Bitcoin’s CEI improves to -2.73 after -8.73 slump in December 2019

Bitcoin started the new year on a positive note after the world’s largest cryptocurrency registered an uptick of over 30 percent in January alone.

Last month was constructive for Bitcoin with respect to other market fundamentals as well, something highlighted by Circo’s latest Crypto Economic Index report.

The CEI index, an index that measures the level of network and audited activities of a crypto-asset in terms of strength, volatility, and valuation, turned in favor of Bitcoin as well.

According to the report, Bitcoin’s CEI index rose back up to -2.73 in January, easing into a bit of stabilization after a disastrous December 2019 saw it slump to -8.73. Alongside its rising CEI index, Bitcoin’s hashrate surged by nearly 17 percent from the previous month. Although a negative rating suggests that the network is experiencing a decrease in usage and strength, a rise from -8.73 to -2.73 is still considered by many in the community to be a good sign for the cryptocurrency market.

The report in question also observed that the number of Bitcoin nodes was 9006 at the time of publication, and continued to stay within the range of 9000 and 9500.

Over the month of January, the number of average transactions recorded on Bitcoin’s chain has also improved and the average transaction fee paid through the month has fallen by 4.76 percent.

The Asian continent continued to dominate in terms of the highest activity over a period of 24 hours as the highest number of average transactions took place from 20:00-20:59 (UTC -5). The average transaction over a period of 30 days was 307,962, with the highest 24 hours recorded transactions being 358,020.

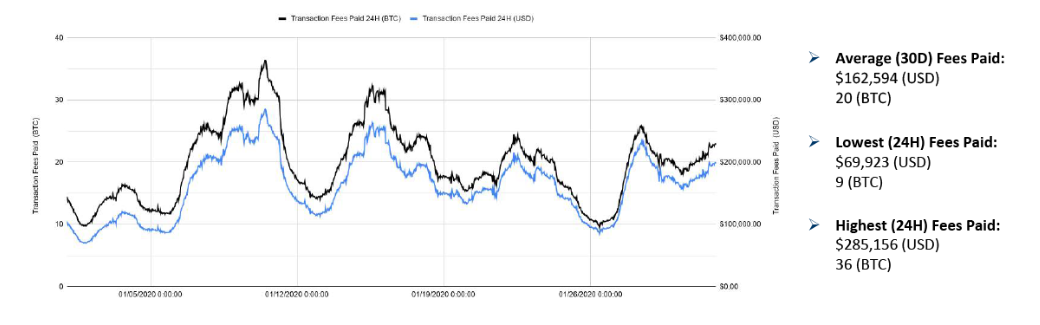

Source: cir.co

From the chart above, it can be observed that the average fees paid by users were around 20 BTC over a 30-day period. This is a minor decrease from December 2019, a time when the average fees paid were about 21 BTC.

The sentiment surrounding the world’s largest crypto-asset is strongly bullish at the moment but over the past 24-hours, the asset was recording some sideways movement on the charts. As the 3rd halving approaches in May 2020, many in the community believe that BTC’s price will rally further over the next few months.