Bitcoin, ‘too volatile’ to be a long-term investment? Not really…

The world of finance tends to normally take a traditional route when it comes to its evolution. This is why cryptocurrencies and the digital asset revolution within mainstream finance have been deemed such a disruptive force. Cryptos like Bitcoin seem to have been a response to archaic financial institutions and traditional forms of money that had a wide variety of flaws that were inevitably exposed during the 2008 financial crisis.

Interestingly, a recent research paper published by Stanford Graduate School of Business discussed the issues pertaining to cryptocurrencies in the digital era of money and whether or not regulatory bodies are required to keep crypto stable. The paper highlighted how a new taxonomy or a classification process is key to understand money in the digital era, especially in light of very many cryptocurrencies trying to replace traditional forms of currency like central-bank regulated fiat.

The paper noted that such a classification of money will look at four key criteria behind any form of mone be in crypto or fiat. It read,

“This taxonomy, known as the “money flower,” evaluates four properties of money: issuer (central bank or other entity); form (electronic or physical); accessibility (universal or limited); and transfer mechanism (centralized or decentralized, i.e. peer-to-peer).”

The paper highlighted some of the common inadequacies with cryptos like Bitcoin, i.e they are too volatile to be deemed a dependent long-term investment option. The speculative nature of such assets adds another layer of complexity.

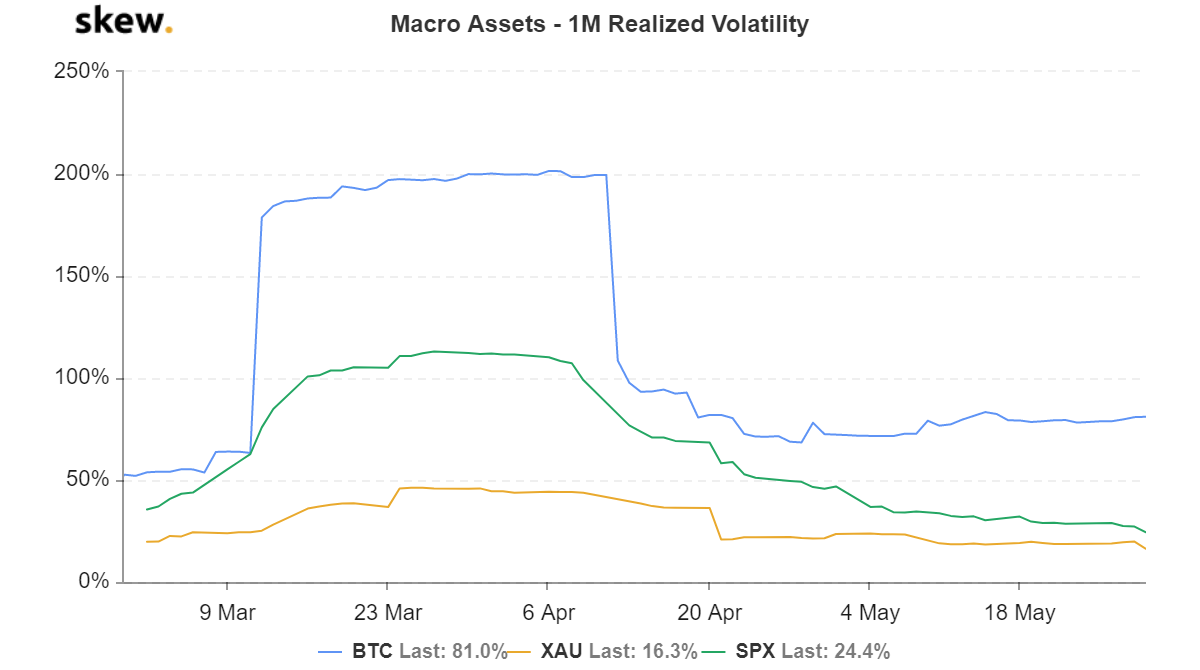

Source: skew

Interestingly, while cryptocurrencies do exhibit more volatility in comparison to traditional assets like gold or the S&P 500 index, the past three months displayed that even traditional assets are not volatility-proof. For assets like Bitcoin, data from skew shows a significant dip in realized volatility moving in tandem with gold and the S&P 500.

In the past year, regulations for crypto and adoption have increased dramatically, the study noted that its growth and popularity may also come with certain downsides, it highlighted that,

“The prospect of outsized cryptocurrency growth as a standalone asset class raises concerns, to say nothing of scenarios in which large bank holding companies and other financial companies begin dealing, transacting, and otherwise sponsoring cryptocurrency and related assets and instruments.”

While cryptocurrencies like Bitcoin continue to be fully decentralized and highly democratized when it comes to transactions being validated, centralization is inevitably a lot more efficient. The recent rush to develop CBDCs and Facebook’s entry with its Libra project may end up subverting fundamental crypto-ideals. The study added,

“This scenario is the confluence of “too big to fail” assets meeting “too big to fail” institutions, a dynamic that is applicable not just for banks but also for big tech firms like Facebook.”