Bitcoin

Can Africa count on Bitcoin as its go-to safe-haven asset?

Bitcoin’s status as a safe-haven asset has been one of its key selling points for a long time. In fact, this has enabled the world’s largest and most dominant cryptocurrency to welcome more users into the ecosystem, especially in light of the fact that citizens in failing economies are rapidly losing faith in their depreciating fiat currencies. With a pandemic shaking up 2020, Bitcoin’s safe-haven status seems to have come to the fore yet again.

Africa continues to be one of the smallest cryptocurrency markets in the world with crypto worth around $8 billion received and $8.1 billion sent on-chain in the past year, according to Chainalysis. However, what the data doesn’t tell you is the fact that for many users in Africa, exposure to cryptocurrencies like Bitcoin has proved to be extremely useful thanks to the economic instability that is prevalent in most parts of the continent.

A recent research paper published by the University of the Witwatersrand looked at how strong Bitcoin’s safe-haven value proposition is and whether Bitcoin could offer refuge against Africa’s emerging equity markets.

The paper found that both Bitcoin and precious monetary metals like gold have not acted as much of a hedge against Africa’s largest and medium-sized equity markets during the COVID-19 pandemic. The paper observed,

“Bitcoin acts as a complementary safe-haven asset but not a superior substitute to the precious metals, especially gold and palladium, over the two crisis periods.”

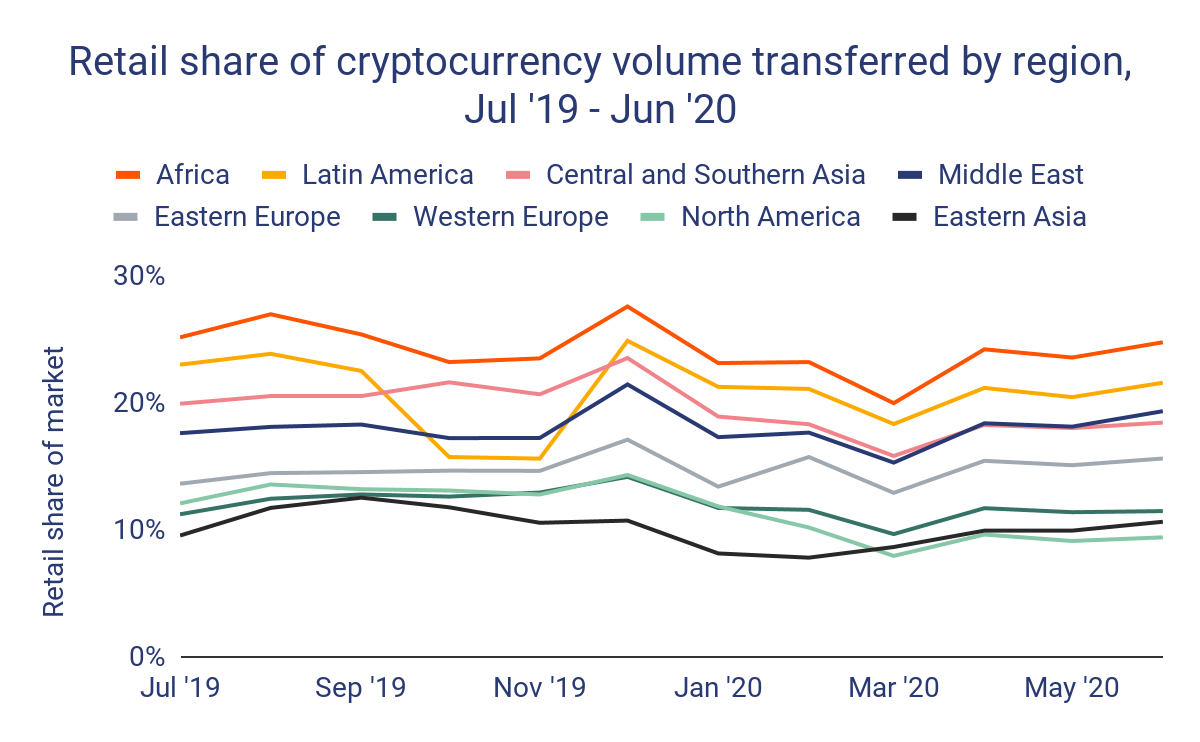

Interestingly, a recent Chainalysis report had highlighted Bitcoin’s growing importance in Africa, despite its rather small footprint in terms of adoption and activity. It pointed out that retail investors and retail-sized transfers do dominate Africa’s Bitcoin landscape and amount to the largest chunk of crypto-related activity in the region. The report read,

“Retail-sized transfers (transfers under $10,000 USD) make up a larger share of Africa’s cryptocurrency activity than any other region, and the need for remittances is a big part of this.”

The study in question also looked at traditional safe-haven assets like gold, silver, and the likes of Bitcoin and highlighted that none of these assets provide a safety net for emerging equity markets during the pandemic, something that makes it quite challenging to offset investment losses.

In the case of Bitcoin, it was observed that the coin’s relatively high volatility has made it harder to act as a safe-haven during this period and that “it will best serve, for now, as a complementary safe-haven,” implying that it can work best as a hedge and safe-haven with other assets like gold, but is still far from replacing the likes of monetary metals.