Bitcoin

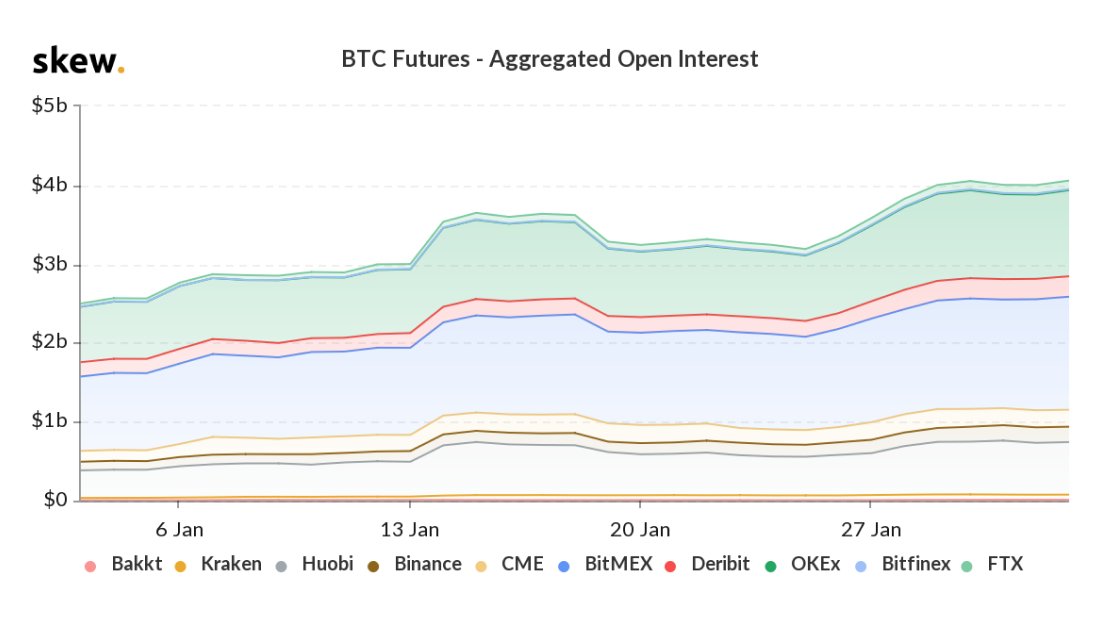

Bitcoin Futures’ Open Interest surges by over 60%; global interest over $4B

Bitcoin Futures are once again in the limelight after Open Interest was found to have surged by over 60% since the beginning of the new year. According to the data provider, Skew markets, Bitcoin Futures reflected rising Open Interest among exchanges and stood at $4 billion.

Source: Skew

The aggregated Open Interest was the least on Bakkt – $4.6 million, at the beginning of 2020. However, this changed as the year progressed and on 2 February 2020, it stood at $11 million. A similar trend of rising Futures contract was noted on other exchanges like CME, BitMEX, OKEx, Deribit, and CME as well.

BitMEX and OKEx led the derivatives exchanges in terms of rising Open Interest that recently breached a billion. As per Skew, BitMEX and OKEx reported an Open Interest of $943 million and $703 million, respectively, at the beginning of January 2020. On 2 February, the two exchanges welcomed more interest in the Futures contract and registered an Open Interest of $1.4 billion and $1.1 billion, respectively.

Source: Skew

Further, Bitcoin Options on Deribit exchange hit a new record. According to a tweet shared by Deribit on 3 February, its month-on-month Bitcoin Futures turnover was up 70%. The tweet added,

“New options record!

#Bitcoin Options have officially taken off. On these charts, you can see 70% month on month growth in USD options turnover. Additionally, Options contract volume peaked in January 2020, with more than 180k contracts traded. Option OI remains above 86% ?”

According to Skew,

Source: Skew

Deribit led the Open Interest among other exchanges, while CME barely managed to make a mark. At press time, Deribit noted a volume of $21 million, followed by OKEx with a volume of $1.5 million. Previously, AMBCrypto reported on 22 January of Bitcoin’s volume expanding globally, as the Futures market noted exchanges of over $25 billion.