Bitcoin supply crunch is real – Here’s why it might worsen soon

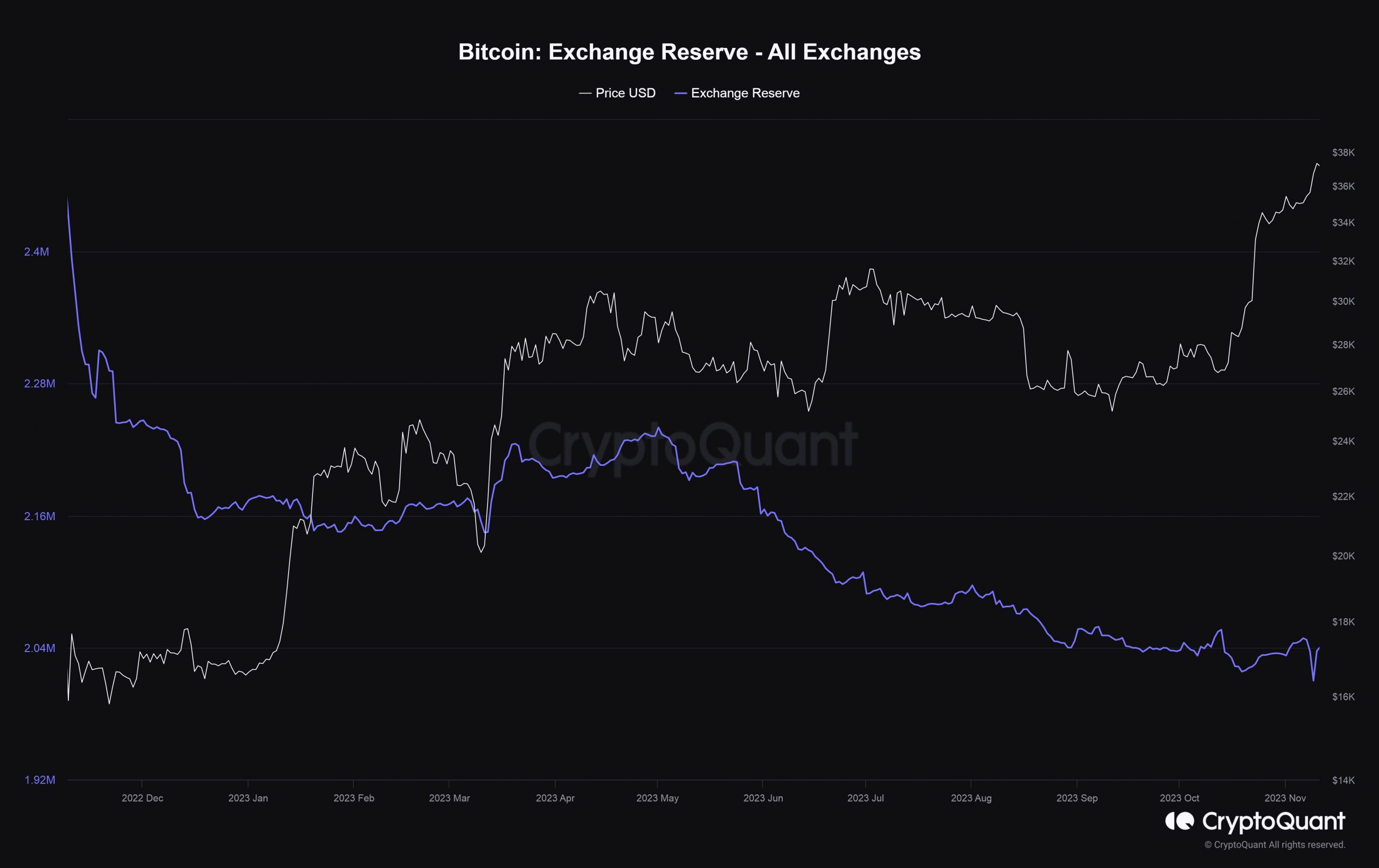

- BTC’s exchange reserve at the time of writing was 36% lower than the 2020 peaks.

- Growing institutional adoption could erode liquid supply further.

Bitcoin’s [BTC] liquid supply has been sinking to new depths, thanks to the strengthening ‘store of value’ narrative and expectations of a strong bull market in 2024.

Indeed, exchange supply has trended downwards in 2023 despite BTC prices more than doubling on a year-to-date (YTD) basis, as per AMBCrypto’s analysis of CryptoQuant’s data.

Moreover, BTC’s exchange reserve at the time of writing was 36% lower than the 2020 peaks.

Demand>> Supply

A CryptoQuant researcher argued that the continuing decline in exchange supply was the result of demand exceeding supply for Bitcoin. The analyst with the pseudonym ‘PAPI’ added,

“Higher emissions and less demand in the first decade saw supply rise. I consider 2018 the last “early” cycle. The cat was out of the bag in 2020>2021. Remember all the Superbowl ads? Since then, demand has outstripped supply, Bitcoin finally (truly) entered popular culture.”

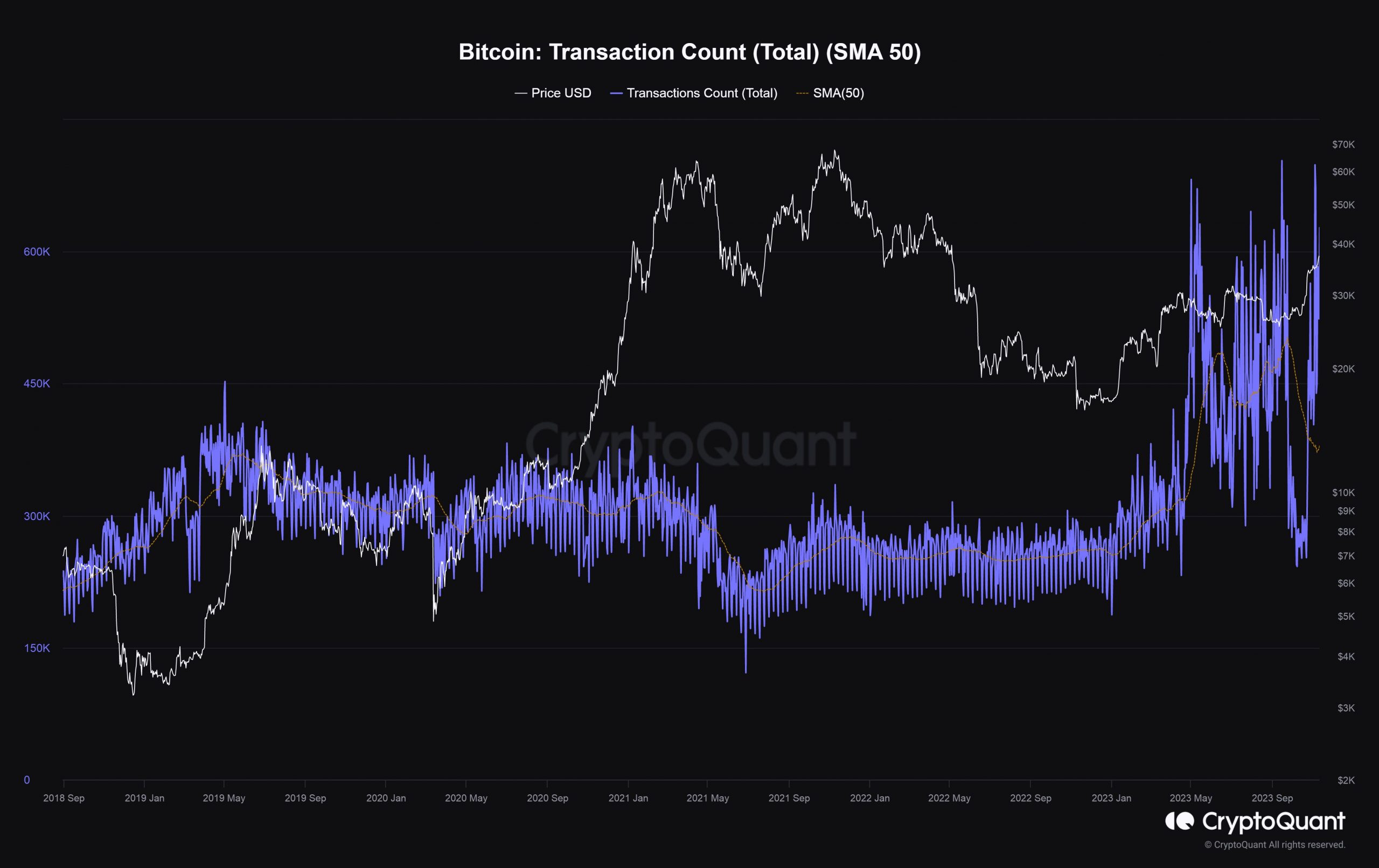

This assertion was also reflected in greater utilization of the Bitcoin blockchain. The 30-day average of daily transactions lifted dramatically in 2023, a sign of growing mainstream adoption.

Spot ETFs to reduce liquid supply further?

The analyst also predicted a supply shortage owing to greater market penetration by institutional giants. The argument held merit in light of the expected approvals of several BTC spot ETF applications.

Unlike some of the other funds, a spot ETF involves holding Bitcoin as its underlying asset. Clearly, asset managers will have to purchase a lot of Bitcoins to keep the price of the share equal to the real-time value of the cryptocurrency.

In doing so, a large chunk of supply will once again become off-limits for the general public. Add to this the quarterly halving events, that will anyway limit Bitcoin’s entry into the market. All these factors could potentially enable sustained scarcity-driven growth for the king coin.

Cryptoquant analyst PAPI opined,

“At the current rate, even if ETFs don’t expedite the drain on exchange supply, we’ll still be trending towards near zero within the decade. “

Is your portfolio green? Check out the BTC Profit Calculator

Traders still greedy

Bitcoin dipped below $37,000 in the last 24 hours, as profit-hungry traders applied selling pressure into the market.

The market emotion was still biased towards greed, indicating good upside potential in the short-term.