Bitcoin

Bitcoin Futures stall early as market springs a surprise

A tale of two halves – Bitcoin Futures market edition.

On 22 February, Bitcoin stayed flat. The reason this nonchalant movement bears significance owes to how the week started, with the coming of the golden cross. However, soon after what should ideally be a signal of bullish times, the coin’s price tumbled by over 5 percent in an hour, back down below $10,000.

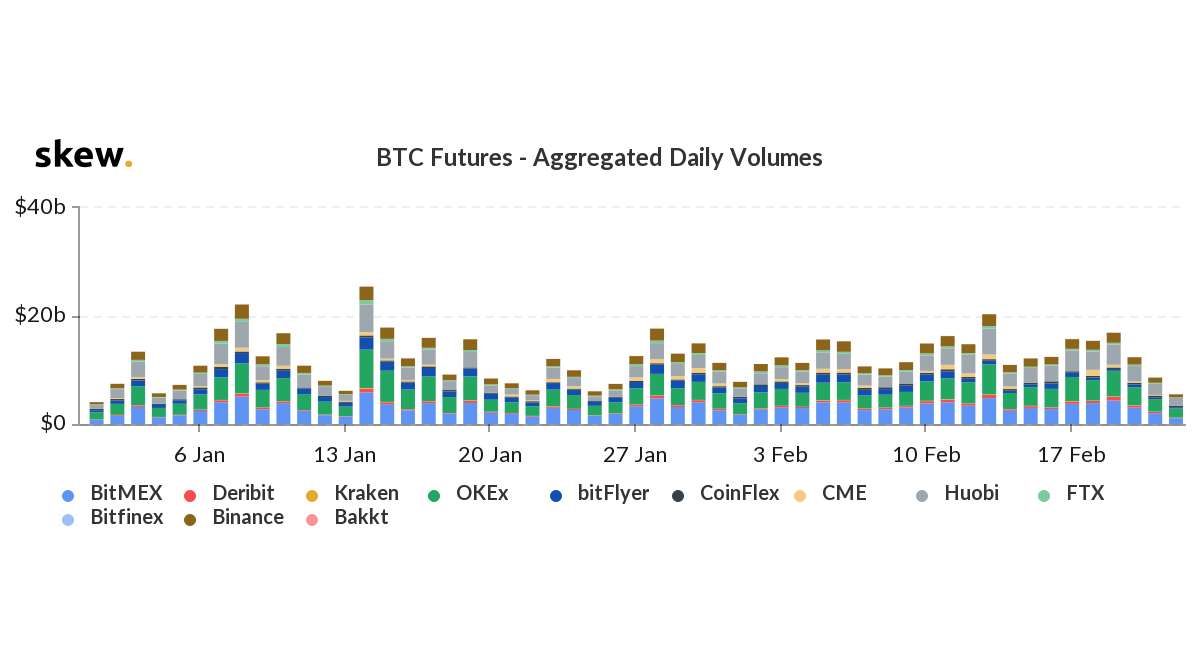

This roller-coaster ride was followed by smooth sailing. Bitcoin was locked in the $9,600- $9,800 range and Bitcoin Futures traders responded with withdrawal. After a week that recorded $1 billion in Futures volume on the institutional CME exchange and over $3.7 billion in volume on BitMEX, OKEx, and Huobi, the rut was not welcomed.

Source: BTC Futures daily volume, skew

Bitcoin’s price plateau saw Futures volume drop. The three days of stable movement triggered a trading drop, culminating in a collective trading day of $5.89 billion for all exchanges, excluding CME and Bakkt.

The drop in price contributed to the lowest volume being recorded, since the first day of the year, a day when less than $4.1 billion was traded.

The CME saw a similar drop in volume, with its daily volumes dropping to 2,300 contracts with a volume of $118 million, its lowest since New Year’s Day.

Across the board, while the Open Interest saw a remarkable drop on a week-on-week basis, as the previous week came to a close, there was a slight recovery, with the OI rising from $4.22 billion to $4.42 billion.

However, it should be noted that unregulated exchanges like BitMEX, Huobi, and OKEx will take into account the price fluctuations of the weekend, while the CME and Bakkt will not as they only operate on weekdays. And that will account for a lot!

Source: BTC Futures Liquidations on BitMEX, skew

Between 0300 – 0400 UTC on 23 February, Bitcoin broke out of this range and surged by 1.4 percent. This hourly swing continued as the price climbed to $9,920, at press time, from $9,600 just three hours earlier.

In fact, this unexpected price swing upwards saw shorts take a beating. In the first hour of the price increase, over $4 million of the XBTUSD contracts on BitMEX were liquidated, while in the next, over $10.1 million, with a single trade accounting for over $2 million.