BNB suffers a massive drop to $227 – Is a recovery likely?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- BNB fell from $271.9 to $224 in eight hours on Tuesday, a move that measures 17.62%.

- Despite the huge amount of fear in the market, a bullish bias in the short term was reasonable.

Binance Coin [BNB], the exchange token for Binance, witnessed extraordinary volatility on the price chart over the past 24 hours. This was unsurprising given the magnitude of the news that came out.

Such volatility could be a great ally to traders, especially the patient ones. The market structure of BNB has flipped bearishly after the huge losses posted on 21st November. Yet, the bulls could force a move higher once more.

The Fibonacci levels have been handy so far

The RSI of BNB on the one-day chart slipped below neutral 50. Alongside the market structure break, it highlighted a bearish disposition. Yet, the 78.6% Fibonacci retracement level was not convincingly broken.

A dip to $224, just beneath the 78.6% level, was followed by a bounce that reached $238.5. This meant that it was possible that the liquidity in the $225-$230 region was swept and that the market had changed direction.

The On-Balance Volume saw a huge dip as selling volume skyrocketed on Tuesday. If the indicator embarks on a downtrend in the coming days and prices fail to ascend past $240, traders can lower their expectations of a recovery.

Liquidity data points toward a possible bounce as well

Source: Hyblock

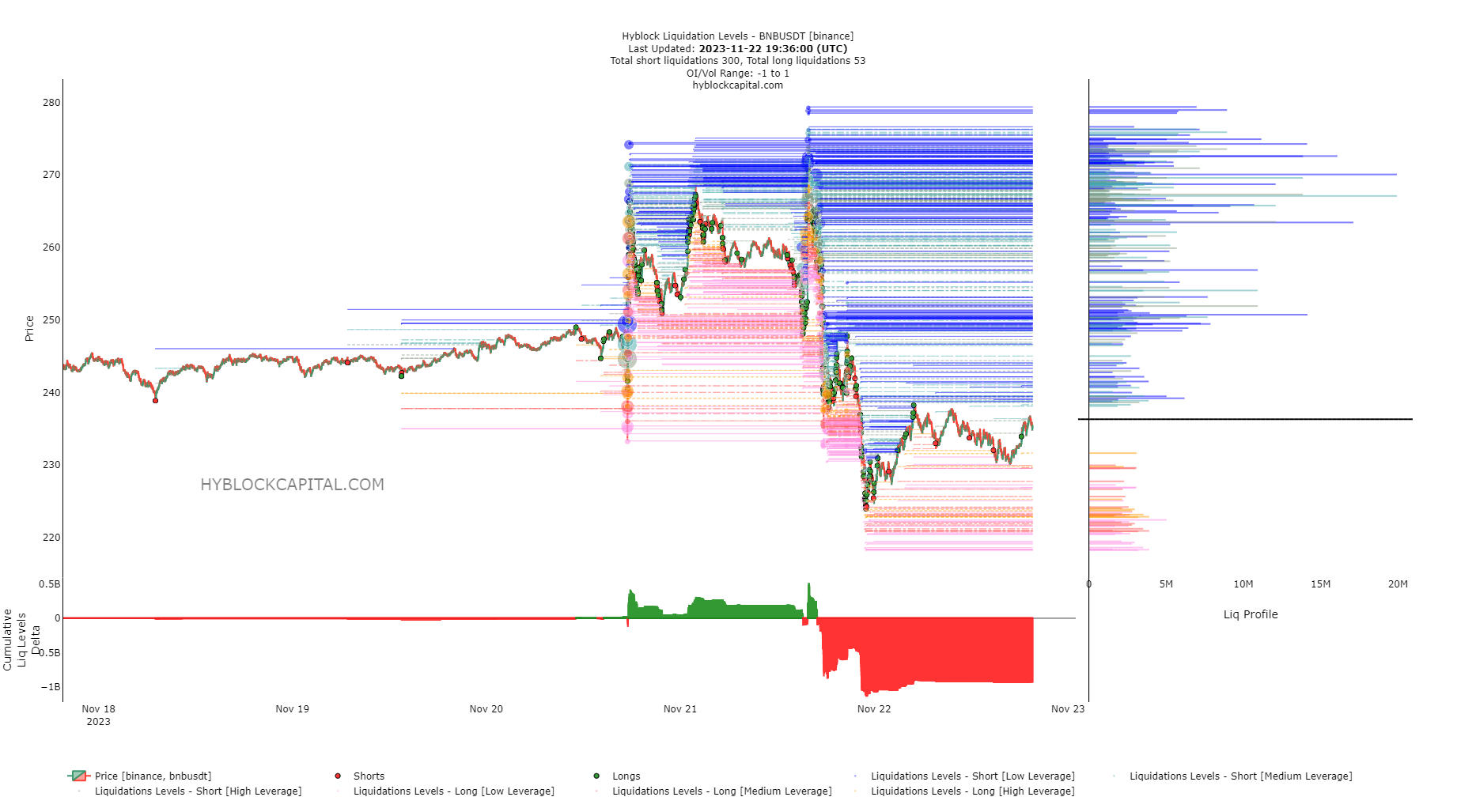

AMBCrypto’s analysis of the liquidation levels from Hyblock showed that a bullish short-term bias was much stronger than a bearish one.

This was because of two reasons. The first was that the Cumulative Liq Levels Delta was deeply negative. Hence, bears stand to lose a lot should the BNB price trend reverse.

Is your portfolio green? Check the BNB Profit Calculator

The other reason was that there were substantial pockets of liquidity to the north. A move to $250.7, for example, would trigger short liquidations worth $15 million.

The Delta combined with several nodes that could see large short liquidations past $250 meant a BNB move to $250 and $272 was quite likely.