Bitcoin short-term Price Analysis: 05 November

After its third-retest within a period of 7-days, Bitcoin finally breached above the $14,000 and it is currently consolidating above $14.5. The current price is at an extremely unfamiliar trading zone, last witnessed in the first week of January 2018. At the moment, there wasn’t any particular resistance to look out for, but the trend reeked of corrections amidst relentless upwards movement.

Bitcoin 4-hour chart

Source: BTC/USD on Trading View

Over the course of October, Bitcoin’s meteoric appreciation from $10,125 followed an ascending parabolic curve. While the asset should have undergone a period of correction after consolidating above $13k, BTC kept pushing forward, invalidating the parabolic curve at press time. Now, over the past 1-week, Bitcoin has climbed another $1000, and the bullish rally remains unfazed.

While a lot cannot be said in terms of important levels, the divergence between Bitcoin’s price and trading volume is fairly evident. It is a clear bearish divergence and while a move above $15,000 may materialize, at some point in time, there has to be a period of correction.

Immediate support for Bitcoin:

- $14,000

- $13,000

- $12,500-$12,200

Market Rationales

Source: Trading View

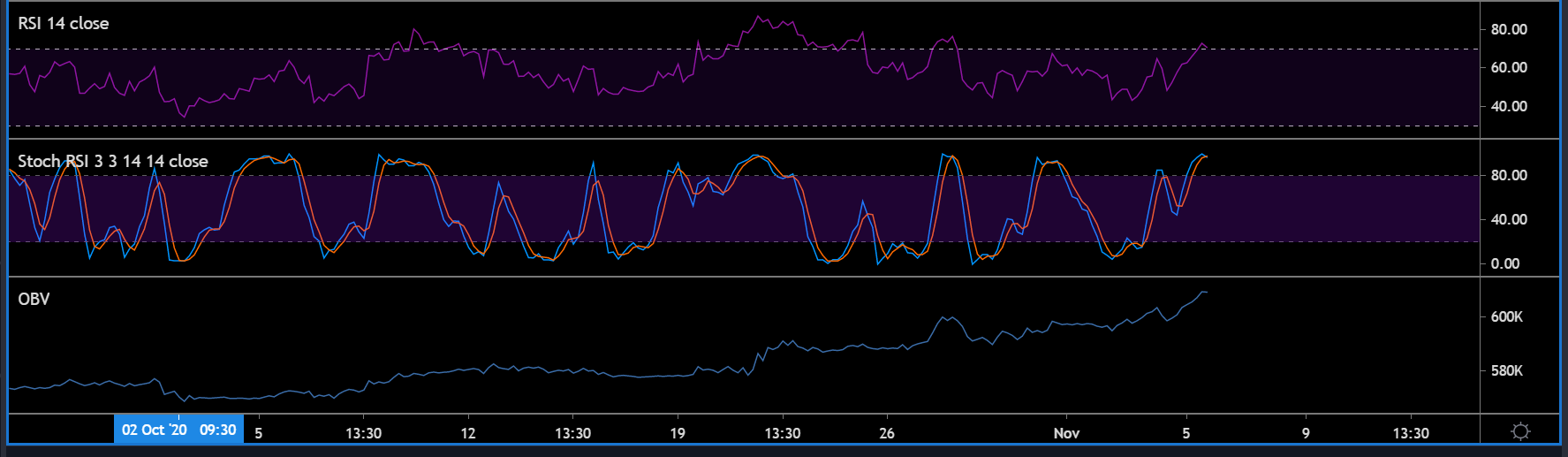

Analyzing the market indicators, it is clear as day at the moment that the Relative Strength Index or RSI continues to remain under the realm of buyers. Buying pressure has continuously kept the RSI line above 50 in the past month, addressing the strength of the rally.

While the trend remains overall bullish, Stochastic RSI is indicative of a bearish crossover. While the blue line is currently above the orange line, any movement under the signal at an overbought zone may inject a bit of bearish momentum.

On-balance Bitcoin volume is also reaching high levels of early-August. From here, institutions might start selling, as FOMO in retail will absorb the pressure.

Conclusion

Opening a long-position or short-position, both can be equally lucrative at the moment but it should be avoided until a clear period of correction takes place. However, the local top is difficult to predict hence an inaccurate short-position will be wasteful.