neither buyers nor sellers were dominant in this timeframe.

The On-Balance Volume lacked a trend in November. Meanwhile, the Chaikin Money Flow (CMF) has steadily dropped over the majority of the past three weeks. This meant that capital flow was directed out of the market.

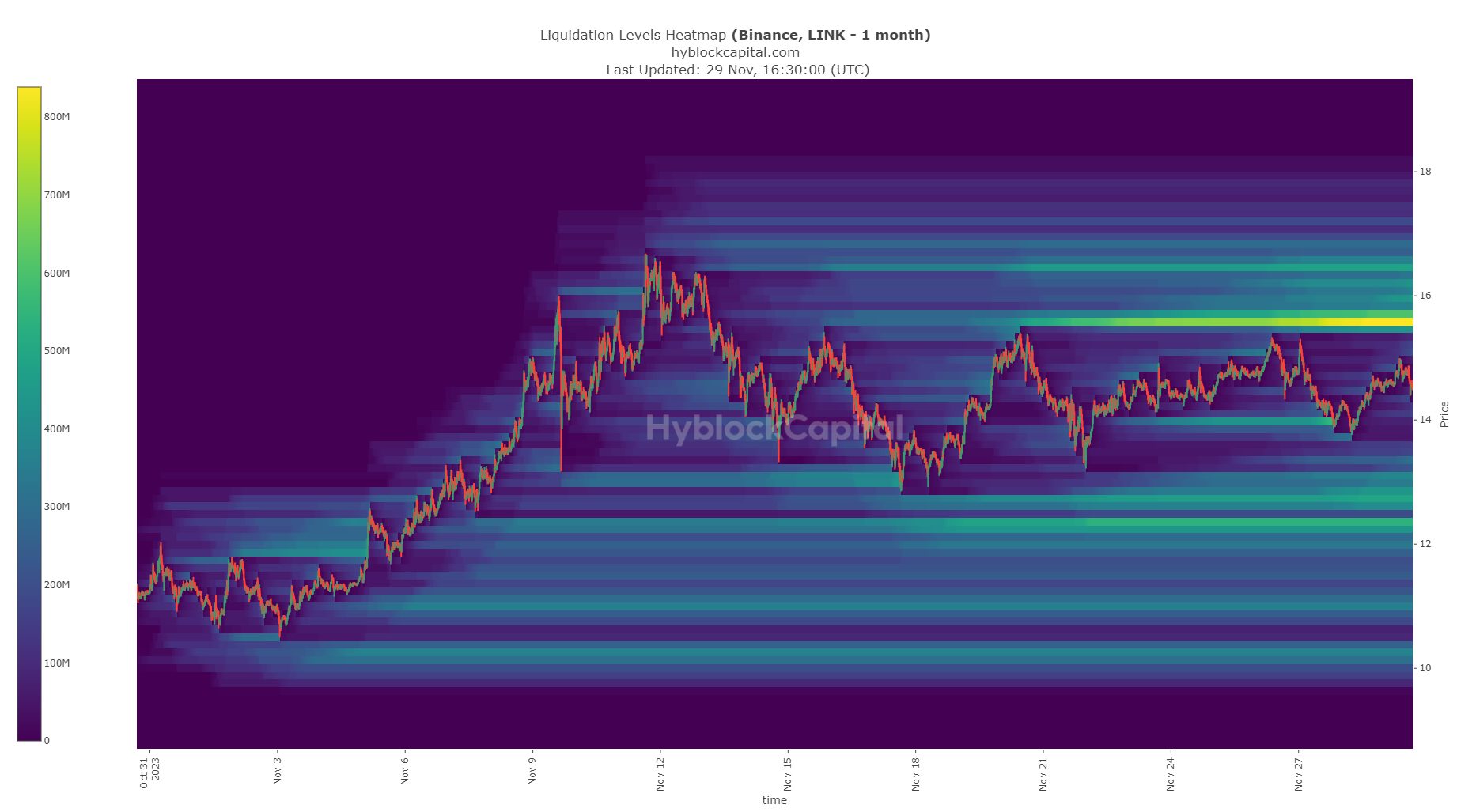

The liquidation levels heatmap showed which direction LINK was likely headed next

Source: Hyblock

Traders can treat range formations as clear territories where a good risk-to-reward buy or sell opportunity can arise. However, as of press time, LINK was closer to the mid-range mark.

AMBCrypto explored where it would go next using liquidation levels data from Hyblock, which showed that the $15.6 region contained an intense number of estimated liquidations.

Read Chainlink’s [LINK] Price Prediction 2023-24

Since price is attracted to liquidity, a LINK sweep of the area just above the range highs at $15.6-$15.9 was a strong likelihood. If this occurs, LINK would likely build up bullish expectations.

A reversal southward could trap the early bulls, leading to even more liquidity for the market to the south. Therefore, a move to the $14.37 (mid-range) and $13.35 (range low) would be the next step.