Bitcoin

Bitcoin options volume on Binance over $87 million; surpasses Deribit and OKEx

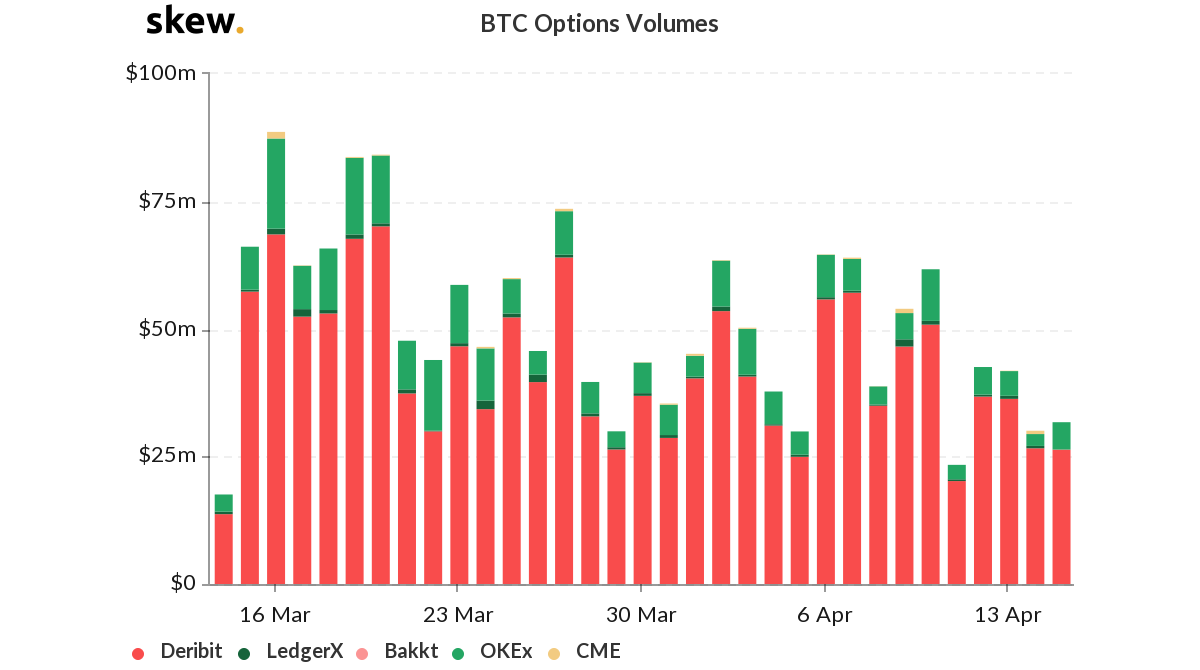

The Bitcoin derivatives market has been a good indicator in assessing the future of the BTC market. The Bitcoin options market has been noting a decreased volume sever since the March collapse. However, Deribit and OKEx were the only two exchanges noting relevant volume. According to data provided by Skew, Deribit was reporting a volume of $26 million, while OKEx had a volume of $5.4 million.

Source: Skew

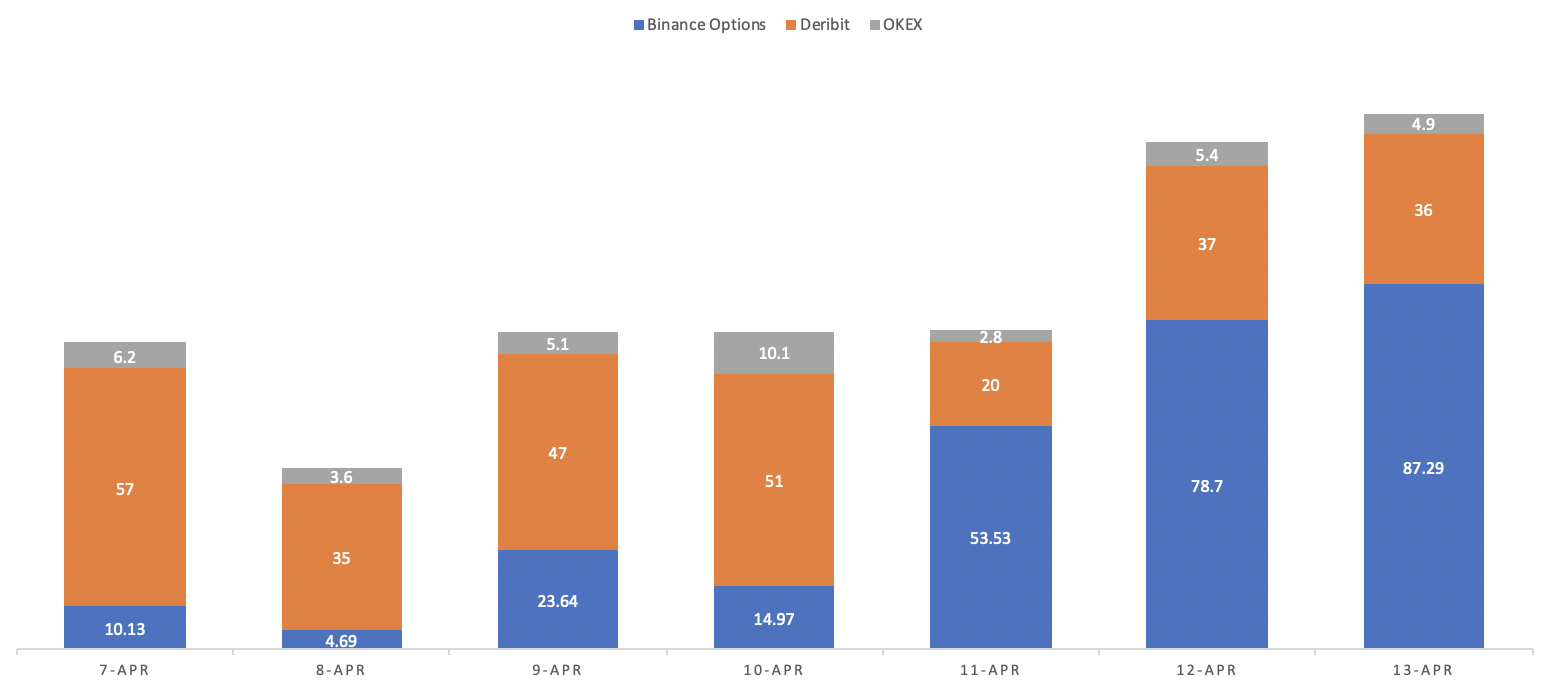

However, a new entrant has challenged Deribit’s standing in the BTC options market. Binance recently launched Options trading through on its mobile application and it has reported great volume within two days. According to the data provided by Binance, the exchange has already beaten Deribit and OKEx in terms of volume.

Source: Binance

According to the data, on 13 April, Binance reported a daily volume of $87.29 million, while Deribit noted $36 million. OKEx’s volume remained restricted under $5 million. Other exchanges, however, like CME, LedgerX reported low volumes in thousands and Bakkt flatlined with $0 in volume, as per data offered by Skew.

However, unlike the Options market, the BTC futures market reported an average volume of $1.5 billion, a value way higher than the Options market. This could be due to the absence of Option writers/sellers, creating an illiquid market leading to widened bid-ask spreads. With Binance’s entry into the options market, there could be a rise in liquidity and the volume traded may notice an exponential growth.

Meanwhile, the seeking pressure in the Options market has also been on a rise. The Put-Call ratio on BTC options had dropped the beginning of April, but, climbed its way up.

Source: Skew

The drop indicated an increase in buying pressure as traders were preferring call options, but as the day progressed the ratio noticed an escalation to 1.33, indicating high selling pressure.