Bitcoin crosses $8k but will its volume continue to reinforce its rally?

We have seen this happened in the past, and it is happening again.

Bitcoin crossed $8k and registered an ROI of 120 percent since the crash of 12th March. The rally as we speak is still undergoing at the moment with the valuation currently trading above $8300. Bitcoin proponents would be salivating at the current surge but there is more to it than what meets the eye.

BTC/USD on Trading View

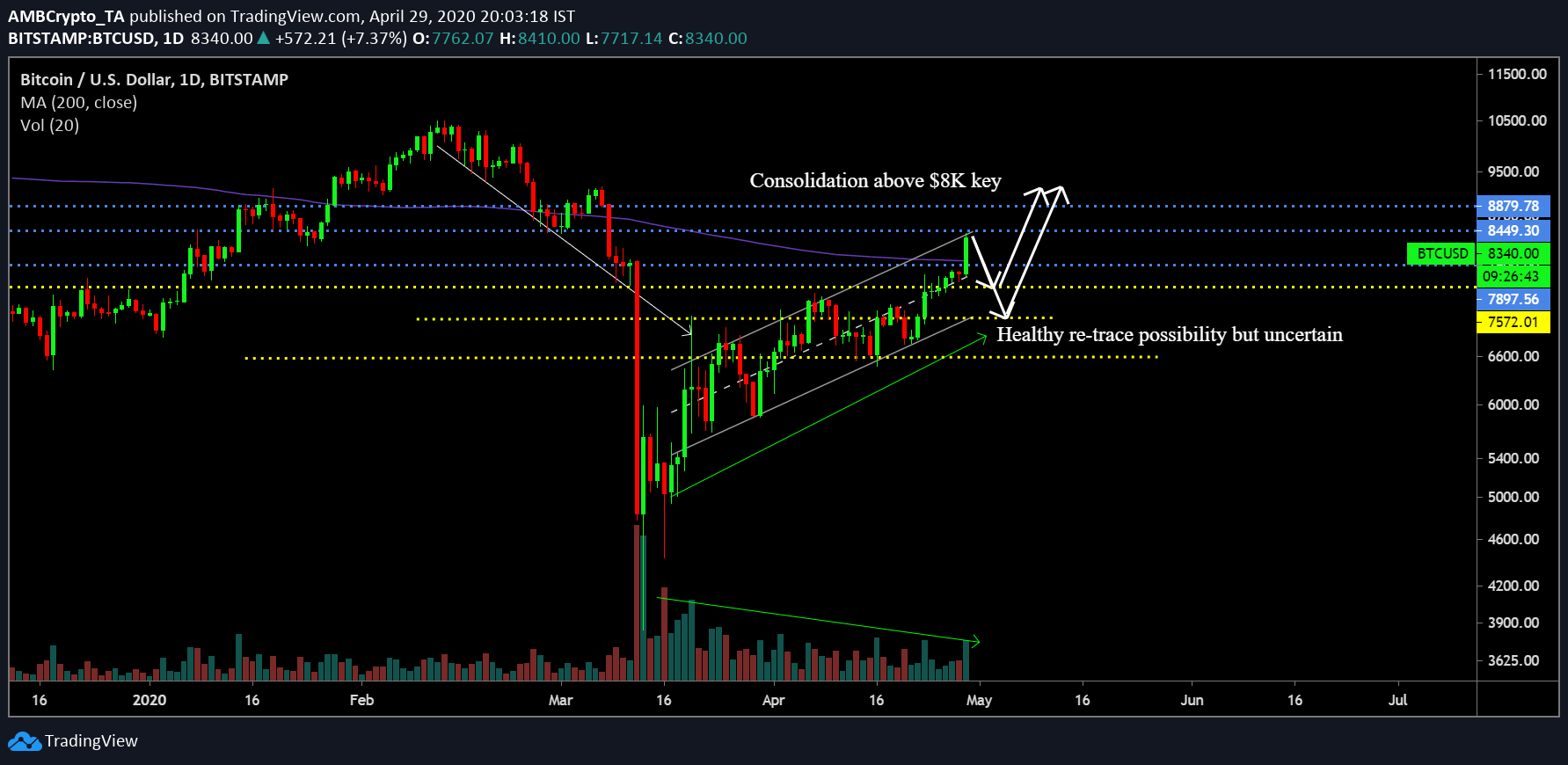

According to the chart above, Bitcoin is currently moving inside an ascending channel and over the past week, it has managed to breach resistance at $7500, $7900, and at press time, it is above immediate support at $8200.

Now, according to the pattern, Bitcoin should be looking at a bearish pullback anytime and one of the possible scenarios is a retracement down to $7897. A pullback could also happen all the way down to $7572 as well but it seems a little less likely.

It is important to note that these pullbacks would strengthen the support at $7500 but at the moment the rally might continue for the time being.

One of the major indications of an impending pullback is the divergence between trading volume and rising price. As exhibited in the charts, the volume hasn’t been able to keep up with the rise in price for BTC, which necessarily underlines a weak rally. A rising in valuation without trading volume generally leads to exhaustion over time causing a drop in the charts.

On the other hand, the collective trend before the halving may remain bullish as the market would be primed for a bearish outburst after the third halving takes place.

The next resistance at $8400 is key after which the long-term target for Bitcoin is $8900. However, the major sign of trend reversal at the moment is the reversal of 200-Moving Average. Bitcoin is consolidating above the MA for the first time since 12th March. Although, it is imperative for BTC to maintain consolidation above $8K for the next 48-hours if the surge has to continue.

Conclusion

Bitcoin’s price is currently riding on a weak rally without trading volume, hence uncertainty looms high in the charts. The next 48-hours remain crucial for Bitcoin and will provide a better picture for the coming weeks in May.