Bitcoin’s dormant market paves way for negative sentiment

Bitcoin’s market has been laying low over the past couple of weeks, with traders were getting antsy predicting the future of the market. However, in order to predict any price movement or the direction, the crypto-market will take, just looking at the chart wasn’t enough. This is evident in the case of the market’s top two cryptocurrencies, Bitcoin and Ethereum, both of whom have been exhibiting other signs as well.

When Bitcoin’s price movement was observed, at the time of writing, it could be seen that the coin had remained inactive over the past couple of weeks. This inactivity was also visible in its Token Age Consumed charts. The said metric measures the number of tokens changing addresses, multiplied by the number of blocks created on the blockchain since they last moved.

A spike in the same ordinarily suggests that a large number of tokens are moving after being idle for an extended period of time, while also underlining an upcoming change in the cryptocurrency’s price.

Source: Santiment Insights

According to the latest data released by Santiment insights, the BTC network failed to register any significant spike over the past week in this regard, a sign that this metric can be considered dormant. Further, Bitcoin’s strong correlation with Ethereum meant that the second-largest crypto-asset was also in a passive state, thus, the Token Age Consumed for Ethereum was also visibly dormant.

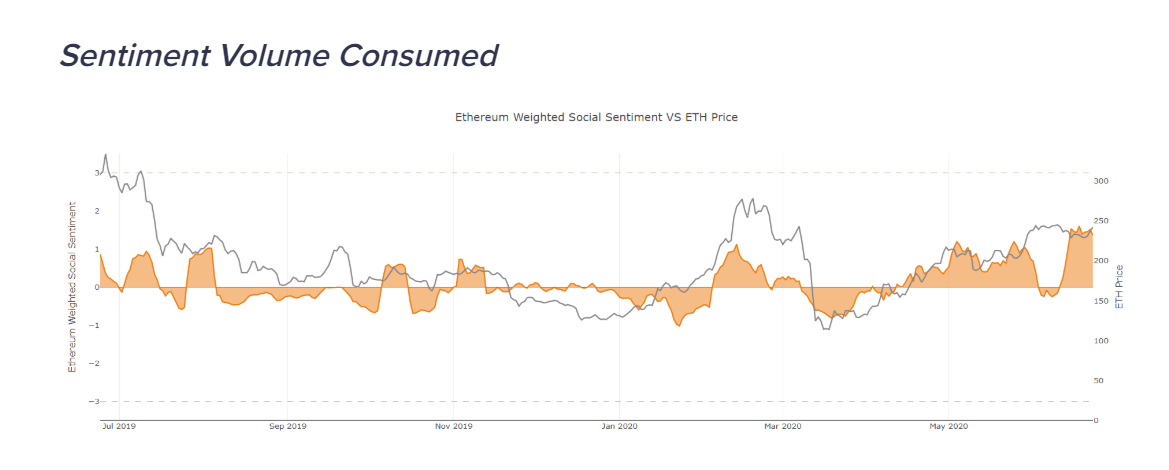

The Sentiment Volume Consumed by Ethereum has been on a one-year high in terms of positivity. In fact, ETH’s sentiment on Twitter has been high, with the asset remaining above a standard deviation of +1. This is a striking revelation as the coin has been lacking any price momentum. Interestingly, the positive sentiment in the market could be due to the news regarding COMP and Defi adding to the value of ETH.

Source: Santiment Insights

However, a peak is not conclusive of a confident market and it might have to cool down a bit for traders to consider a serious rally in ETH/BTC price.

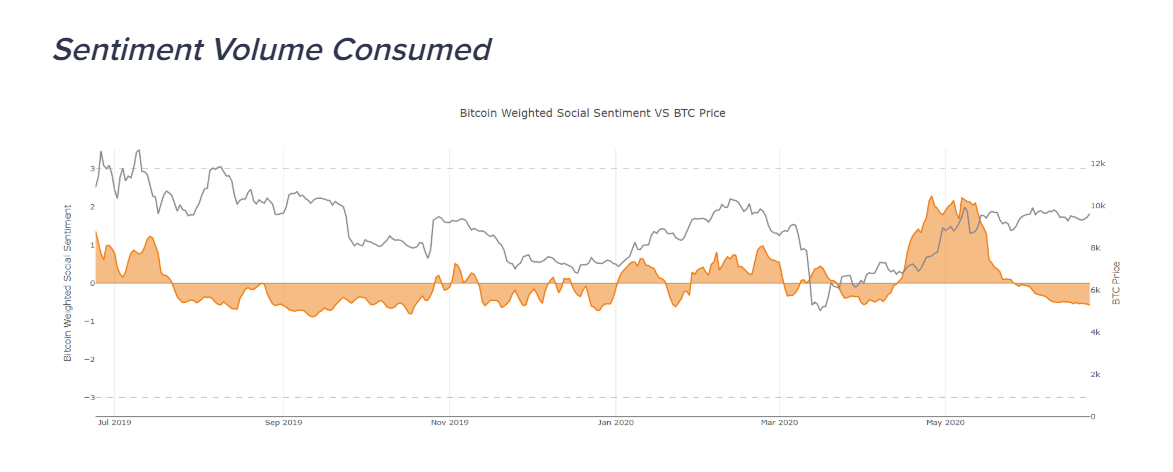

On the other hand, Bitcoin’s sentiment had fallen from a one-year high in May into the negative territory, at the time of writing, a trend that took shape in the month of June. Bitcoin’s stagnating price over the past six weeks has also contributed to the complacent and unenthusiastic attitude of the market’s traders.

Source: Santiment Insights

However, despite being a negative zone, this could be a good sign for bullish traders and as the standard deviation moves close to -1, it could be a perfect buying opportunity for them.