Can Bitcoin reinvent itself and become more than a jack of all trades?

All cryptocurrencies are equal, but some cryptocurrencies are more equal than others

In an ecosystem with thousands of cryptocurrencies, Bitcoin is often referred to as the king coin, and rightly so. Not only did it kickstart the revolution, but Bitcoin’s market cap is also close to seven times that of Ethereum, the world’s second-largest crypto-asset. But, in a world of ever-evolving digital assets and currencies, is Bitcoin the greatest coin or has its dominion been divided up by market competition, each eating away bits of Bitcoin’s utilitarian worth?

Is the holistic approach worth it?

Bitcoin, over the years, has been able to accumulate a lot of goodwill and trust from stakeholders and users operating in the crypto-industry. Most crypto-enthusiasts are perpetually long on Bitcoin, with its price expected to go past levels such as the $100k mark in the next few years.

Over time, the king coin has also found in itself facing a lot of issues; issues that the king coin still struggles to negotiate. One of the biggest divergences since its inception has to do with the king coin abandoning the ‘decentralized digital cash’ narrative and instead, replacing it with the store-of-value investment thesis. This stemmed from a fundamental drawback – the lack of scalability.

While the Lightning network was introduced to solve the issue of scalability, like many of Bitcoin’s upgrades, the project has been slow to gain traction and turn around the scalability crisis that plagues a proof of work coin like Bitcoin. This also raises the question of why many of Bitcoin’s developmental projects stall and in the worst case, stop altogether.

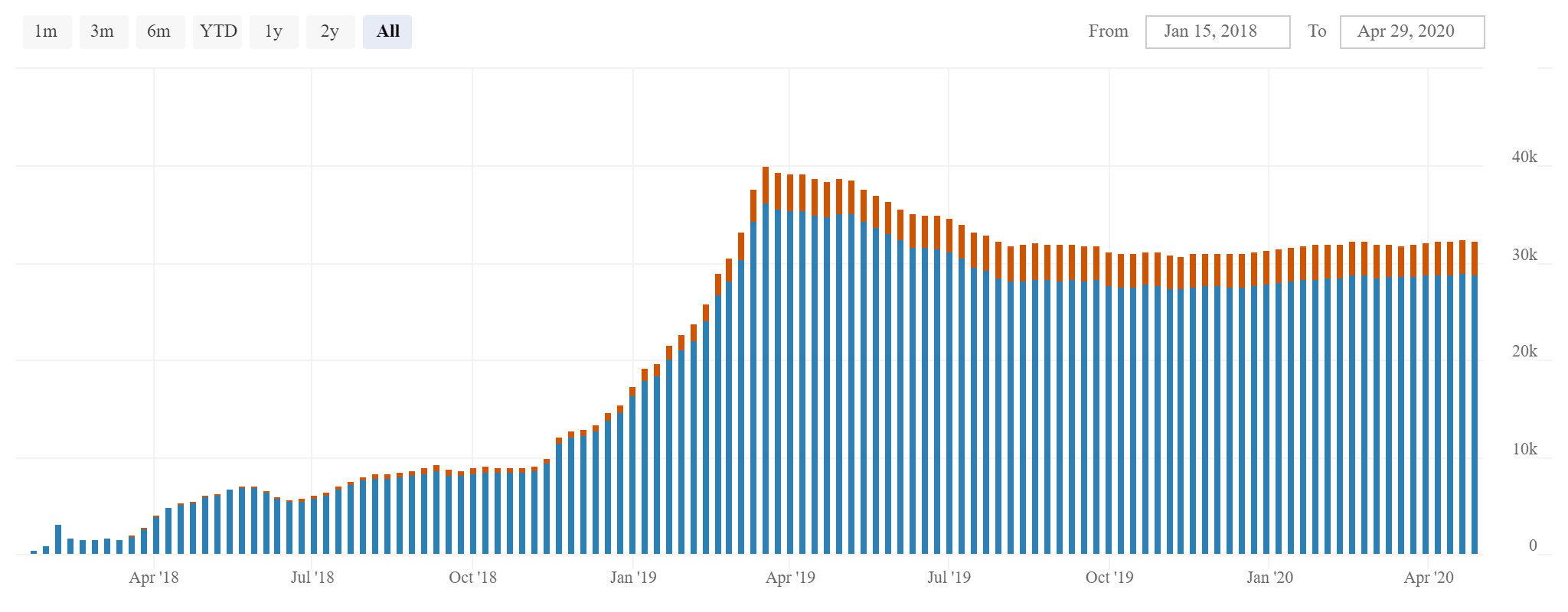

Source: Bitcoin Visuals

The Lightning Network is a prime example of this plague of perpetual infancy. According to network data regarding the lightning network’s channels, unique channels connecting nodes for the first time and duplicate channels that connect nodes that have already established a connection for transactions, have largely plateaued, which in turn indicates that the upgrade has much more to do in order to bring in more adoption.

Are altcoins following the divide and rule tenet?

If there were a competition to find a solution to Bitcoin’s transaction speeds issue, XRP seems to have found the answer to the problem of scalability and has emerged at the forefront of the cross-border payments frontier. With its blockchain able to achieve over 40,000 transactions per hour on average, the competition seems to be eating into Bitcoin’s turf to such a degree that traditional financial assets like gold seem to be its current rivals, something that again pushed the store-of-value narrative.

With respect to a decentralized ecosystem, Ethereum seems to have gotten it covered with its wide variety of offerings via DeFi and the lending space.

Source: DeFi Pulse

With a focus on decentralization, the DeFi ecosystem has been fairly successful and lending seems to have emerged as a big win within the decentralized finance landscape. In fact, according to data from DeFi Pulse, out of the total value locked in DeFi (at press time – $856 million), lending accounts for over $638 million.

What next for Bitcoin?

With over a decade under its belt, has the king coin been relegated to a mere investment vehicle or can future developmental efforts put it back on track to be truly the most dominant cryptocurrency in the market?

While the Proof of Work consensus algorithm has enabled a lot of security for the Bitcoin network and the transactions it validates, questions are also raised whether or not Bitcoin’s innate nature is in fact a limiting factor.

Has Bitcoin found solace in the fact that it was and will always be the project to dare to dream differently in the conventional world of finance or are we yet to see more disruptive innovations from the community that made headlines a decade ago?