Bitcoin Options volume, Open Interest on Deribit surge to new heights

The digital asset ecosystem has been losing sleep over the past 15 days after a bearish turnaround in mid-February contributed to a substantial dip in the prices of major crypto-assets. Coins such as Bitcoin, Ethereum, and Litecoin were significantly affected as their prices slumped below key resistances.

However, taking a moment away from the current bearish trend, institutional investments in both BTC Futures and BTC Options recorded a fruitful period in February.

Deribit has grabbed a foothold in the industry over the past year, with the exchange recording consistently high Options volume over the past 6 months. According to Deribit‘s latest institutional newsletter, the exchange recorded an average of 120K Bitcoin Options per month. However, over the past two months in 2020, the volume shifted gears and recorded an even higher average.

Over 183k Bitcoins were traded in January and in February, with a hike of 56 percent improving the volume to a total of 287K BTC Options. In terms of dollar value, the total Option turnover remained around $3 billion, rising by almost 80 percent from the previous month.

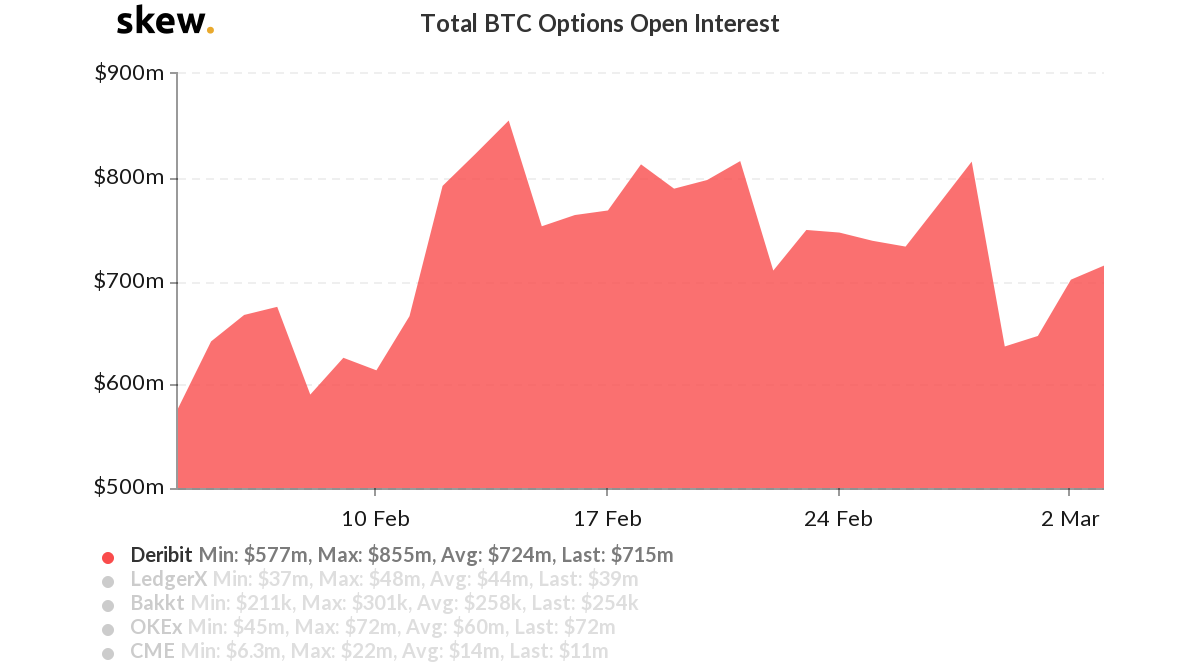

Over the same time period, the overall market Bitcoin options’ notional Open Interest registered was more than $1 billion, a finding that highlights the fact that the influx of investors has been the highest over the past month.

Source: Skew

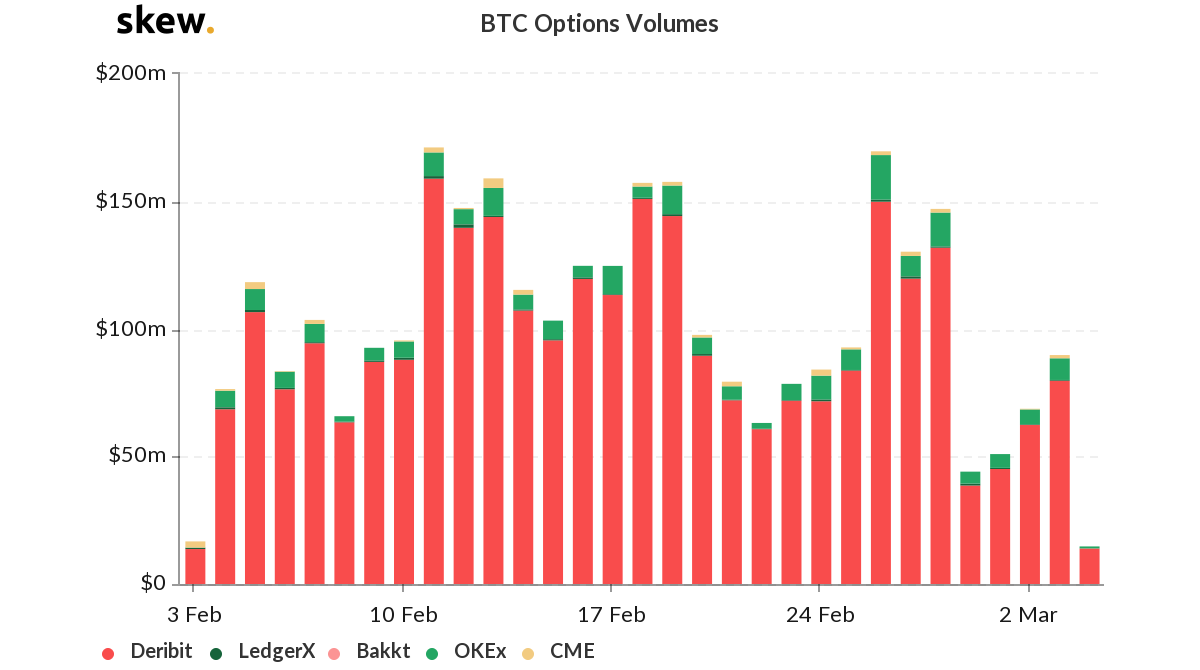

Source: Skew

On observing the above Skew charts, Bitcoin Options’ Open Interest on Deribit has been relatively consistent over the past month, witnessing a high during the 2nd week of February. The OI reached a high of $855 million on 14 February after registering a monthly low on 8 February with $590 million.

However, with February BTC contracts expiring last week, OI and volumes witnessed only mild trading activity over the last few days. Bitcoin’s price depreciation may have caused a drop in OI as well, with investors now exhibiting a cautious approach.

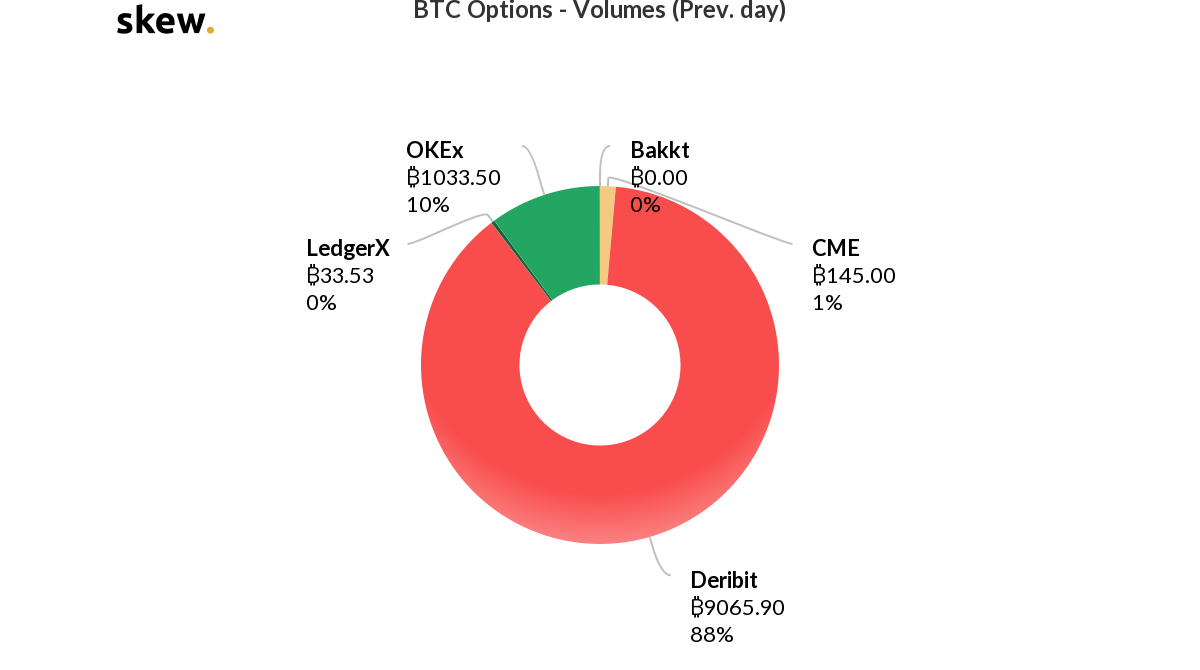

Source: Skew

Interestingly, in spite of low market interest, on 3 March, Deribit managed to outperform exchanges such as CME, OKEx, and Bakkt with a massive 88 percent accumulation of daily Options volume.

With the market currently in a consolidation phase, the sentiment across the market may take a while to register an upswing. However, the early year surge on the Institutional side is a positive sign from the investors’ point of view.