Bitcoin derivatives traders bemused as price plays hide-and-seek

One of the main merits of a derivatives platform for any asset class is the ability of price-discovery, and for an asset as volatile as Bitcoin, it is even more so. However, with markets facing an imminent recession as they plummet to record lows, even Bitcoin doesn’t know where to go from here.

Needless to say, any significant movement in the price of Bitcoin brings in Futures and Options traders in droves, opening new positions based on where they think the price is headed, but the recent dip and rise in the price of the world’s largest cryptocurrency failed to record any such movement.

Following one of the most crucial weeks in Bitcoin’s history, one that saw the cryptocurrency lose a third of its value, the price was perched at around $5,200, at press time. A vast majority of that drop happened on 12 March, a day when the coin dropped by over 20 percent in an hour, falling to as low as $3,800 before buying pressure pushed it over $5,500.

Since this massive drop, Futures have been trading off the charts, with average volume soaring over $20 billion. But this volume is more traders closing out positions, rather than opening new ones, depending on the spot price of the crypto.

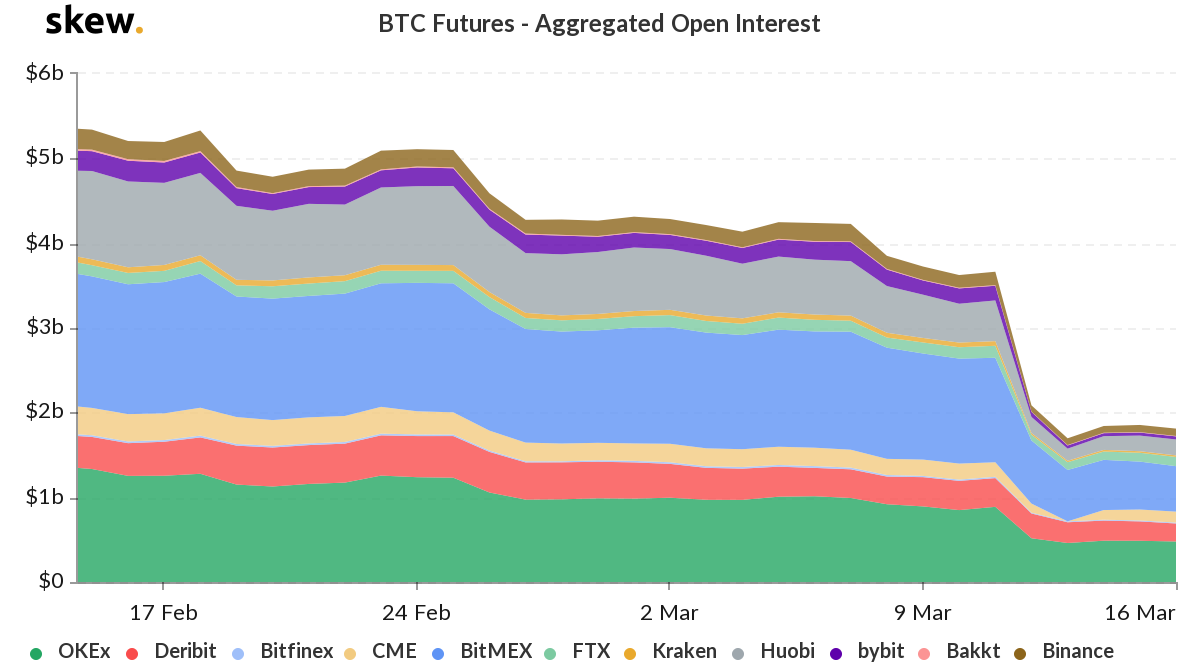

This “close-out” trend was confirmed on 16 March when the price moved down from $5,200 to $4,500 and back up to $5,300, all within 30 hours. This massive price fluctuation of a cumulative of over $1,000 was met with immense trading and a continued drop in Open Interest, across exchanges.

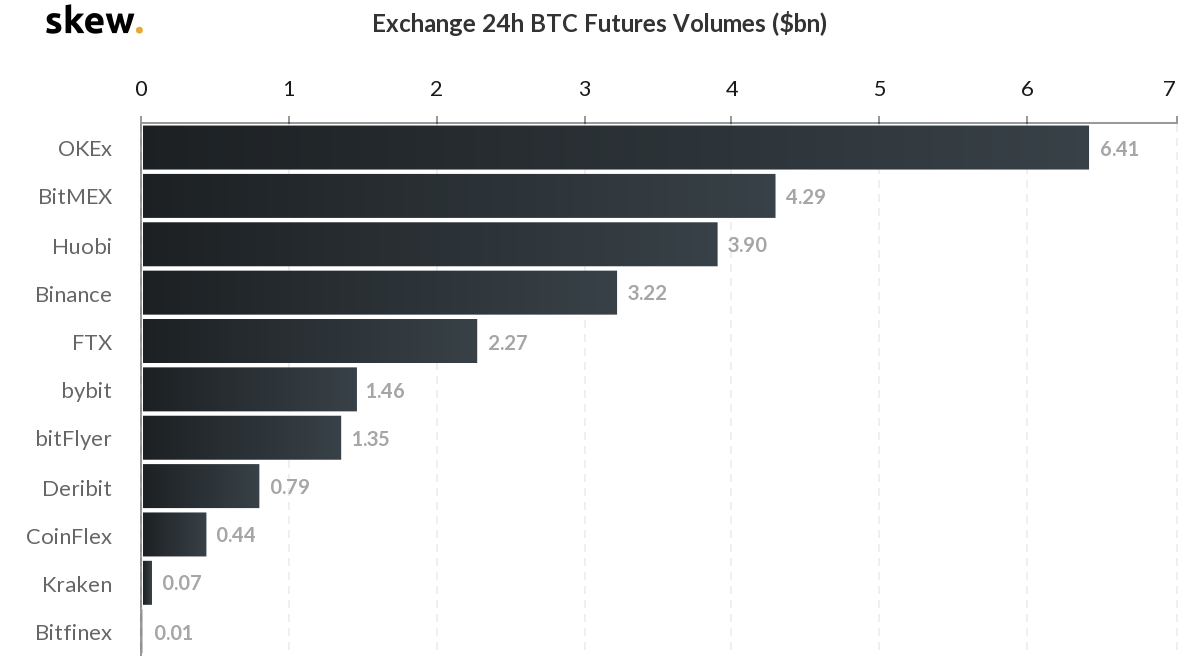

At press time, the Bitcoin Futures 24-hour volume on the top three derivatives exchanges, BitMEX, OKEx and Huobi, totaled $14 billion, while other exchanges like Binance and FTX recorded trading of over $2 billion each, according to data from Skew markets.

BTC Futures Volume 24-hours | Source: skew

This increased trading was not met with new positions being created as OI across exchanges continued to drop. BitMEX saw active positions on its coffers fall from $1.2 billion prior to the price collapse to $530 million today; OKEx and Huobi recorded drops of 46 percent and 60 percent, respectively, over the same time period.

BTC Futures Open Interest | Source: skew

Based on historic Bitcoin price movements, volatility attracts derivatives volume and increasing Open Interest in either direction, but this time is different. As things stand, Bitcoin is clearly not standing up to be a safe-haven asset; traditional store of values like gold are being sold off, losing over a tenth of its value in the past 7 days, all this while the Federal Reserve has cut interest rates down to 0 and pumped up its overnight cash injections.

Traders looking at the confusion in the markets and an overall slump across asset classes are mystified in confusion and are hence, unsure of whether the price of Bitcoin is likely to move up or down. Derivatives are trading high volume and closing out fast amid this price confusion.