Cardano: Of soaring metrics and stumbling prices

- Cardano’s Age Consumed metric rose to a level that had not been seen in over a year

- Moreover, ADA declined by a value that had not been seen in two months

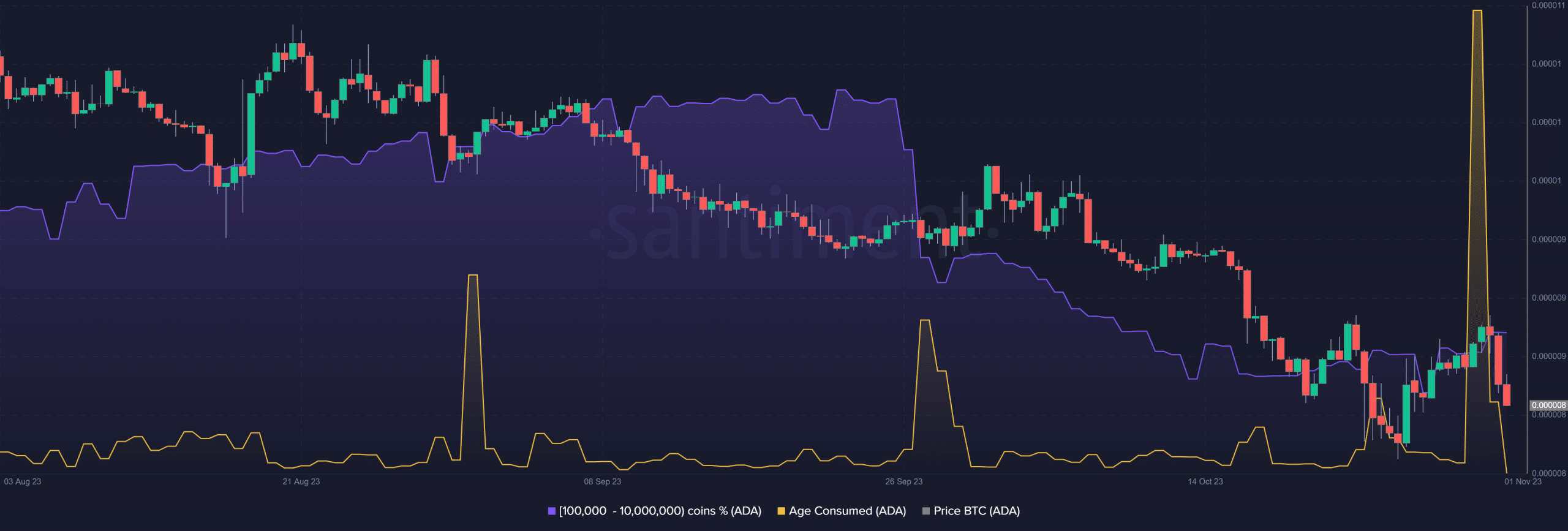

On 31 October, Santiment reported that Cardano [ADA] had witnessed significant activity from long-dormant coins. Notably, the Age Consumed metric saw a remarkable spike, surpassing 314 billion on 30 October.

Is your portfolio green? Check out the ADA Profit Calculator

This marked the highest level of older wallets moving ADA since April 2022. This movement also implied a pending increase in coins entering circulation.

Cardano’s Age Consumed spikes

The Age Consumed metric tracks the duration an asset has spent in a particular wallet without being moved or transacted. It essentially reflects how long the asset was held without being spent or transferred.

Significant rises in this metric, like the one ADA witnessed, indicate a substantial move after a long period of dormancy.

At the time of this report, the Age Consumed had declined to around 648 million. The move suggests a subsequent decrease in activity compared to the peak observed on 30 October.

Cardano sees growth in whale accumulation and volume

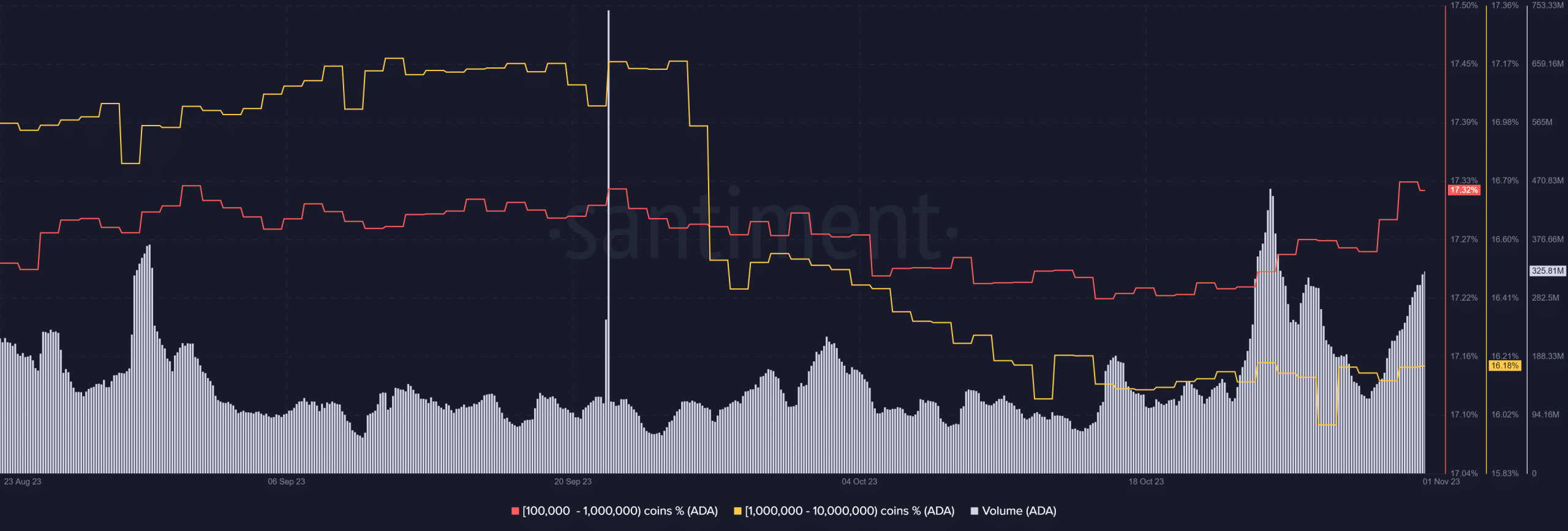

Recent activity in the Cardano ecosystem extends beyond the movement of old coins. Inasmuch, Santiment’s chart below showed that whales have also been quite active.

The whale supply distribution chart revealed a notable increase in accumulation among wallets holding 100,000 to 1 million Cardano. As of this writing, these wallets held 17.3% of the supply, up from 17.2% just a few days ago.

Furthermore, wallets holding 1 million to 10 million Cardano have also seen an uptick in accumulation. As of press time, this group held 16.1% of the total supply.

Additionally, Cardano’s volume has experienced a recent increase following a brief decline around 27 October, dropping from over $300 million to approximately $125 million.

However, as of the time of writing, the volume rose close to $300 million, suggesting an increase in momentum. The movement observed in the Age Consumed metric could also be contributing to this renewed activity.

ADA’s fine trend comes to a halt

Analyzing the daily timeframe chart of Cardano provided additional insight into the recent surge in volume. The chart revealed a significant increase in trading activity, which may halt ADA’s upward trend. Also, it showed the dominance of selling pressure.

Read Cardano’s [ADA] Price Prediction 2023-24

Furthermore, by the end of trading on 31 October, Cardano had experienced a decline of over 3% in value, with its price hovering around $0.29. Also, this was the highest level of decline that it had seen in the last two months.

As of the time of writing, ADA was trading at approximately $0.20, with an over 2% decline. It appears that the token may face a challenging road ahead, especially as its circulating supply is set to increase.