Bitcoin’s trading activity against stablecoin pairs on Binance was over 40 percent for Q3, finds report

Bitcoin, the king of the cryptocurrency market, recorded tremendous recovery earlier this year, when compared to its 2018 lows. The cryptocurrency reached a high of $13,868 in the month of June, reaching the point after more than a year. This rally also resulted in the significant rise of the top altcoins in the market. However, the upward trend soon witnessed a reversal as the top cryptocurrency reached a low of $7712 in the following months.

A new report by Binance Research titled ‘2019 Q3 Crypto-Correlations Review’ shows that Bitcoin’s “price dropped by nearly 30%.” Nevertheless, the dominance of the king coin was on the up for Q3 of 2019, recording a high of over 70 percent. The report also revealed that more than 40 percent of all of Bitcoin’s trading activity on Binance was against stablecoin pairs. The report read,

“The third quarter of 2019 exhibited adverse price movements, breaking the two consecutive quarterly price gains in Q1 and Q2. In Q3, Bitcoin price dropped by nearly 30%, closing on September 30th at around $8000. In comparison, BTC trading dominance fluctuated around 15-25% for the first half of 2019.”

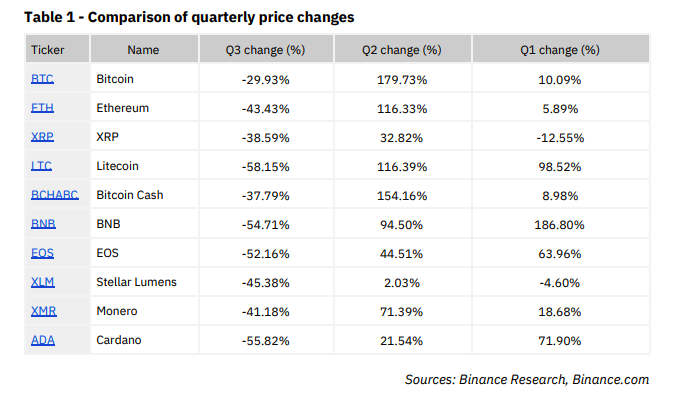

In terms of altcoins, the research paper reported that the leading altcoins recorded a downfall ranging from 38 percent to 60 percent. Ethereum exhibited a drop of 43.43 percent, while Litecoin took the seat of the biggest loser among the top altcoins as it recorded a drop of 58.15 percent. The silver coin was followed by Cardano and Binance Coin as they saw a fall of 55.82 percent and 54.71 percent, respectively.

Source: Binance Research

The report concluded,

“Over the third quarter of 2019, the average correlation between Bitcoin and most other large cryptoassets remained in line with the previous quarter. However, the average correlation among large cryptoassets increased in Q3 2019 with a significant positive increase in the corrections of BNB, Chainlink and Bitcoin SV with other cryptoassets.”