Bitcoin volumes on exchanges will rise only after ‘bull-flip’

Three weeks ago, a sharp turn was observed on the Bitcoin exchange balances charts. BTC held by exchanges were identified to entertain a hike on the charts after months of decline in 2020. However, recent data would suggest that this might have been a false alarm, with volumes falling down to a new yearly low.

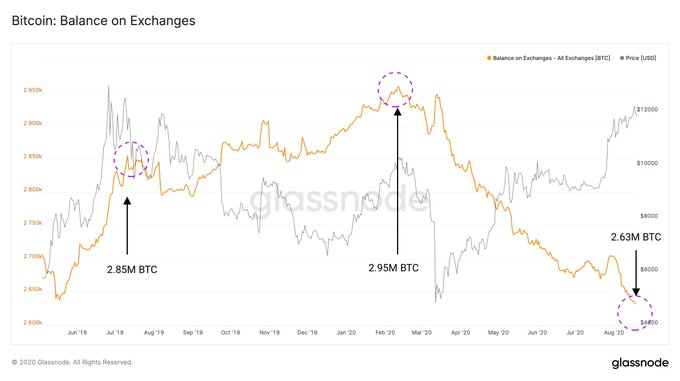

Source: Glassnode

According to the attached chart, Bitcoin levels on exchanges were down to 2.63 million, at the time of writing, after rising to 2.69 million in late-July. Considering the fact that Bitcoin was trading at a high price when the rest of the year is put into perspective, Glassnode explained that it was significantly lower than the last time Bitcoin reached a yearly high in 2019 (2.8M) and lower than the figures before the sell-off in March (2.9M).

Is Bitcoin volume dropping on exchanges still a point of concern?

Here, such a concern would need further clarification. Apart from price movement and investors sentiment, nothing else really impacts BTC volume held by exchanges. However, the drop in BTC volumes might explain the latest price drop on Bitcoin’s charts.

According to Glassnode, while exchanges kept losing BTC from their platforms, Bitcoin’s latest price surge was more of an overheated rally.

With selling pressure having fallen considerably owing to BTC’s decline on exchanges, the surge in question stood on weak fundamentals, and hence, correction from $12,400 to $11,600 came about quickly and as expected.

Source: Coinstats

On a positive note, such a pullback is actually a healthy retracement for the crypto-asset, but a decline of $800 is always going to raise a few eyebrows.

In the meantime, reducing sell pressure for BTC might undergo a change as well. When Bitcoins are held on exchanges, they can be used to trade with altcoins, or traded with fiat. According to CoinMarketCap, Bitcoin’s dominance was down to 59.3%, at press time, and with altcoins slowly improving on their market caps, an argument can be made that the selling pressure on BTC will inevitably increase.

Yes, Bitcoin held by exchanges is at a low, but as the previous article argued, it is just a temporary resort and the flip will come after the larger digital asset industry entertains another active rally.