Bitcoin rich list is getting richer

The month of May has been filled with volatility for the Bitcoin market. The coin has been noticing grave challenges as the sell-off increased within the past one month. According to data provider, Skew, the sell-off liquidations on BitMEX alone was $856 million, out of the total $1.2 billion liquidations taking place on the platform. However, there were many traders in the market who were buying the dips.

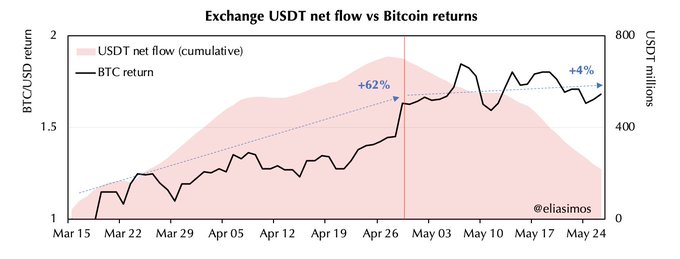

This could be inferred by a trend highlighted by the research analyst at Decentral Park, Elias Simos. The analyst pointed out that for the past few weeks, Bitcoin has been rushing out of exchanges, while USDT had stopped “dancing in tandem” and was following Bitcoin’s direction.

Source: Twitter

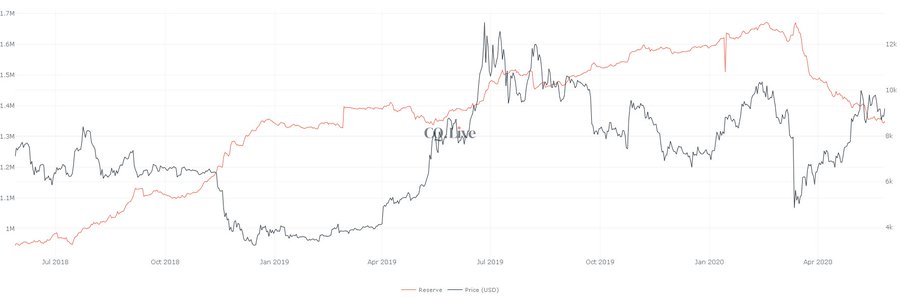

This indicated that USDT was being used to buy more BTC by the users. However, despite keeping the amount of BTC in exchanges, the users preferred to withdraw BTC from the exchange and hodl it in their own wallets. This was confirmed by a trader on Twitter and founding partner of Bitazu Capital, Mohit Sorout. The trader noted that the total exchange reserves were falling and have reached 1.36 million BTC. The last time the reserves on the exchanges were this low was in Q1 2019, after which the bullish rise of BTC began.

Source: Twitter

The trader speculated the reason behind it, he noted,

“It could be that the steep decline in exchange balance since black Thursday is because lots of btc exchanged hands that day. And the new owners moved their btc off-exchange into their wallets.”

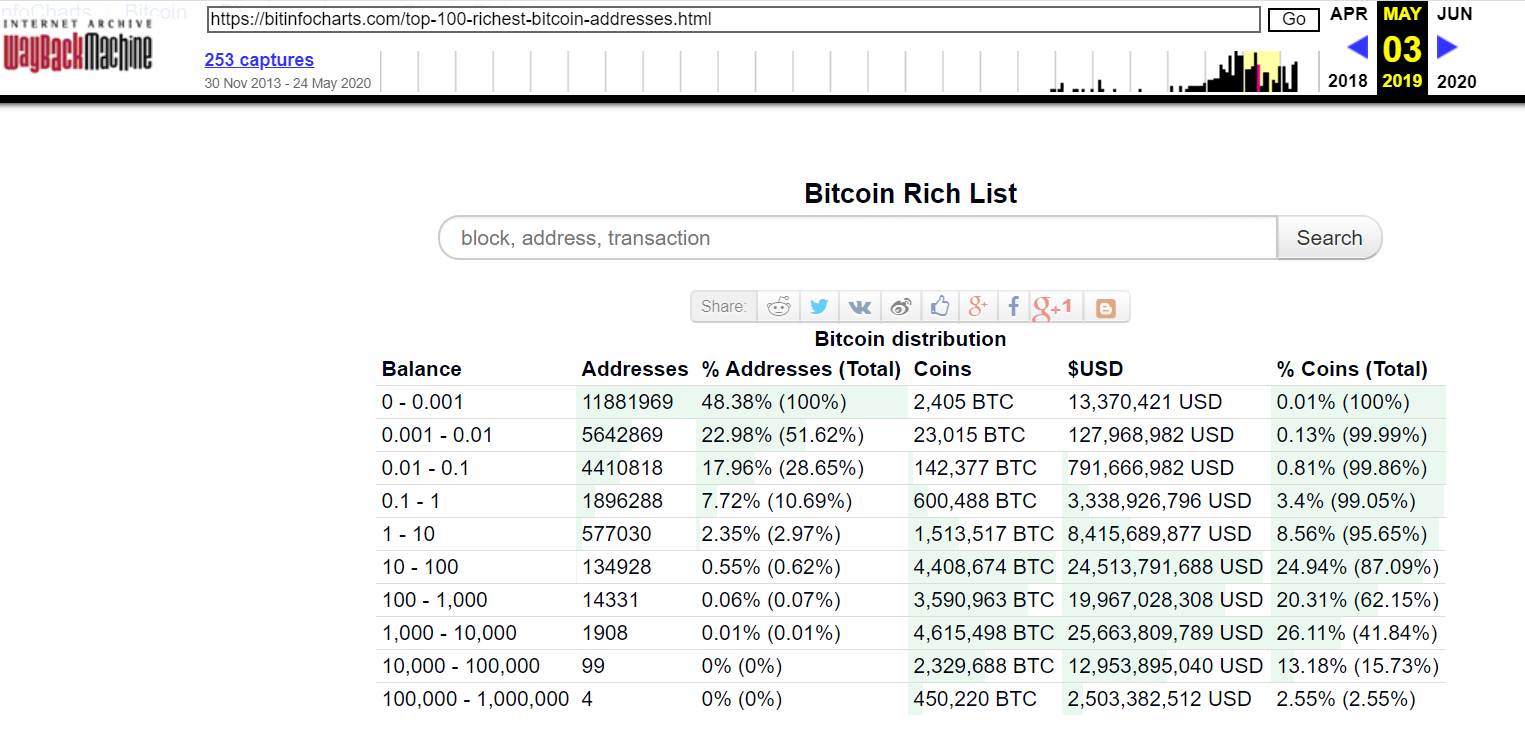

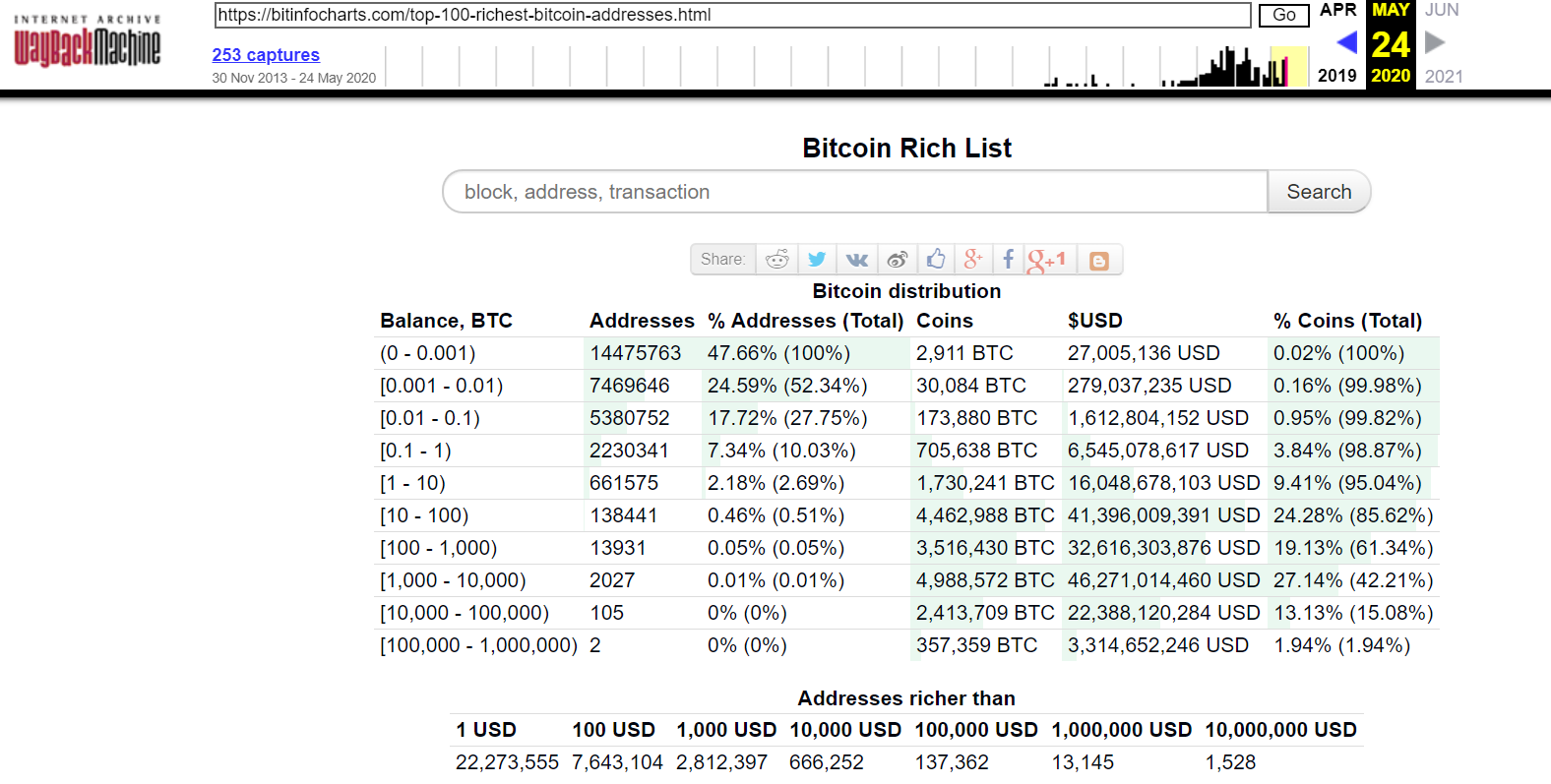

While the traders and analysts speculate hodling, data also suggested the rise in hodling activities. According to data provided by Bitinfocharts, the Bitcoin rich list for the number of bitcoins held in the 0-0.001 BTC range had increased 21% in a year.

Source: Bitinfocharts

The number of Bitcoins held by users in the above-mentioned range was 2,405 BTC in May 2019, which jumped to 2,911 BTC in May 2020, indicating the users are increasingly holding the largest digital asset.

Source: Bitinfocharts

This trend could be emerging due to the market’s expectation of the rising price of BTC post-halving and as per the market indicators, a bullish wave might just enter BTC ecosystem.

Source: Coinstats

At press time Bitcoin was being traded at $9401 with a 24-hour trading volume of $15 billion.