Bitcoin’s volume revisits April 2019 lows as liquidation spurts

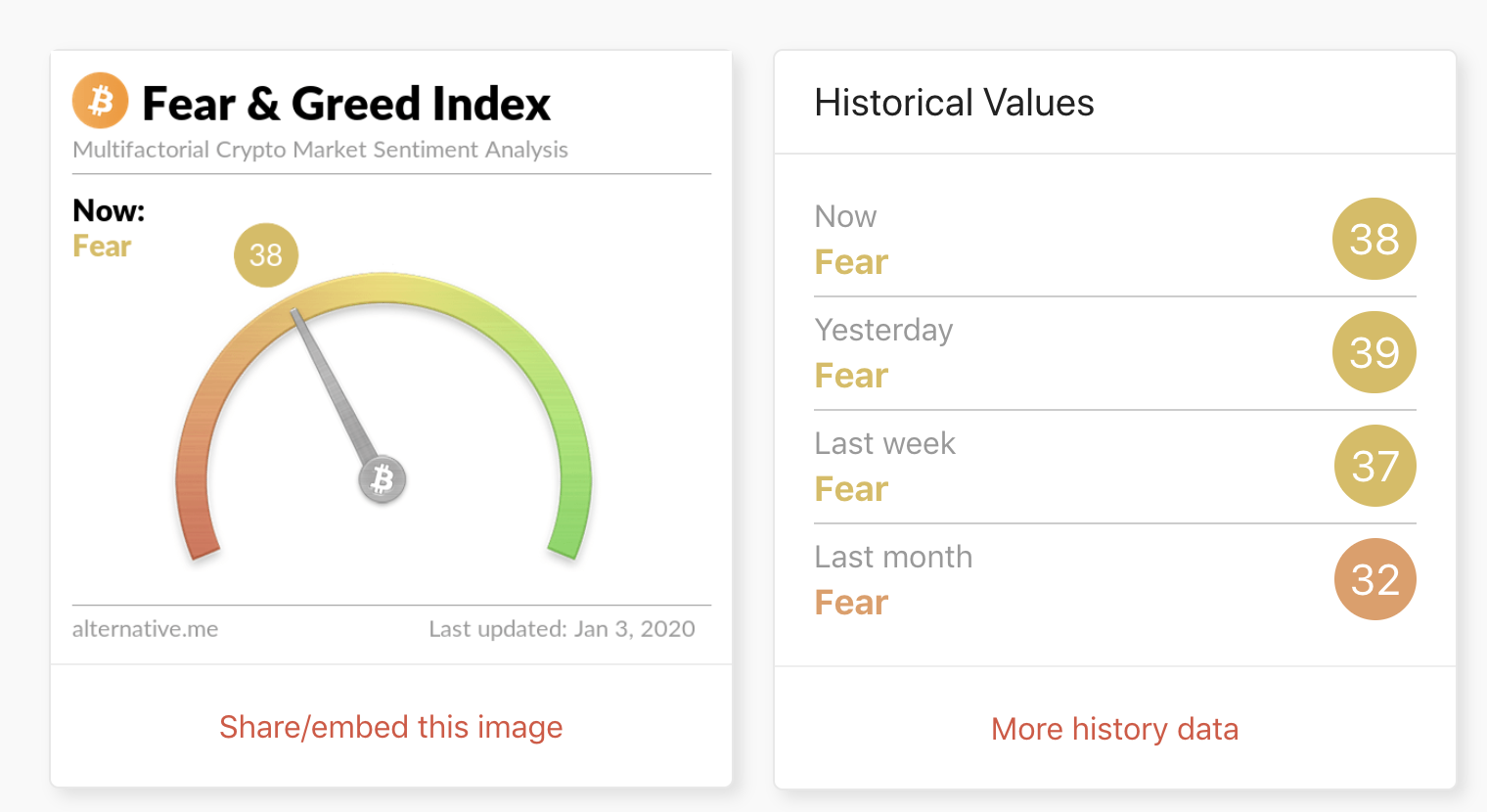

The start of the new decade was a fresh start for Bitcoin too as the coin noted a sudden surge on 3 January, pushing its price above $7,200. According to recent research by Arcane, it was found that the market sentiment had stabilized. The Fear and Greed Index was found to be holding stable over the last week after recovering from December’s lows. Before the spike, Bitcoin was undergoing sideways movement, following which the market sentiment recorded a gradual climb.

Source: Alternative.me

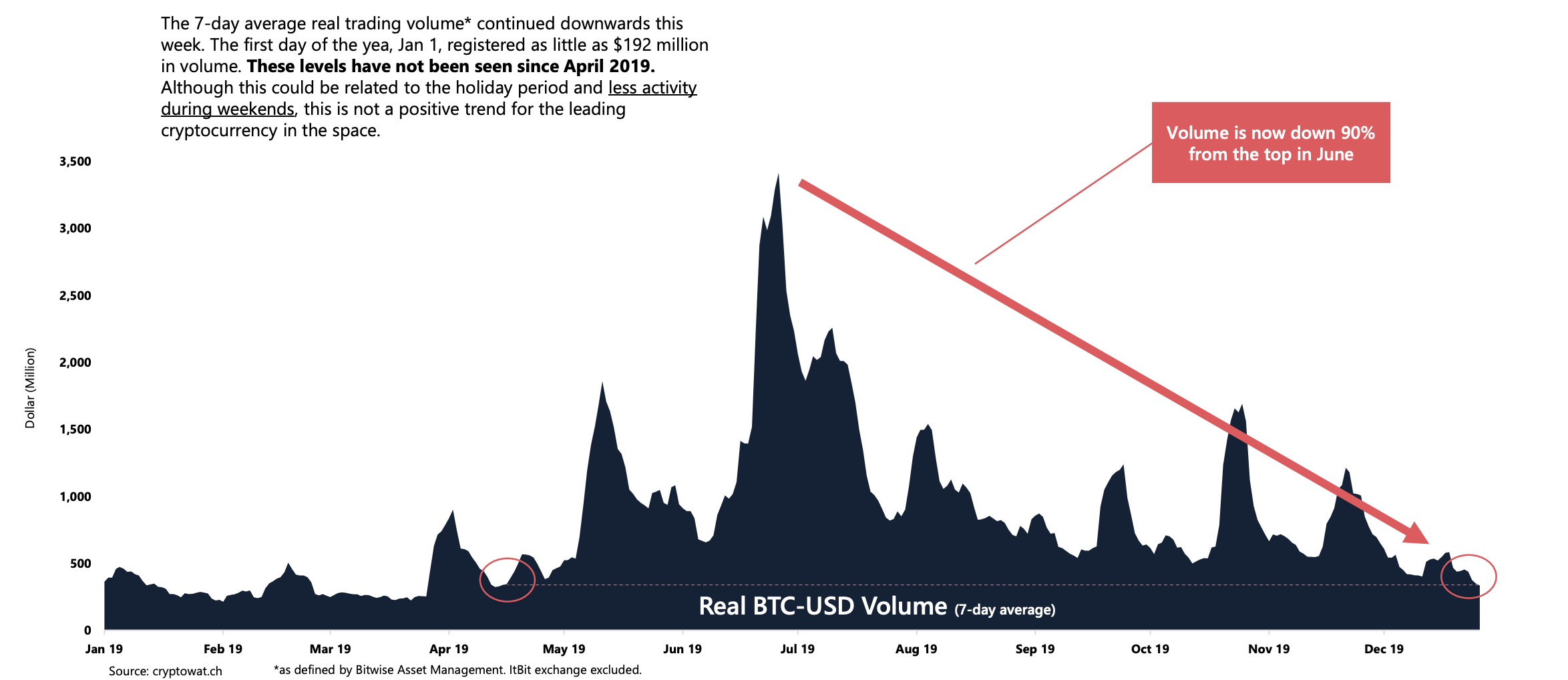

Despite the sentiment changing, the Bitcoin volumes were noted to have registered new lows. According to the report, the 7-day average real trading volume was noting a downward trend, with 1 January noting a minimal volume of $192 million. The last time Bitcoin’s volume had dipped to such levels was back in April 2019.

Source: Arcane

However, the inactivity during this period can be associated with the holiday season too.

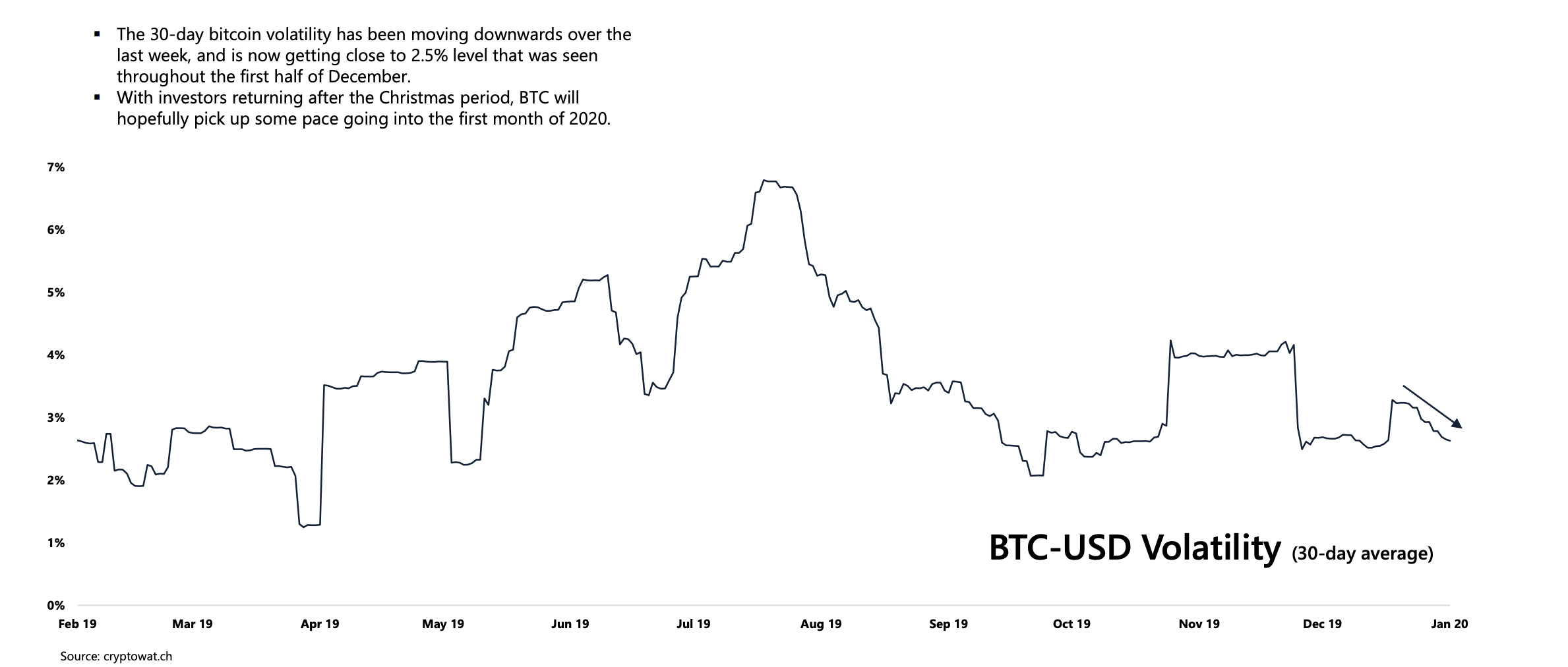

Following the trend, Bitcoin’s volatility was also impacted during the holidays. The 30-day Bitcoin volatility was moving down over the last week and was getting closer to the 2.5% level.

Source: Arcane

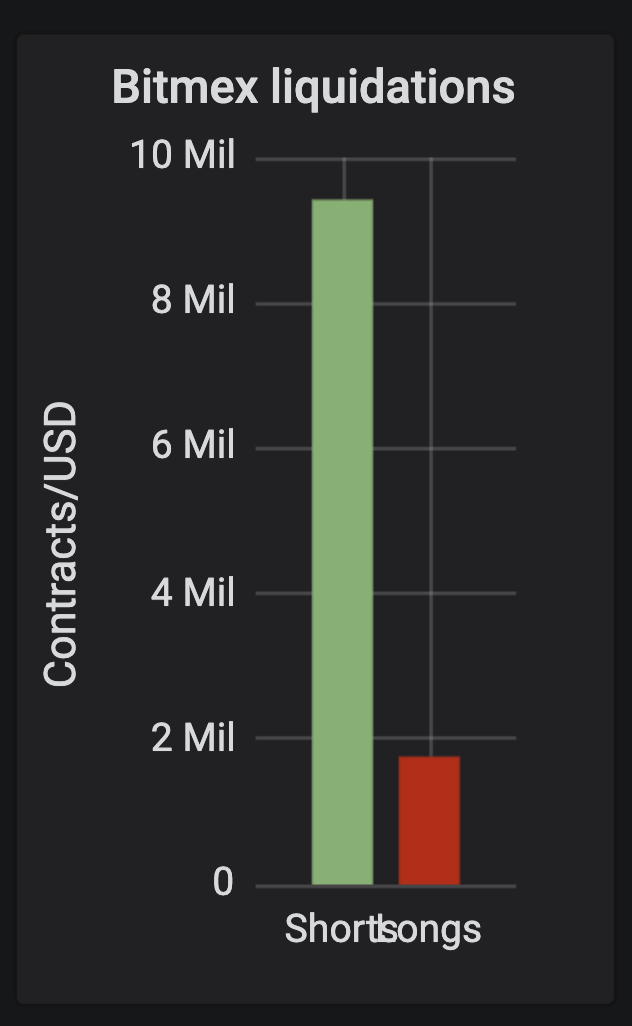

However, as the new year began, Bitcoin’s correlation with Ethereum fell by 0.002, but increased with XRP by 0.007. The sudden surge in Bitcoin’s price was associated with the 11th anniversary of the mining of the Genesis block, along with the airstrike that took place in Baghdad. According to Datamish, $9.419 million in shorts were liquidated, while $1.758 million in longs were liquidated.

Source: Datamish

At press time, BTC was falling by 1.80%, a dip which could be a market correction. The price of the world’s largest crypto-asset was $7,264 with a market cap fo $132.71 billion.