Bitcoin

Bitcoin’s price fall fails to tether stablecoins’ growing market cap

Bitcoin’s losses last week had a devastating impact on the cryptocurrency industry. Undeterred by the chaos, however, was the stablecoin realm. These stablecoins, designed to minimize price volatility, continued to be actively used in the crypto-space, despite the market’s poor performance lately.

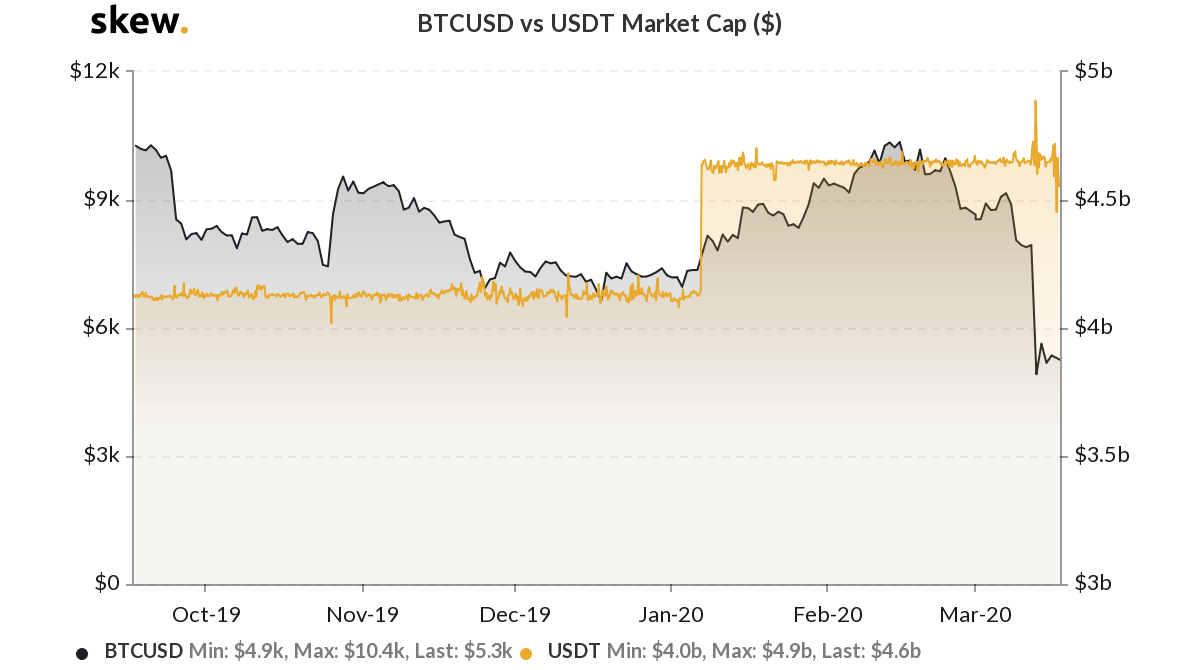

Stablecoins were observed to have been frantically minted after the price drop on 12 March. This contributed to the market cap of stablecoins increasing significantly during this period. Skew markets depicted two consecutive sharp spikes on its ‘BTCUSD vs USDT Market Cap’ chart on the fateful day of 12 March. Tether, the most dominant stablecoin, registered a surge of $4.8 billion in its market cap, an increase of 17% since 1 January.

Token Analyst had previously stated that historically, on days where USDT ERC20 is minted, 70% of the time the price of Bitcoin moves up in 19-27 days. Similarly, on days when USDT Omni is minted, 50% of the time the price of Bitcoin moves up in 12-24 days.

Source: Skew

Interestingly, it’s not just Tether that has been increasing its dominance in the market. Other stablecoin contenders such as USDC, BUSD, TUSD, GUSD, PAX, and DAI have all buckled up. The contenders’ market cap, according to the Skew charts, rose substantially, surging by nearly 38% since its January lows.

According to the latest report by the crypto-analytical and research platform, CoinMetrics, the market cap for most stablecoins increased while the market cap for most crypto-assets fell significantly. This was indicative of the sign that investors were “piling into ‘cash’ or at least crypto-cash equivalents.”

Furthermore, CoinMetrics also revealed that the market cap for Ethereum-issued Tether [USDT_ETH] increased by about $300 million from 10 March to 15 March this year. Also, USDC rose by close to $150 million in market cap since 10 March.

Source: CoinMetrics | Stablecoins’ Market Cap

Additionally, in terms of exchanges, CoinMetrics noted that over 160k BTC flowed into exchanges such as BitMEX, Binance, Bitfinex, Bitstamp, Bittrex, Gemini, Huobi, Kraken, and Poloniex, right after the dump on 13 March. This was the largest inflow recorded in a day since 13 November 2017.

CoinMetrics further noted that BitMEX had the most inflows out of all exchanges, with 43.2k and 37.5k of BTC inflows over 12-13 March.

Notably, the report highlighted extensive inflows into major crypto-exchanges. This figure began rising at an unusual rate. However, this started on 8 March, i.e four days in advance of the price fall, and was speculated to be a potential well-coordinated action by whales to dump Bitcoin.

However, CoinMetrics’s concluded,

“Most of the sell-off appears to have been driven by relatively short-term holders, and longer-term holders seem to be holding strong, at least for now.”