Bitcoin Options on Deribit now reporting $100M in trading volume regularly

The beginning of 2020 has been like a nauseous ride on a roller coaster. With the fear of an imminent world war taking place one day to the Coronavirus pandemic taking over, we have survived a lot this year. We saw the world’s largest crypto-asset, Bitcoin, struggle to consolidate its gains after weeks of steady movement at a time when the stock market began to crumble. In fact, the world of cryptocurrencies saw the rise, fall, and correction of a lot of crypto-assets over the first three months of 2020.

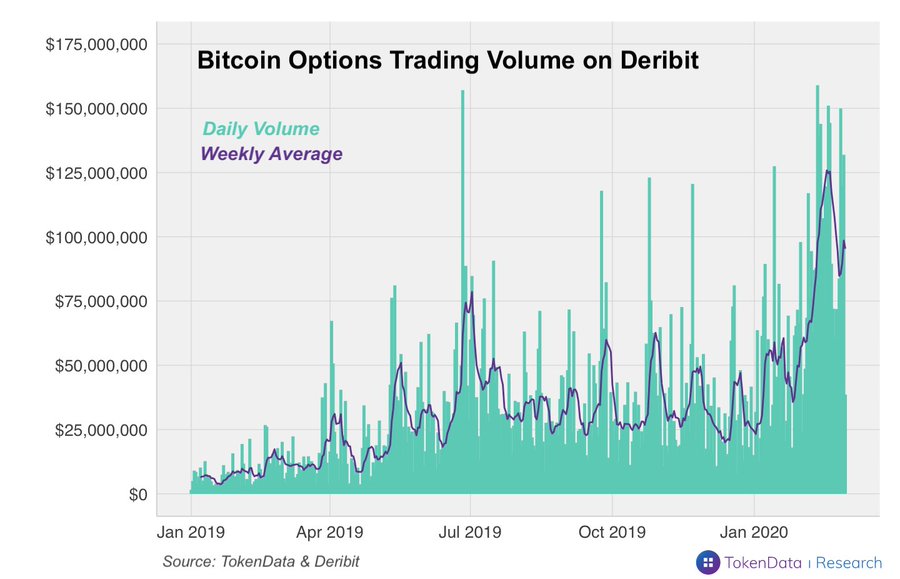

The Bitcoin Options market has been noting growth in trading volume, especially on the Deribit exchange. Even though the exchange offers many Futures and Swap services, it commands the Bitcoin options space. In fact, Deribit accounts for >90% market share in the Options space, according to research conducted by Token Data.

Source: Twitter

According to data provided by Token Data, Deribit’s growth in 2019 was contributed to by the clearing of over $150 million in BTC Options in June and ” four +$100M days over the remainder of the year.” 2020 seems to be a successful year too as the exchange’s volumes crossed $100 million and $150 million on a regular basis.

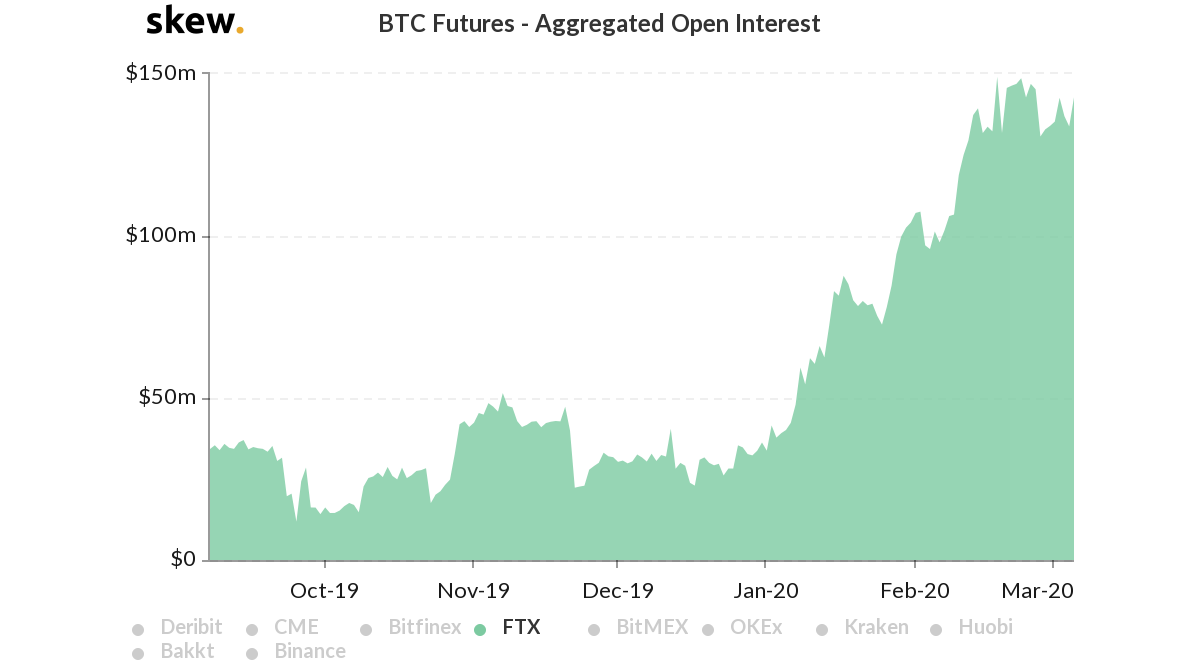

On the other hand, the recently established FTX exchange has been making the news almost every week with fresh investments and margin trading. Its FTX token recently acquired listing on Bitfinex’s exchange. Along with the token generating news, the exchange has been hands-on with launching products for its users, keeping investors and the market engaged. According to the research, FTX exchange has managed to handle more than $1 billion in crypto-derivatives on a daily basis since its launch.

Its latest product, Move, allows people to trade volatility without having to enter separate Option positions. In the BTC Futures market, FTX’s aggregated Open Interest was noting a high of $149 million on 18 February and despite the constant dropping and rising price, the interest was hovering at around $143 million on 5 March.

Source: Skew