Bitcoin

Bitcoin Futures volumes on CME, Bakkt dip as Open Interest recovers

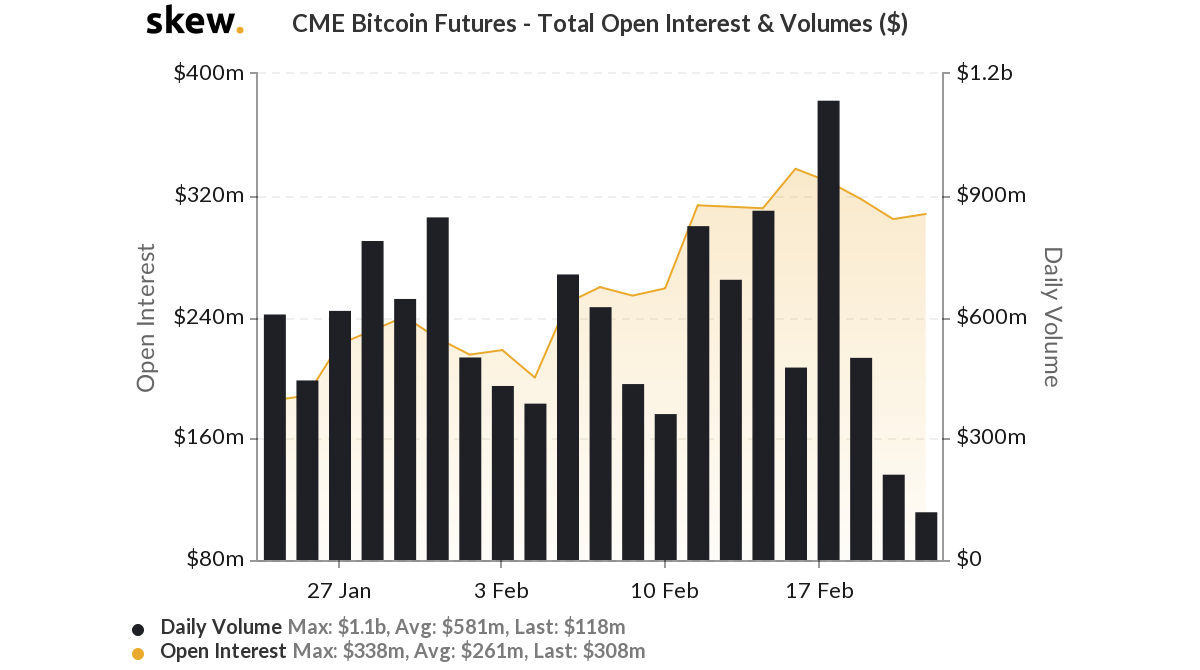

The erratic nature of the Bitcoin market has given way to many derivatives products. One of these additions was the Chicago Mercantile Exchange [CME] launching Bitcoin Futures in 2017. Even though BTC Futures contracts have been available for over two years now, the CME just recently reported that its Futures volume had surpassed $1 billion on 18 February. However, this volume could not be sustained as it gradually noted a fall over the next few days.

Source: Skew

After the peak on 18 February, the volume took a huge hit as it fell by nearly 55% on 19 February. Here, it should be noted that the date coincides with the day when Bitcoin’s price once again dipped under its $10k resistance.

Source: BTC/USD on TradingView

Despite the fall in Bitcoin’s spot price and the reduced Futures volume, the CME still exhibited strong Open Interest. On 18 February, the Open Interest stood at $329 million, whereas it shifted a little on 19 February to $318 million, despite the volume falling by more than half. This reducing volume has been an observed trend in the market over the past couple of days. On 20 February, the CME Futures volume fell to $211 million and marked the end of the week on 21 February with a volume of $118 million, whereas the Open Interest recorded a minor dip and recovery on Friday.

A similar trend was observed in Bakkt’s Bitcoin Futures market, with its Open Interest marking an all-time high on 14 February at $19 million. Despite the rising interest, however, the Bakkt platform did not register much volume as it was recorded to be just $33 million, a figure that was lower than its previous and following day. Over time, the Open Interest was also slashed as the contracts expired on 20 February. The Open Interest plunged to $10 million. The volume observed on the weekend was $18.6 million as the Open Interest was recovering at $11 million.

Source: Skew