Bitcoin’s retail interest may have overtaken institutional investors

Over the past year, Bitcoin’s derivatives market has become crucial to the crypto-industry, with the same contributing to an increasing surge in institutional and retail involvement lately.

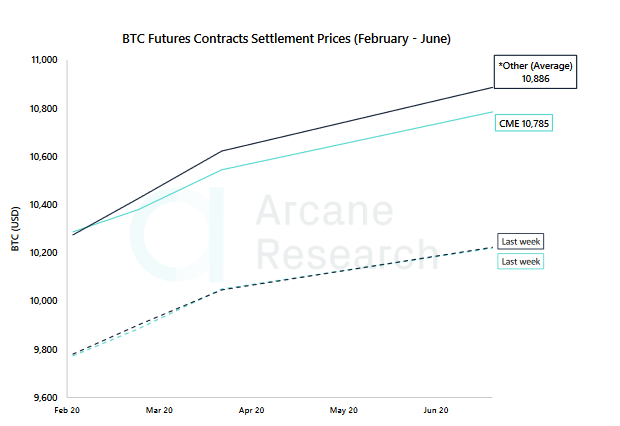

Bitcoin’s price has hiked by over 40 percent in 2020 and the effects of the bullish rally can be identified in Futures trading as well. However, in spite of an increase in institutional investors, according to a recent report, the premium rates on retail exchanges have surpassed those of the CME over the past week.

During the 1st week of February, Bitcoin Futures premium rates were equal for both retail exchanges and the CME. However, over the past 7 days, the average premium rates combined on exchanges such as BitMEX, Kraken, Deribit, and FTX have overtaken CME.

According to the latest Arcane Research report, CME rates on BTC contracts for March 2020 and June 2020 were 2.51 percent and 4.84 percent, respectively, whereas the rates on retail exchanges had improved to 3.38 percent and 5.96 percent.

Source: Arcane Research

The attached chart highlights that the settlement prices on Bitcoin Futures for the period between February – June on CME is around $10,785, with retail exchanges recording a higher settlement rate of $10,886. Such a scenario suggests that retail investors are currently outperforming institutional interest over the past week.

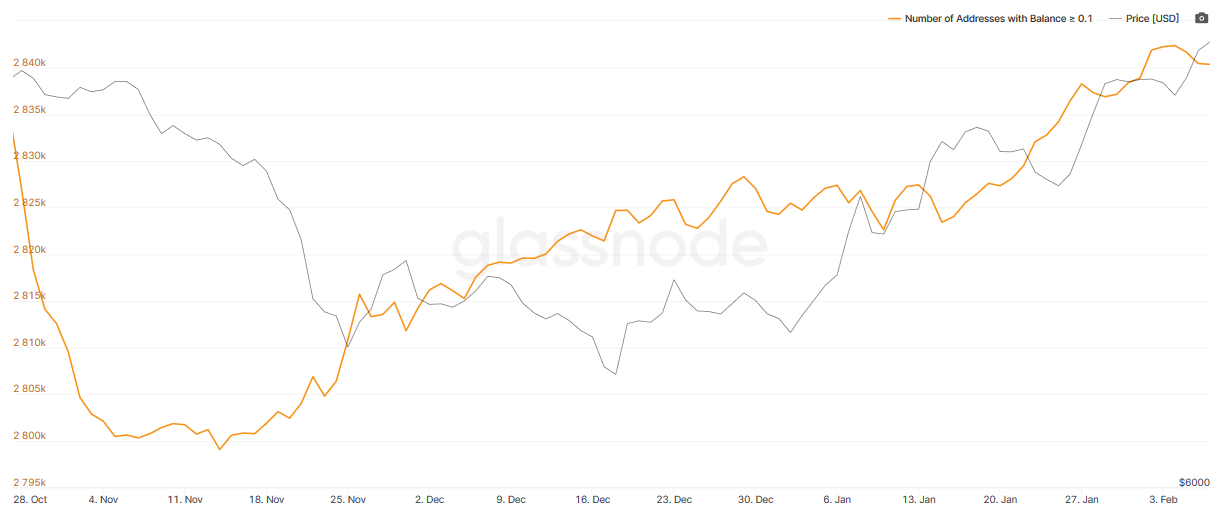

The aforementioned sentiment can be verified on observing the number of Bitcoin addresses with a balance equal to or greater than 0.1 BTC.

Source: glassnode

The attached chart from glassnode indicates that the number of addresses with BTC balances equal to or greater than 0.1 BTC has periodically increased since the end of last year, with the market’s present bullish rally assisting in the rise in the number of addresses as well.

The number of such addresses has risen by 16,085 since the start of the year, which even though it is a minor number, might suggest a significant increase in retail interest over the past few months

Further, the overall sentiment for Bitcoin Futures continued to improve as over the past week, aggregated Open Interest across all the exchanges surpassed $5 billion on 13 February. An increase in Open Interest exhibited that more money is flowing into the markets and traders are expecting the price to rise higher in the near-term.