Bitcoin

Bitcoin volatility poised to spike in June with price close to 2017 peak

In less than 15 days, the Bitcoin block rewards will get slashed by 50 percent. With the world in a spread of inflation, Bitcoin’s intended deflationary effect is poised to take the coin’s volatility through the roof. And if you ask option traders, this volatility will be looking up, rather than down.

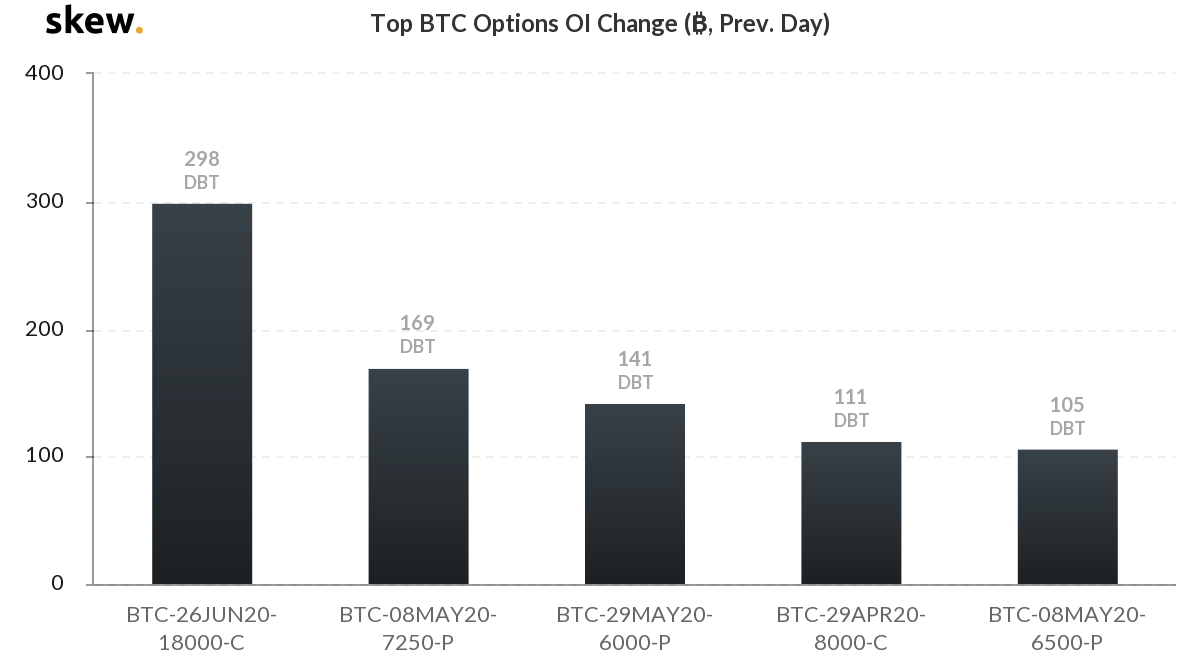

According to data from skew markets, the BTC options volume on April 28, 2020, closed with a call option sporting an $18,000 strike price amassing the maximum volume. The contract expiring on 26 June 2020 saw 298 contracts traded, significantly higher than the rest of the field. The second highest contracts traded on the day was a put option of strike price $7,250 with 169 BTC in volume.

If the trend holds clear, and the traders’ speculation is proven right, we could see a second coming of the December 2017 highs, this time in June 2020.

Bitcoin options volume | Source: skew

This high price for Bitcoin is on the cards of options traders for two reasons. The first being quite straight forward, the perceived bullish pressure that will pile on the Bitcoin market as the supply drops, with the mining rewards down to 6.25 BTC per block mined. Further, the increased liquidity in the market, with central banks’ loose monetary and fiscal policy will also look to play a crucial role.

Further, the significance of the aforementioned expiry cannot be understated. After the massive expiry last Friday, 26 June 2020 is set to be the date of the largest single-day expiry of Bitcoin options in 2020, with skew estimating the contracts tapping out at 36,200. With the $7,800 press time price of Bitcoin attached, we are looking at a conservative volume of almost $300 million, just from expiry.

Bitcoin options open interest by expiry | Source: skew

Looking ahead from the date, the volatility term structure suggests a leveling off of price fluctuation. From the halving till the end of June the volatility is poised to jump, and then till the end of the year, the volatility is poised to see minimal movement. Whatever has to happen, in the Bitcoin market, will happen between the halving and the expiry at the end of June, following which a sea of calm will subsist.

With 26 June over a month and a half ahead of the halving, there should be enough time for the market to absorb the effect of the reward reduction and alter the price accordingly. Traders are expecting this ‘balance’ to be in favor of a price increase, and hence are placing a high premium on the price of Bitcoin on 26 June.