The odds of BLUR sustaining its bull rally

- Whale activity around BLUR remained high as they bought more tokens.

- A few market indicators hinted at a trend reversal.

It has been a few days since Blur [BLUR] announced the closure of its second season of airdrops. The airdrop had an immediate positive impact on the token’s value as its price rallied over the last few days.

Meanwhile, a whale has withdrawn BLUR tokens worth millions from an exchange, suggesting that buying pressure on the token remained high.

Blur investors are rejoicing

Since the airdrop, the token’s price has surged considerably.

According to CoinMarketCap, BLUR was up by more than 36% in the last seven days.

In fact, the token’s price rallied by over 28% in the last 24 hours alone. BLUR’s trading volume also surged by 80%, acting as a foundation for the price uptrend.

Interestingly, when the token’s price went up, a whale withdrew 15 million BLUR tokens, which was worth over $5 million from OKX.

This clearly suggested that the whale was confident in BLUR and expected its price to pump further.

We noticed that a whale withdrew 15M $BLUR($5.72M) from #OKX in the past hour and staked it.https://t.co/aKXreuSDPa pic.twitter.com/ShN5CNtLZ3

— Lookonchain (@lookonchain) November 22, 2023

AmBCrypto’s analysis found that not just one, but several whales, were interested in BLUR. This was evident from the rise in the number of whale transactions over the last few days.

The token’s supply held by top addresses also increased, further establishing the fact that whales had high hopes for BLUR.

Investors at large also followed a similar trend of accumulation. The token’s exchange outflow spiked sharply during its price uptrend.

Additionally, its total amount of holders registered a massive spike, suggesting that retail investors were buying the token. Nonetheless, its supply on exchanges increased, which can be attributed to the recent airdrop.

Will BLUR continue its rally?

AMBCrypto’s analysis of BLUR’s daily chart revealed that its price touched the upper limit of the Bollinger Bands. Its Relative Strength Index (RSI) entered the overbought zone, which can increase selling pressure on the token.

Realistic or not, here’s BLUR’s market cap in BTC terms

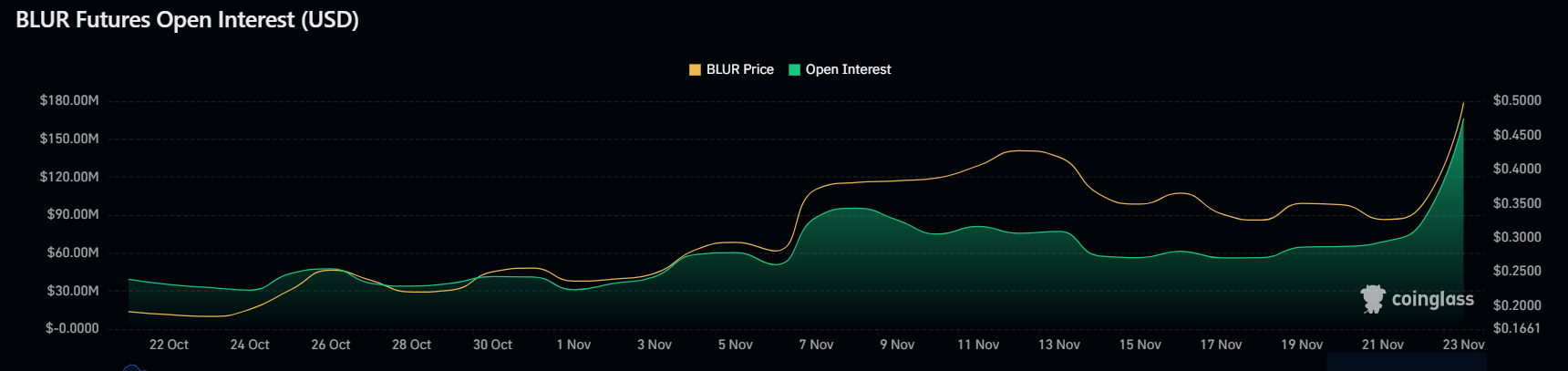

However, the MACD displayed a bullish crossover, suggesting that the token might continue its bull rally. On top of that, BLUR’s open interest increased sharply along with its price.

Whenever open interest goes up, it increases the chances that the current price trend will continue.