Bitcoin derivatives mark turnaround as liquidity returns to normal

An important indication of the past and the future of any asset class is the derivatives market and based on the current Bitcoin trend, its market is showing signs of life.

Since the beginning of the month, Bitcoin has surged by 8.5 percent, breaking the $9,000 mark after falling below amidst the global sell-off owing to Covid-19 fears. The drop in Bitcoin’s price and the global market meltdown stopped derivatives traders from closing out their positions, but now it looks like they’re back.

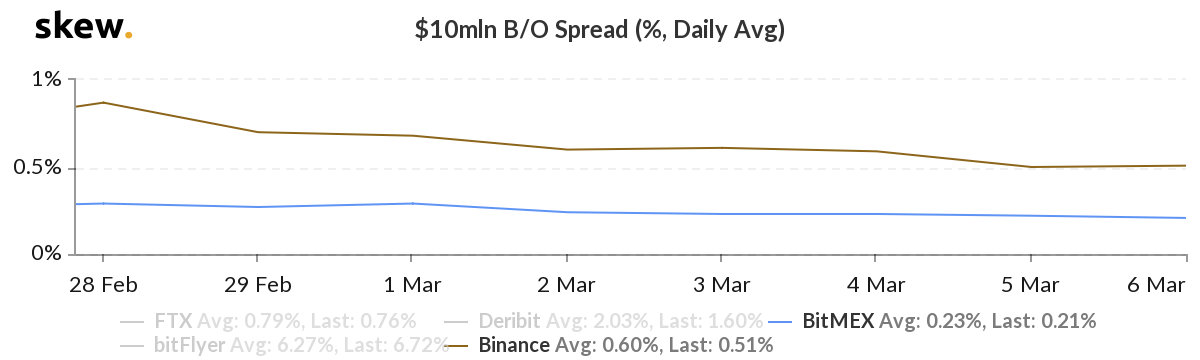

According to data from Skew markets, the liquidity on top exchanges is increasing as volumes tend to stabilize. BitMEX, the veteran derivatives platform headquartered in Seychelles, has seen a massive drop in its $10 million Bid/Offer spread for its Bitcoin Futures contracts.

In the last few days of February, a time period when Bitcoin fell by over $700, the spread on BitMEX was over 0.3 percent, well above its average of 0.23 percent. This low liquidity, coupled with the dropping Open Interest, was indicative of traders closing out fast when expecting a fall in price.

BitMEX vs Binance $10 million B/O Spread [Daily Average] | Source: skew

Similar liquidity drops were seen on the charts of the retail investors-focused Binance. The leading spot exchange also saw its liquidity rise as the $10 million B/O spread dropped by almost 40 basis points from 0.87 percent to 0.51 percent, at press time. FTX, another top derivatives exchange, saw its spread drop from 0.82 percent to 0.76 percent since the close of the previous month.

This liquidity drop, coupled with the stabilizing and marginally increasing Open Interest, is a sign of a return of the bulls in the Bitcoin derivatives market. Since February, the Open Interest on BitMEX has risen by $100 million, while other competing exchanges like OKEx and Huobi have seen inclines of $30 million and $15 million, respectively.

From a month-to-date standpoint, the volume of the top-9 derivatives exchanges is $61.5 billion, but the marginal change, on a day-to-day basis, has been in the negatives. This suggests that while the volume has been around $10 billion on average, bar the first day of the month, the volume has been dropping since.

The turnaround in market liquidity and the resurgence of OI is a sign of derivatives traders reviving their hope in Bitcoin.