Bitcoin

Here’s how Bitcoin reacted to the PBoC’s latest draft law

A common belief that has been doing the rounds lately is that Bitcoin’s recent price behavior is a replica of its historic 2017 bull run. That’s all well and good, but what most people forget is that back in 2017, there were stories equating the 2017 bull run to 2013’s.

#bitcoin is creeping up people!!!

I smell some bullrun of #2017 nostalgia ?? $XRP $ETH $ADA pic.twitter.com/w6H3oxXeNB— Rob_Cash71 (@Rob_Cash71) October 27, 2020

That’s not all, however, as many in the community seem to have also forgotten how China’s PBoC has reacted to each of these yearly developments. Whenever Bitcoin crossed a resistance level that hadn’t been tested for a long time over the aforementioned time periods, the PBoC reacted, following which, the price of the cryptocurrency fell.

Simply put, there have been three bull runs – 2013, 2017, and the ongoing one – and the PBoC has reacted to each and every one.

Back in 2013, when Bitcoin’s price crossed $1,000, the People’s Bank of China issued some comments and Bitcoin crashed. The People’s Bank of China (PBOC) had then sent out a statement claiming Bitcoin was “not a currency in the real meaning of the word.” In fact, the PBoC went on to restrain financial institutions from getting further involved with the cryptocurrency.

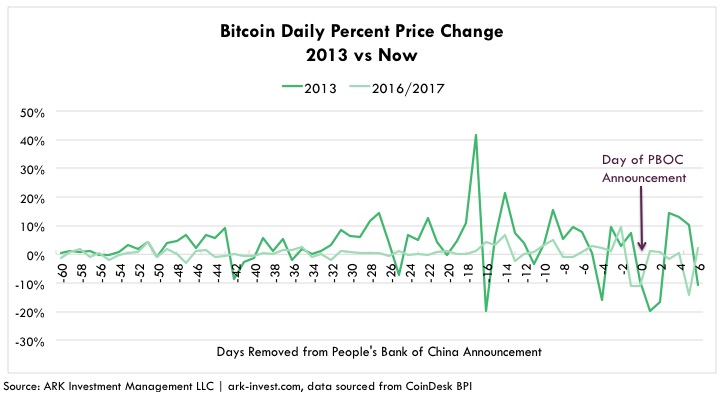

The rest, as cliched as it may sound, is history. Bitcoin’s daily percent change before and after the PBoC’s statements is evident from the following chart from Ark Invest.

Bitcoin Daily Percent Price Change || Source: ARK Invest

As can be observed, the daily percent price change dropped to negative 10% on the day of the PBoC’s announcement. While the price recovered soon after, the cryptocurrency’s price rally did suffer as a result of such an announcement.

Fast-forward to 2017, when Bitcoin’s price crossed $1,000 again, the PBoC sent out new statements indicating that its representatives had met with major China-based Bitcoin exchanges to reinforce the importance of remaining compliant with “relevant laws and regulations.” After the PBoC announcement, Bitcoin’s volatility dropped.

Bitcoin Volatility || Source: ARK Invest

Throughout the PBoC’s announcements, volatility remained around 3.4% in 2016/17, while the same was as high as 9.1% in 2013. However, a week after, the volatility was noted to have risen by nearly two times in both 2013 and 2017.

As anticipated, in 2020, when Bitcoin crossed $12,500 and consecutively, the next resistance levels at $13,500 and $13,700 were breached, the PBoC made an announcement. The bank revealed a draft law that bans private entities from issuing digital currencies.

It’s interesting to see the influence the PBoC yields, and how it dictates the narrative, seven years since the first Bitcoin bull run. The announcement came on 28 October 2020, and this time, the impact was the opposite of the conventional pattern.

Historical Price Data for Bitcoin || Source: Coinmarketcap

Post the announcement, the price hit a high of $13,837 and it has sustained itself above $13,400 for 3 consecutive days since. Though the price is not entirely dependent on the PBoC’s announcement, back in 2013 and 2017, the impact on the price rally was negative and significant.

Currently, the response has reversed the existing trend. A major factor behind the same could be the fact that current fundamentals are stronger than ever and with over 18.5M Bitcoins in circulation, the network is growing stronger every day. Institutions like J P Morgan, Grayscale, MicroStrategy, Square, and PayPal have associated themselves with Bitcoin, further suggesting that a regulatory nod may be on the cards.

Since the asset is more mature than in the past, the price will likely be influenced by relevant factors like network health, transactions, adopters, supply, and demand, rather than statements issued by the PBoC or the FUD that is a response to it.