Bitcoin

Bitcoin in, dollars out: Fed stimulus shows who wants what

If I told you at the beginning of the year the United States would be handing out checks worth over $1,000 to every citizen and it would find its way into Bitcoin, you would’ve laughed me out of the room. But now, lo and behold, Bitcoin, on the west of the Atlantic is seeing a Federal Reserve stimulus.

With the ongoing pandemic causing an economic collapse, resulting in an inevitable recession, central banks the world over have been engaging in loose monetary policy to float their global economy. Chief among these floaters is the United States Federal Reserve.

Last month, the Fed announced a series of ’emergency’ interest rates cut, pumped billions through quantitative easing, and initiated a retail stimulus program. With enough time for the effects of the ‘dollars-in-abundance’ program to play out, the result is a pump for Bitcoin, on both the retail and institutional side of things.

Institutional revival

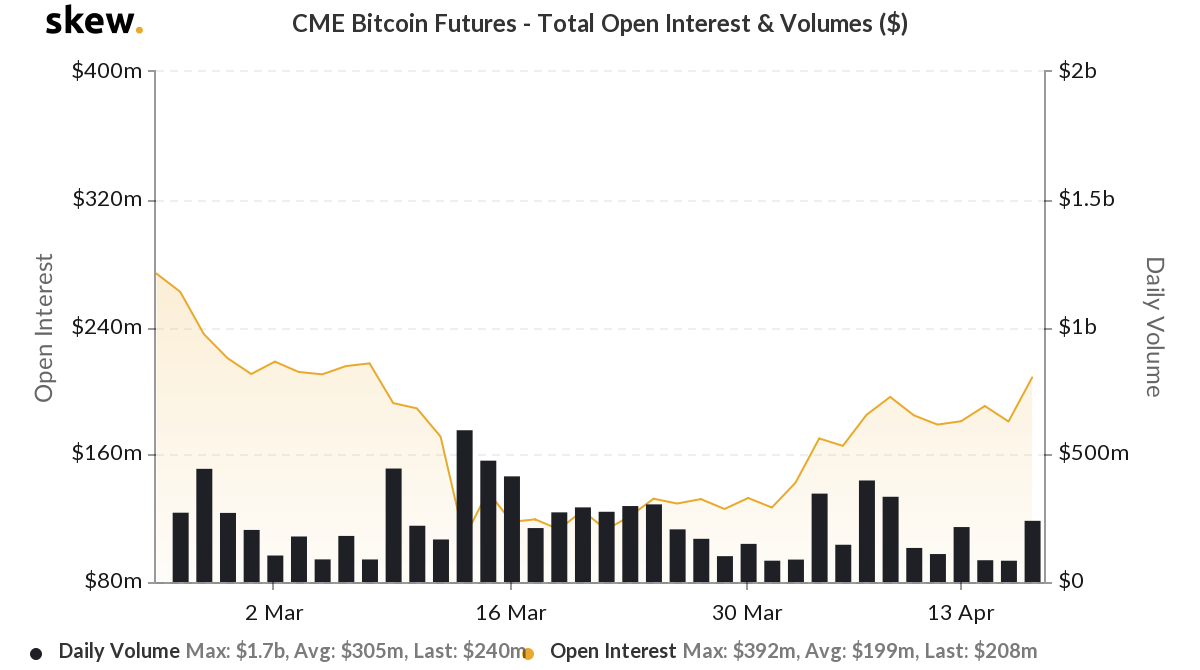

In the United States, the chief inflow into Bitcoin from dollar sources on the institutional front is through the Chicago Mercantile Exchange’s [CME] Bitcoin Futures contracts, which interestingly saw an average of over 6,000 contracts traded per day in 2019. The CME, after enduring the collective Bitcoin plummet on March 12, has found its footing once again as the amount of open and outstanding positions, or open interest [OI], on the exchange has revived back to its pre-plummet days.

CME Bitcoin Futures volume and open interest | Source: skew

On March 12, the CME saw an OI for its Bitcoin Futures at $171 million, which a few days after the BTC sell-off dropped to $107 million, its lowest point in the past 12 months. This was a result of the need for cash resulting in highly liquid assets like Bitcoin and gold being sold off, owing to Bitcoin’s larger perception as a risk-on asset, the sell-off and the recovery for the cryptocurrency was greater than the commodity.

However, since the plummet, the spot price of Bitcoin has recovered by over $1,200, even rising above $7,000 on April 16, for the first time since the drop. This price recovery caused a surge in the OI on the CME, which rose from the aforementioned low to $208 million yesterday. This is the highest amount of outstanding positions on the exchange in over a month.

Further, the CME’s revival is in stark contrast to the rest of the Bitcoin Futures market. BitMEX and OKEx, which hold the highest open interest positions [nearly x3 CME’s current OI] in the unregulated Bitcoin derivatives market have seen much lower recoveries. For instance, BitMEX’s OI following the crash was $530 million [down from $1.2 billion], and at press time, the exchange amasses an OI of $597 billion i.e. only a 19 percent increase from its low following the Bitcoin price plummet.

Retail resurgence

Another inkling of the US government’s decision to issue a ‘helicopter money’ like retail-focused stimulus program in order to usher consumer spending has, it would seem, resulted in a move up for Bitcoin.

Coinbase, the San Francisco based cryptocurrency exchange has been seeing a significant amount of buy deposits that are, coincidentally the same amount as the $1,200 stimulus check issued by the Federal Reserve. Brian Armstrong, the CEO of the exchange noted via Twitter,

— Brian Armstrong (@brian_armstrong) April 16, 2020