Bitcoin: Not all participants are bystanders as BTC falls

- Smaller wallets with less than 1 BTC are taking advantage of the dip.

- BTC may drop below $36,000 if sellers continue to take profits.

After the storm comes the calm is a popular saying, indicating respite to a turbulent situation. But for Bitcoin [BTC], the last 24 hours have not been the best of days.

At press time, BTC changed hands at $38,375, representing a 3.21% decrease within the said timeframe.

According to a 17th November Santiment post, the drawdown could be connected to widespread profit-taking in the market. The on-chain data provider also disclosed that addresses holding more than 100 BTC were the major culprits of the selling pressure.

However, smaller wallets with less than 1 BTC in their portfolio are doing Bitcoin the favor of buying.

??? #Bitcoin's wallets have fluctuated during this major market-wide surge. Tons of new smaller wallets with less than 1 $BTC have flooded the network. Meanwhile, the 1-100 tier has flattened out, and 100+ tier may be in the midst of some profit taking. https://t.co/va51CcexC1 pic.twitter.com/PNZtA9ir2U

— Santiment (@santimentfeed) November 17, 2023

Big bets regardless

Considering the disparity and impact between these cohorts, BTC has no option but to slide.

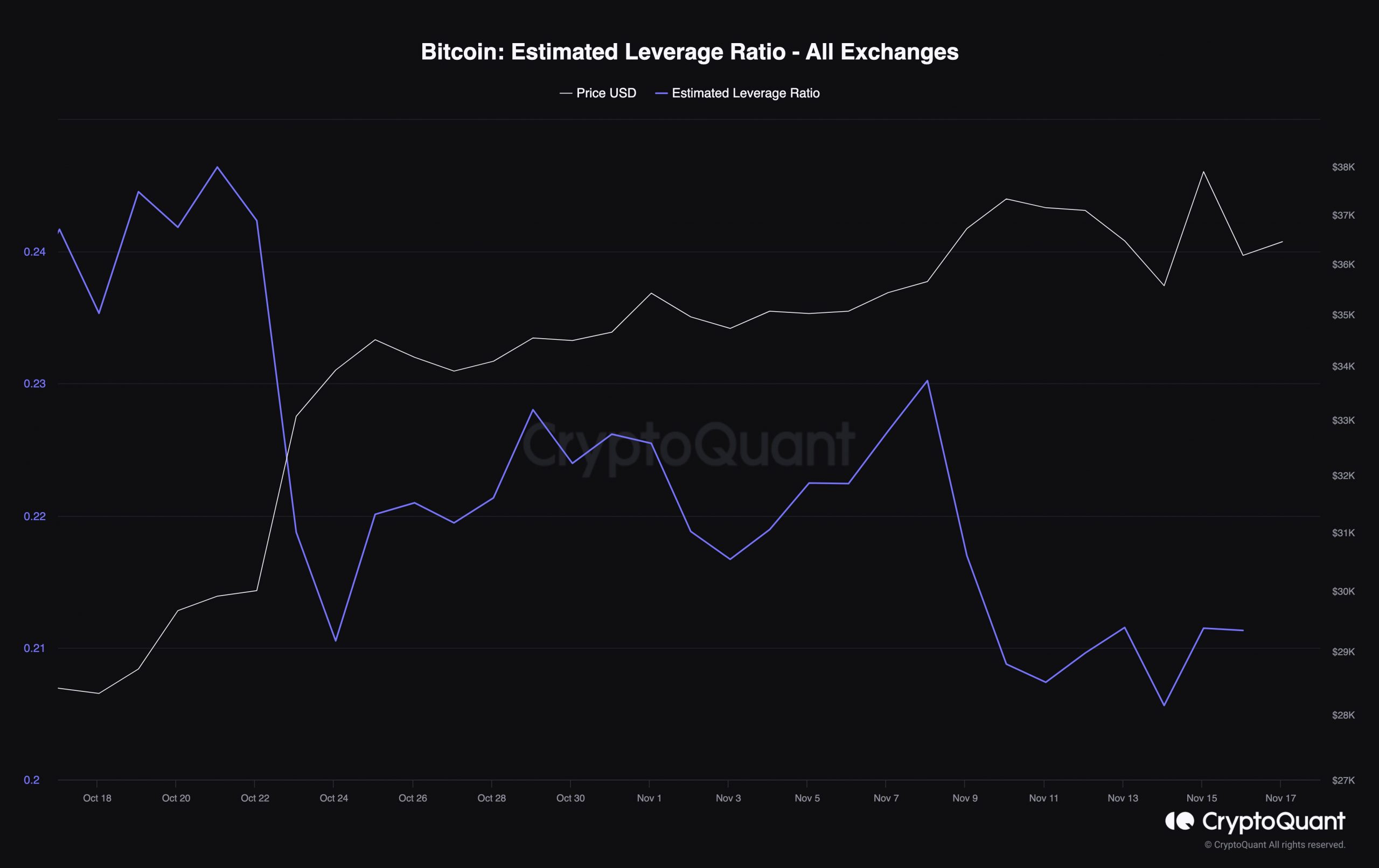

However, Bitcoin’s drawdown does not seem to have affected the bullish bias traders have. AMBCrypto was able to get this inference from the Estimated Leverage Ratio (ELR) metric on CryptoQuant.

The ELR shows how much leverage market players are using on average. When the metric decreases, it means traders are being cautious with respect to margin levels.

However, Bitcoin’s ELR in the last 30 days, had increased to 0.21.

The increasing ELR trend suggests that traders are engaging more of the 20x, 50x, and 100x leverage to bet on the BTC price action. AMBCrypto’s conclusion that most of the positions were long was because of the funding rate.

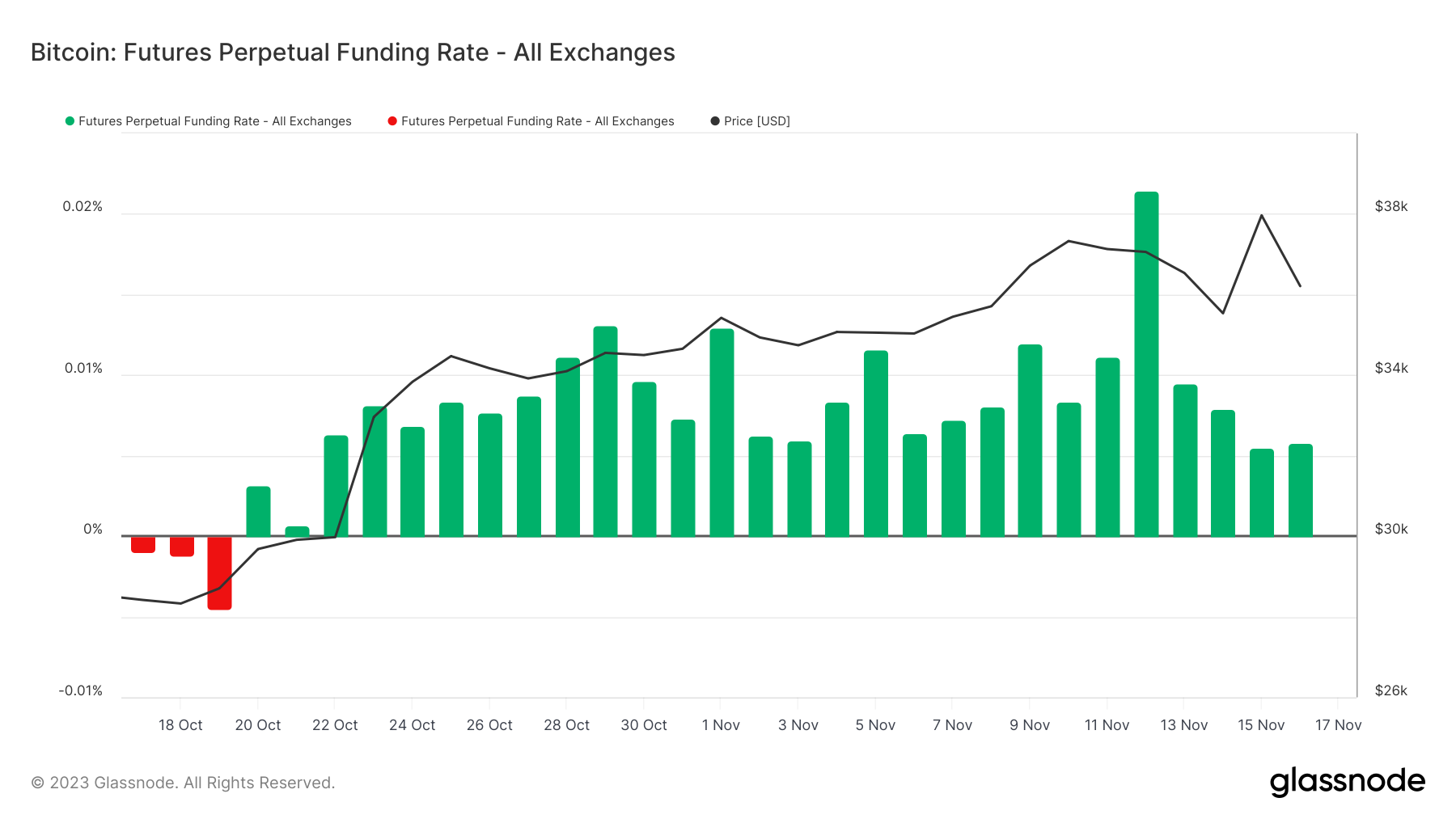

Funding rates show if traders are either bullish or bearish on a coin price. A positive funding rate indicates bullish sentiment while a negative one suggests a bearish tone.

At press time, Bitcoin’s funding rate was 0.006, confirming that traders expect the price to recover in a short while.

Sellers are running riot

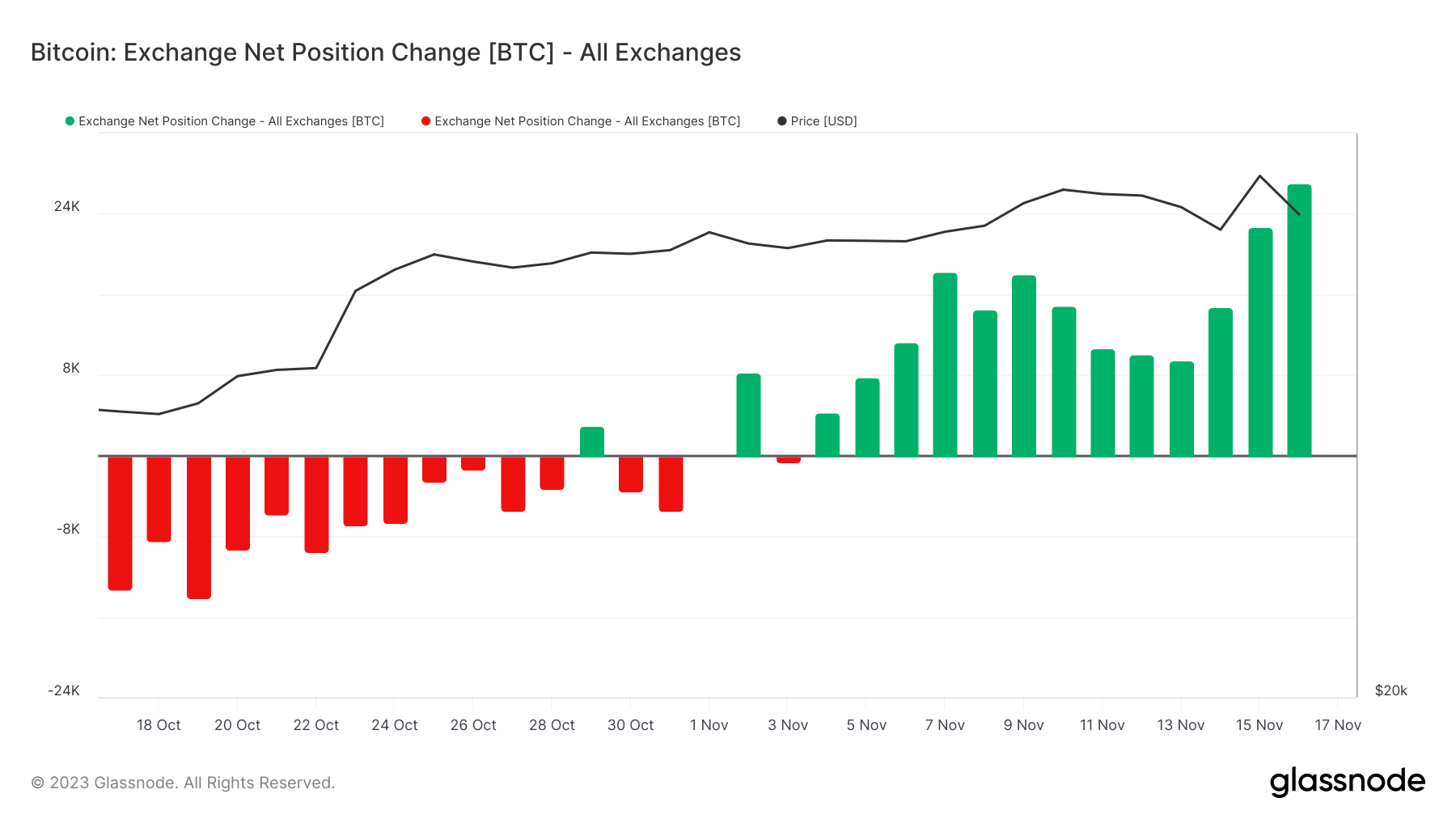

Another metric to consider regarding the BTC price is the Exchange Net Position Change. This metric gauges the 30-day supply held on exchanges. At press time, Bitcoin’s Exchange Net Position Change was 27.056.26.

This increase can be tagged as a sign that investors are looking to sell cash-in on their Bitcoin holdings. Assuming the metric dropped into the negative zone, then it would be a sign that investors have decided to hold.

Therefore, if the Exchange Net Position Change continues to remain positive over the next few days, then BTC may fall from $36,000.

Is your portfolio green? Check the BTC Profit Calculator

In conclusion, it is likely that Bitcoin has hit an overheated point for the time being. However, pullbacks are normal in long uptrend seasons as it is not usually a straight line to new highs.

Should intense accumulation return to the market, a move in the $38,000 direction could be next. But this might take a while considering the market condition at press time.