Bitcoin

Bitcoin’s rally triggers optimism in Futures realm as expectations rise

The total cryptocurrency market capitalization broke the $200 billion mark on 7 April, a level last seen in March, right before the crypto-market collapsed. As the market’s positive momentum continued to sustain itself, there were a lot of expectations regarding the coin’s bullish progression in the days to come.

Source: Coinstats

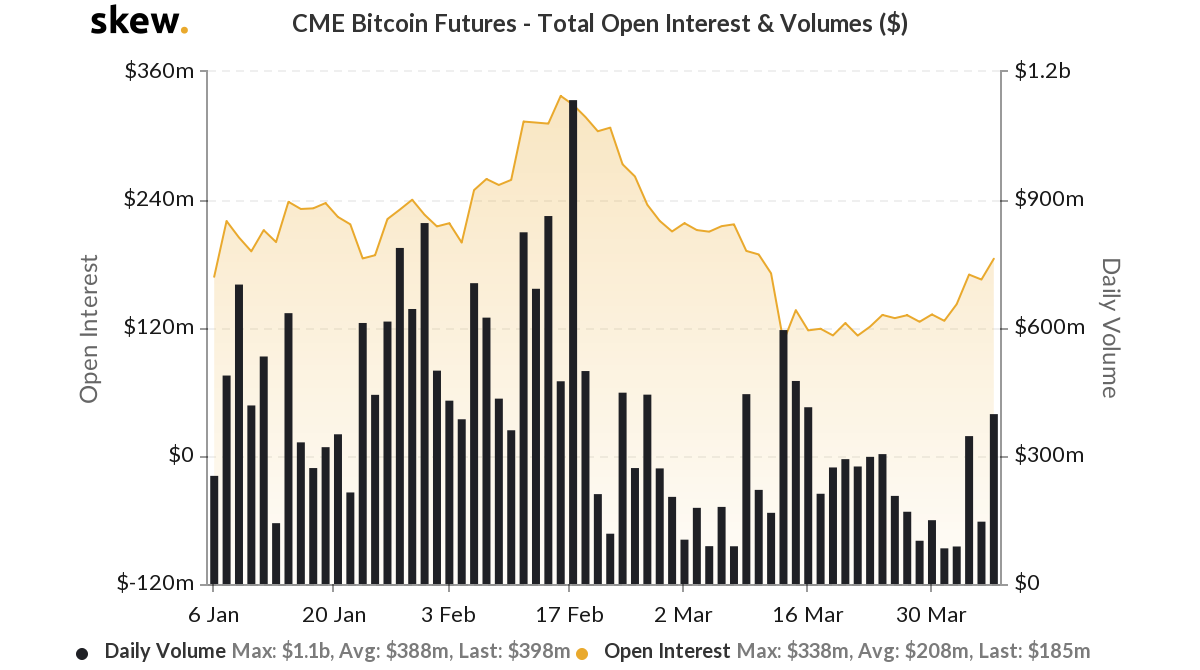

This is an interesting development since the Bitcoin Futures market also registered a revival in terms of positive momentum. According to the data analytics website Skew markets, BTC Futures volume on CME hit a three-week high as the first quarter of 2020 dawned.

Source: Skew

BTC Futures volume on 2 April was observed to be $347 million, a figure that has been on the rise recently, with the numbers rising to $398 million on 6 April. With respect to Open Interest [OI], the figures rose to $185 million on 6 April. A similar trend was also observed on Bakkt’s platform.

The volumes for physically-settled Bitcoin Futures on Bakkt, as well as the volume for cash-settled, have been on a rise for three straight consecutive days. So, have the figures for Open Interest [OI] which rose to $6.5 million on 3 April. These trends essentially point towards rising institutional demand and expectations of a price rise in the near future.

Source: Skew

Turning the tide

AMBCrypto had previously reported that spot trading volume stole the limelight after devastating losses in the last part of the first quarter of 2020, the impact of which was felt across the derivatives realm. However, there could be trend reversal in the offing.

To top that, several network metrics have also suggested a continuation of the bullish momentum in the market, despite the sentiment for Bitcoin being in the ‘extreme fear’ phase. Glassnode chart’s NUPL [Net Unrealized Profit/Loss] metric was above 0, meaning, the network, as a whole, is currently in a state of profit.

Further, the world’s largest cryptocurrency also recorded an interesting correlation with the S&P500. Another analytic firm, Santiment, had noted that the trifecta of Bitcoin, Gold, and SPX, had all exhibited positive momentum on another rebound. It further stated that once the correlation between crypto and the traditional market inevitably descends back to 0, a rebound in Bitcoin’s price to the upside will be expected.