Bitcoin

Bitcoin’s price dictated by less than 50% of BTC in circulation

2019 has been an interesting year for digital assets from the point of view of price activity and institutional involvement.

Bitcoin has been at the crux of the ecosystem with its price volatility, with a majority of the crypto-asset market recording significant movement over the year. However, while many view movement as a norm in the industry, that does not seem to be true according to CoinMetrics’ latest report.

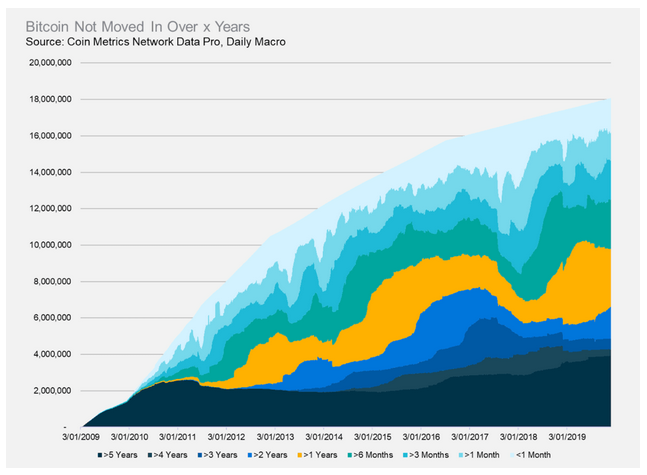

Source: CoinmetricsAccording to the aforementioned report, over the past one year, the amount of Bitcoin exhibiting static movement in the industry has periodically increased. The data acquired up to 31 November revealed that over 3 million BTCs were not moved for over a year in the ecosystem. Additionally, it was also reported that before 18 May 2019, 4,500,526 BTC were not in circulation for a minimum of 12 months.

The aforementioned data also highlighted the improved scarcity value of Bitcoin over time.

Mati Greenspan, Founder of Quantum Economics and reputed crypto analyst, had re-iterated a similar sentiment earlier, stating,

“less than 6.8 million BTC has changed hands in the last 12 months. Remember, it’s the scarcity that creates value.“

More support was given by @Rhythmtrader who supported the argument by mentioning that the cumulative sum of Bitcoin in dormant addresses may have crossed the threshold of over 11 million BTC.

Such immobility registered by a majority of BTC indicated that the price action exhibited over the course of 2019 depended on less than half of the Bitcoins in circulation.

Source: intotheblock

Additionally, it can also be noticed that over 5.5 million BTC were locked up in addresses that existed well before Bitcoin was worth over $1000. Many in the community speculate that despite the turbulent price movement of 2019, the HODLing sentiment has been active in the space.

Spencer Bogart, General Partner at Blockchain Capital, conveyed that same sentiment recently after he claimed that it would unwise to trade against Bitcoin over the next 5 years. He believes that despite a tumultuous 12 months, BTC’s price would improve over the next half a decade.