Bitcoin

Bitcoin’s price theories apply under these conditions

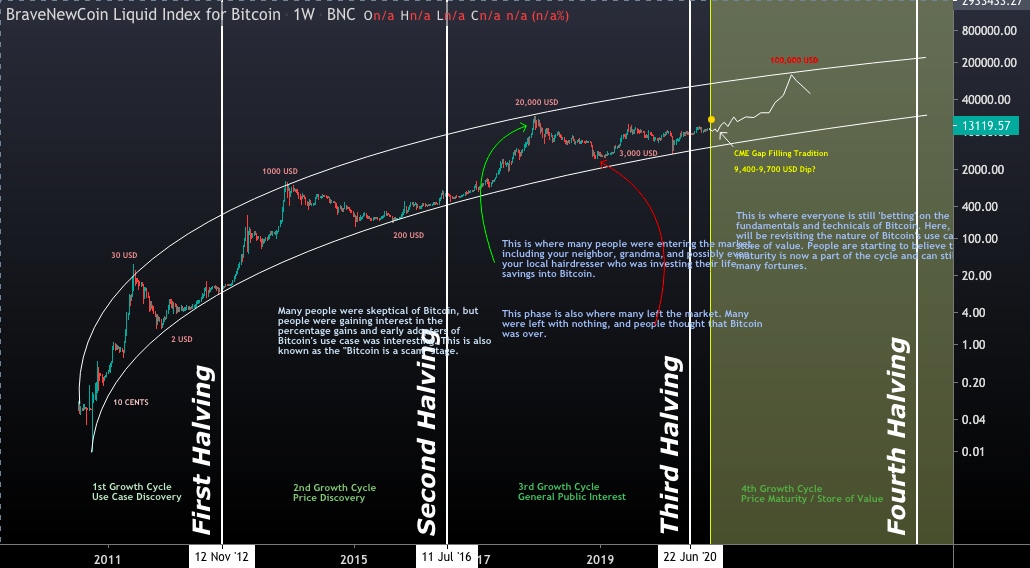

2020 may be the year of the Bitcoin. With the cryptocurrency’s price staying above $12,700 3 days in a row and above $11,000 for the past two weeks, Bitcoin seems to be rallying again. However, price theories by Bitcoin maximalists have been making the rounds for the past 10 months now.

While price trends do not necessarily follow a chart or a predicted pattern, many maximalists single-mindedly tend to look at Bitcoin’s price action with a one-track mind.

Liquid Index for Bitcoin || Source: TradingView

From charts predicting Bitcoin at $100,000 before the fourth halving to the Winklevoss twins’ prediction of $500,000, crypto-twitter has seen it all. However, here it is important to note that many of these predictions are seemingly based on solid rationale.

Consider this – The case for Bitcoin at $500,000 is based on the fact that Great Monetary Inflation is high. The Fed has been printing its way out of debt, and this will lead to further inflation and further debt if the cycle continues. The failure of fiat currencies and centralized institutions is key to the $500,000 Bitcoin narrative. Inflation and scarcity, ergo, are the top two drivers of Bitcoin’s price, making it more valuable and scarcer than Gold.

Source: Twitter

While such narratives fit the bill and make a bullish case for Bitcoin, it does not help predict Bitcoin’s price in the short-run and neither does it guide retail traders or shed light on their dilemma before opening a long or short position. What it does is create a herd mentality and make sheep out of retail traders.

Smart money knows where it is going. The Grayscale Trust, MicroStrategy, and Square’s purchase of Bitcoin was at the $8000 to $11000 level. Although it is still impossible to ascertain if their entry into the space fueled more institutional participation, it did give a boost to the overall market sentiment. With the cryptocurrency’s price now hitting a high of $13,000 and staying there, it is only a matter of time before it crosses over from $12700 to $13000 on average close.

While these predictions by maximalists paint a different picture of the market, what transpires is entirely overlooked, at least in their tweets and commentary. It is common knowledge that retail is the main driver of Bitcoin’s price, and not maximalist theories of the Fed printing money or fiat losing precious confidence from citizens.

With several price rallies since late-2018, Bitcoin’s price is in fact predicted by a combination of signals, from technical charts to trade volumes on spot exchanges. While the entry of smart money and the bullish case presented by maximalists act as catalysts by stirring dormant retail traders into action, that may be all. The actual price action lies in the trade volume and order books of exchanges.

Consider this – In the past 2 months, dropping Bitcoin reserves on top exchanges have had a bigger impact on scarcity and price, than any other factor. It is also a key driver of the cyclic nature of Bitcoin’s price as scarcity post every halving drives the price up, thus, making it profitable for miners to continue mining, despite higher operation costs. Though this is common knowledge to almost every trader in the space, what’s on the surface grabs more attention than what lies under the surface.

So yes, 2020 maybe the year of the Bitcoin, and its price might just continue rallying to touch new ATHs soon enough. However, what’s important to note here is that what meets the eye is only the tip of the iceberg!