Bitcoin Options speculate 260% price hike post-halving

True to Bitcoin’s reputation as a volatile crypto-asset, the price of Bitcoin did see quite a few dramatic ups and downs recently. Since the start of the week, Bitcoin’s price has seen an 11 percent dip and at press time, was trading at around $8800.

Interestingly, for a significant part of 2020, Bitcoin had been recording significant gains, with many expecting the upcoming halving to help Bitcoin supersede its 2017 highs.

Source: BTC/USD on TradingView

However, over the past few days, Bitcoin’s price fortunes have reversed, leading to a drastic dip in the price of the world’s largest cryptocurrency, according to market cap.

While the current price of Bitcoin may not be very inspiring for investors who already own it, the halving event still holds significant influence over the speculation in the industry.

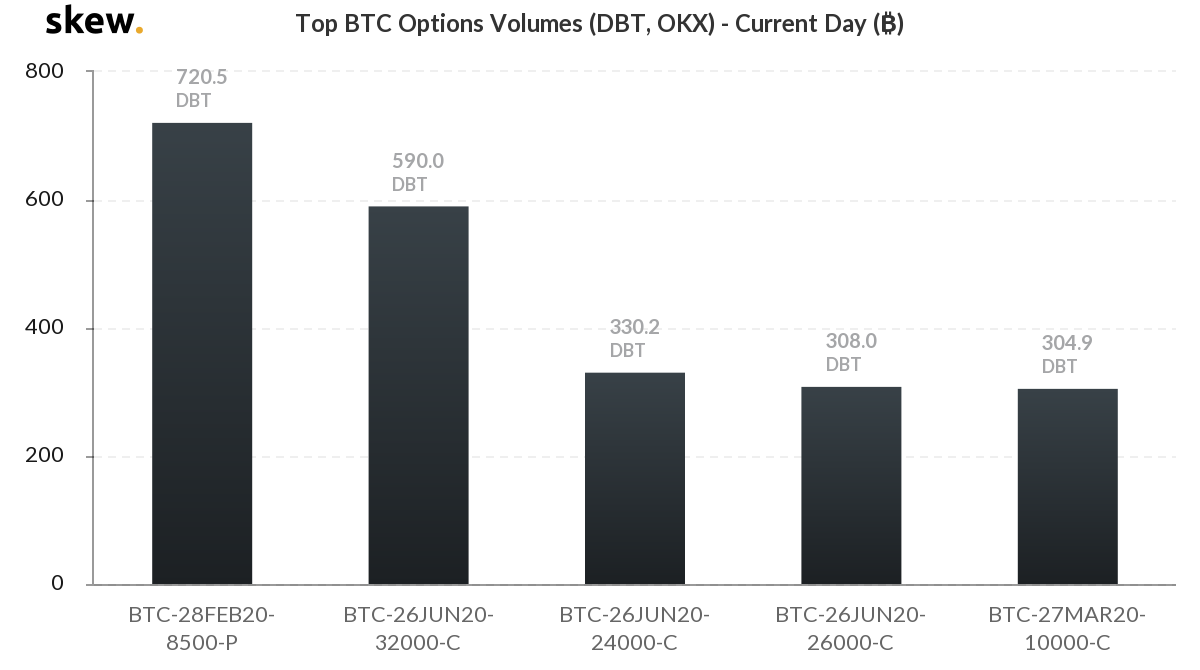

According to data from Skew markets, the BTC Options volume for exchanges such as Deribit and OKEx showed BTC call options with a strike price of a whopping $32,000 and an expiry of 26 June 2020, with a total trading volume of 590 BTC, the second-highest in the market, at press time. Optimism simmers as you go down the ladder, however, with contracts with strike prices of $24,000 and $26,000 traded at 330.2 and 308 BTC, respectively.

Source: BTC Options Volumes, skew

The rationale behind why the data only takes into account Options contract from two exchanges, i.e. Deribit and OKEx is because presently, these two exchanges dominate the BTC Options contract market. Deribit and OKEx have around 99 percent of BTC Options volume, according to the Skew markets’ data.

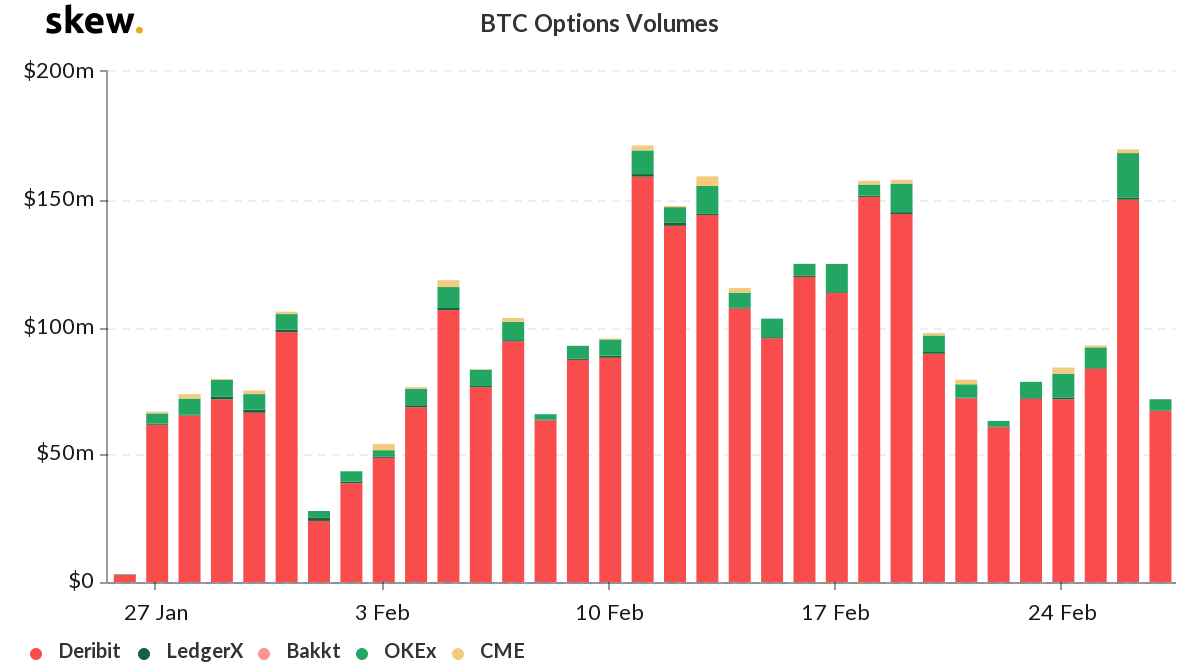

Source: BTC Options Volumes, skew

For BTC Options, the trading volume saw a significant high on 26 February, with Deribit and OKEx registering around $167 million. The Options volume on the same day peaked close to an ATH for Bitcoin Options in 2020.

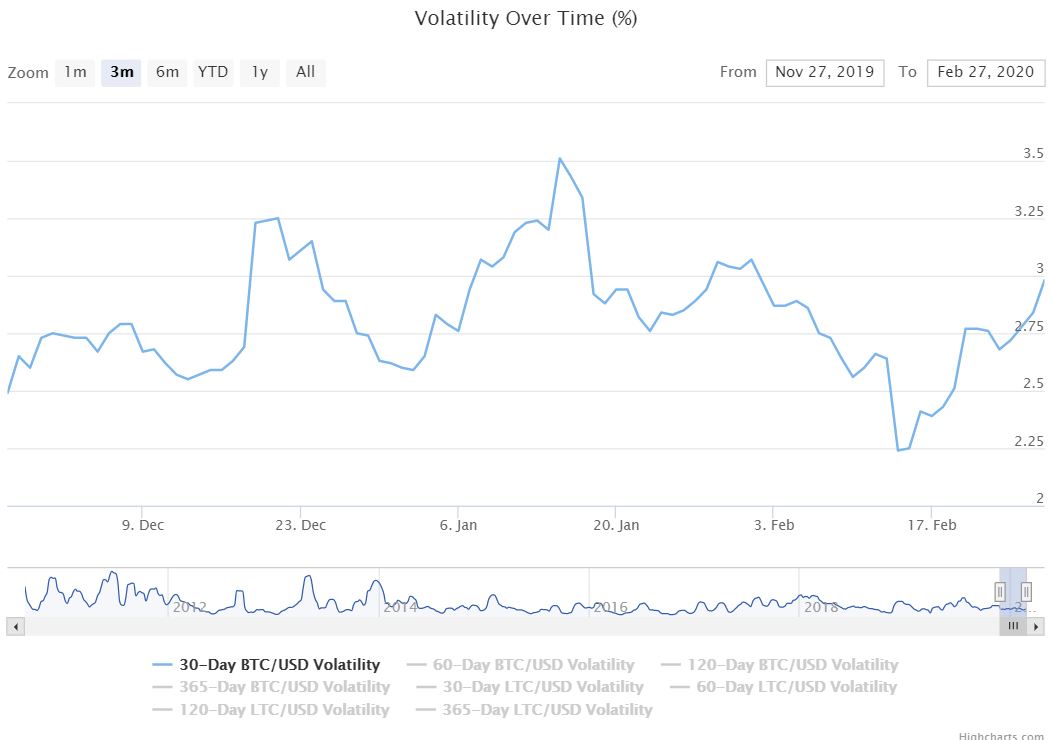

Over the last few weeks, Bitcoin’s price volatility index, according to BitPremier’s data, saw a substantial increase from 2.24 percent all the way up to 2.98 percent. This amounted to a 33 percent increase in volatility for BTC in just two weeks’ time, as per the 30-day BTC/USD volatility index.

Source: 30-Day BTC/USD, BitPremier

The ever-increasing volatility levels for the king coin, coupled with monumental events such as the halving event coming up later in 2020, might swing the price of Bitcoin in either direction. The fact that there are substantial amounts of Option contracts with a price that is around 260 percent higher than the current price indicates that many are putting their bets on some post-halving price movement.

For now, only time will tell what the future holds for Bitcoin’s price.