Bitcoin: Poolin records ‘significant’ changes in wallet balance; selling or holding?

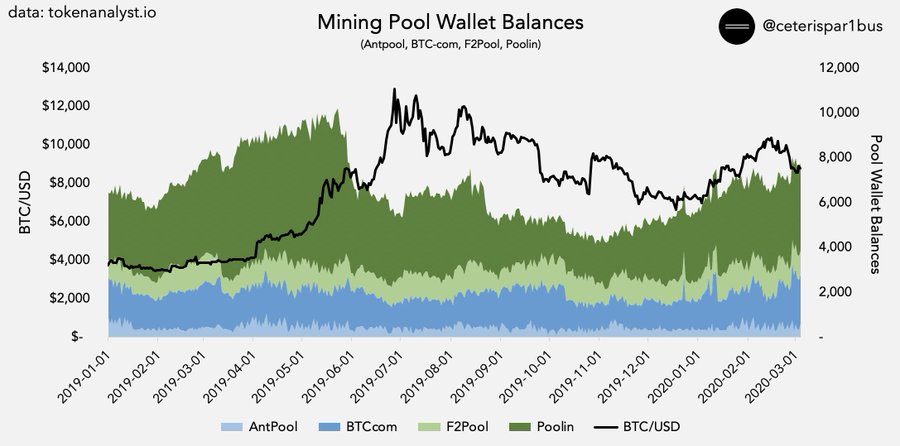

Bitcoin’s price has risen and it’s now back in the game. The coin climbed by 4.34% over the past 33 hours, with the pump helping the coin surpass the psychological barrier at $9k. At press time, Bitcoin was trading at $9,149.23. As the price continues to climb, an observation that was made was the large hash rate accumulation within four mining pools. According to observations made by Ceteris Paribus on Twitter, BTC mining pools – Antpool, BTC-com, Poolin, and F2Pool make up for >50% of BTC’s hashrate.

Source: Twitter

The wallet balance of Poolin has reflected significant changes since its peak in May 2019. However, the wallet balances of mining pools did not necessarily indicate selling, but withdrawal from miners to hold the BTC.

While other mining pools’ wallet balances did not show any drastic changes over time, Poolin’s balance had a notable drop on two occasions – May-June 2019 and August- September 2019. However, the balance began to rise post-November 2019 and has increased by >2k BTC since.

Since most of these mining pools had automated their daily payouts, it is difficult to gauge the selling and holding of BTCs by the miners. However, the crypto-analyst noted that,

“…poolin doesn’t seem to do this to the extent of other pools and their miners look to be accumulating. Interesting to keep on eye on.”

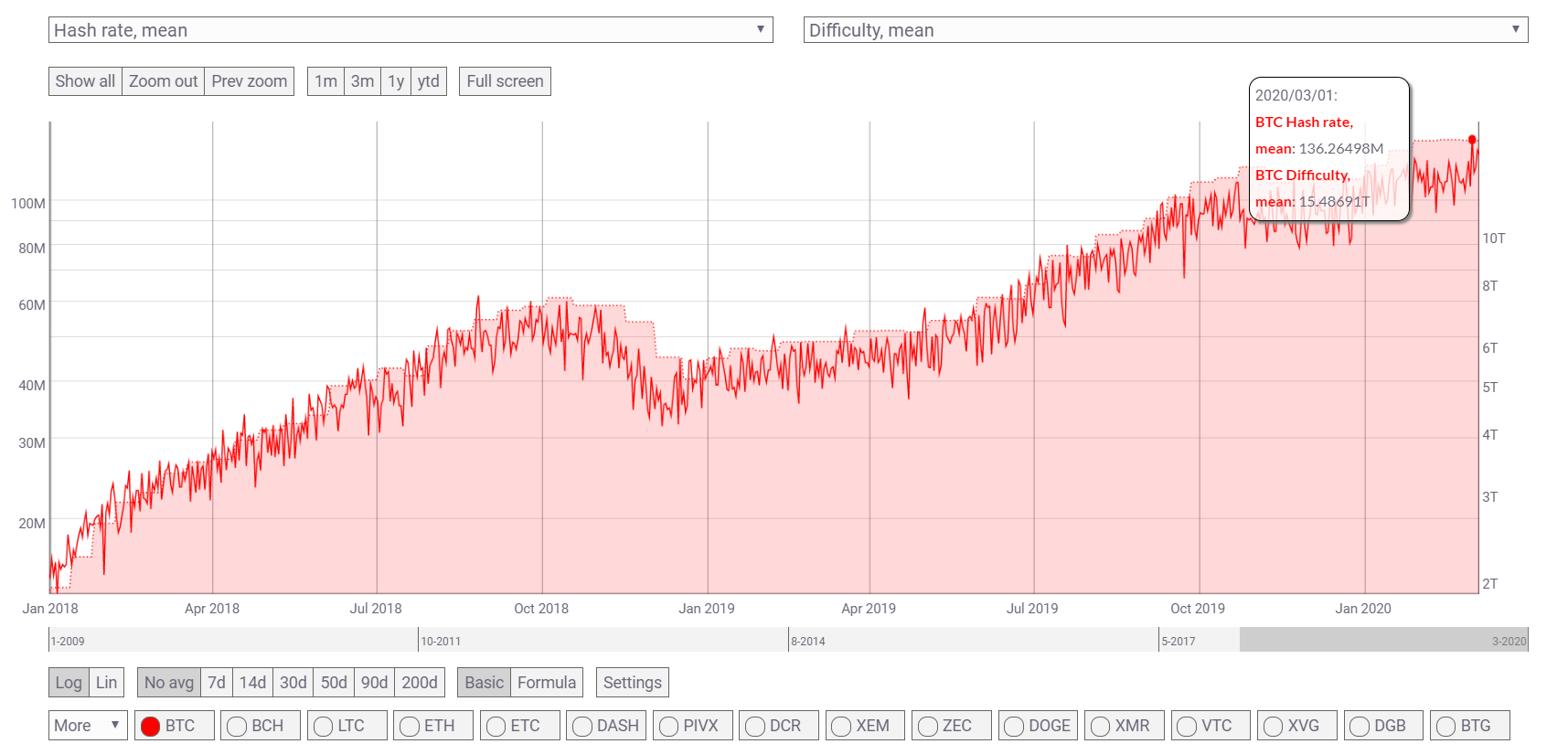

Meanwhile, the period of suffering for Bitcoin’s price was reflected upon the fundamental strength of the network, as the hashrate climbed to a new all-time high. The state of the network and miners were reflected by two important metrics – hashrate and the mining difficulty.

Source: Coin Metrics

On 3 March, both these metrics were performing at their best, with the hashrate at 136.26 TH/s, while the mining difficulty was at 15.48691T.