Bitcoin Cash, XMR, Dogecoin price analysis: 22 June

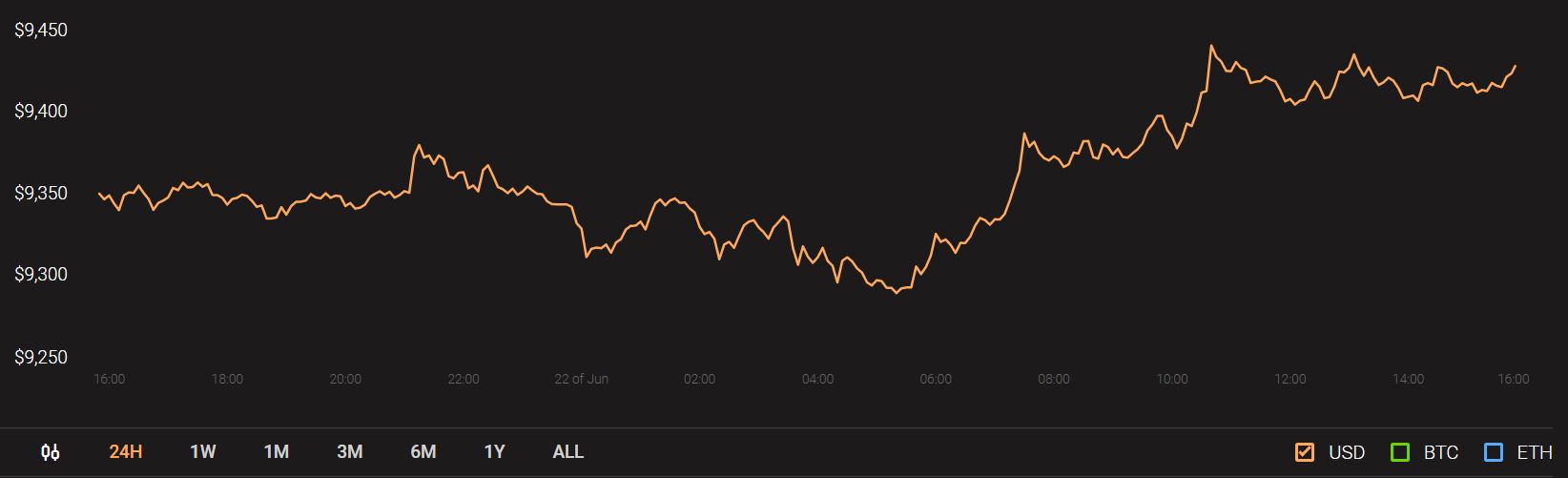

The altcoin market has been noticing immense growth over the weekend. The price of Bitcoin also noted an upsurge from $9,292.91 to $9,436.32, which was a 1.54% rise in price.

Source: Coinstats

Interestingly, what was considered to be a restricted growth for BTC, turned out to be a rising momentum in the altcoin market.

Bitcoin Cash [BCH]

The fork of Bitcoin, Bitcoin Cash [BCH] has been returning 13.47% to its investors since the beginning of the year. However, this has not been a great return of investment in comparison to other alts and BTC has been providing more profit, despite a stagnated market. However, the price of BCH has been surging, at press time, as it has been noting a 3.55% boost and was trading at $235.95. Nevertheless, this boost in its price was not enough to ward off the bearish sentiment emerging in the market.

According to the MACD indicator, the MACD line slipped under the signal line a few days into June and ever since has remained lower. The momentum of the market had been reduced since April and was noting a restrained movement.

Monero [XMR]

Unlike BCH’s returns, Monero has been a prominent and popular coin among crypto users, given its privacy-centric features. XMR has been reaping a growth of 42.13% YTD and has been valued at $64.67. With a second consecutive daily candle, the coin has been recovering from over a week’s fall. The slashing price resulted in a rise of bearishness in the XMR market.

This change in price action was confirmed by the Parabolic SAR indicator, as the markers that were aligned under the candlesticks, arranged above the candles in the past week. Even though XMR’s price has been growing, the recovery may take a couple more days along with the trend to change.

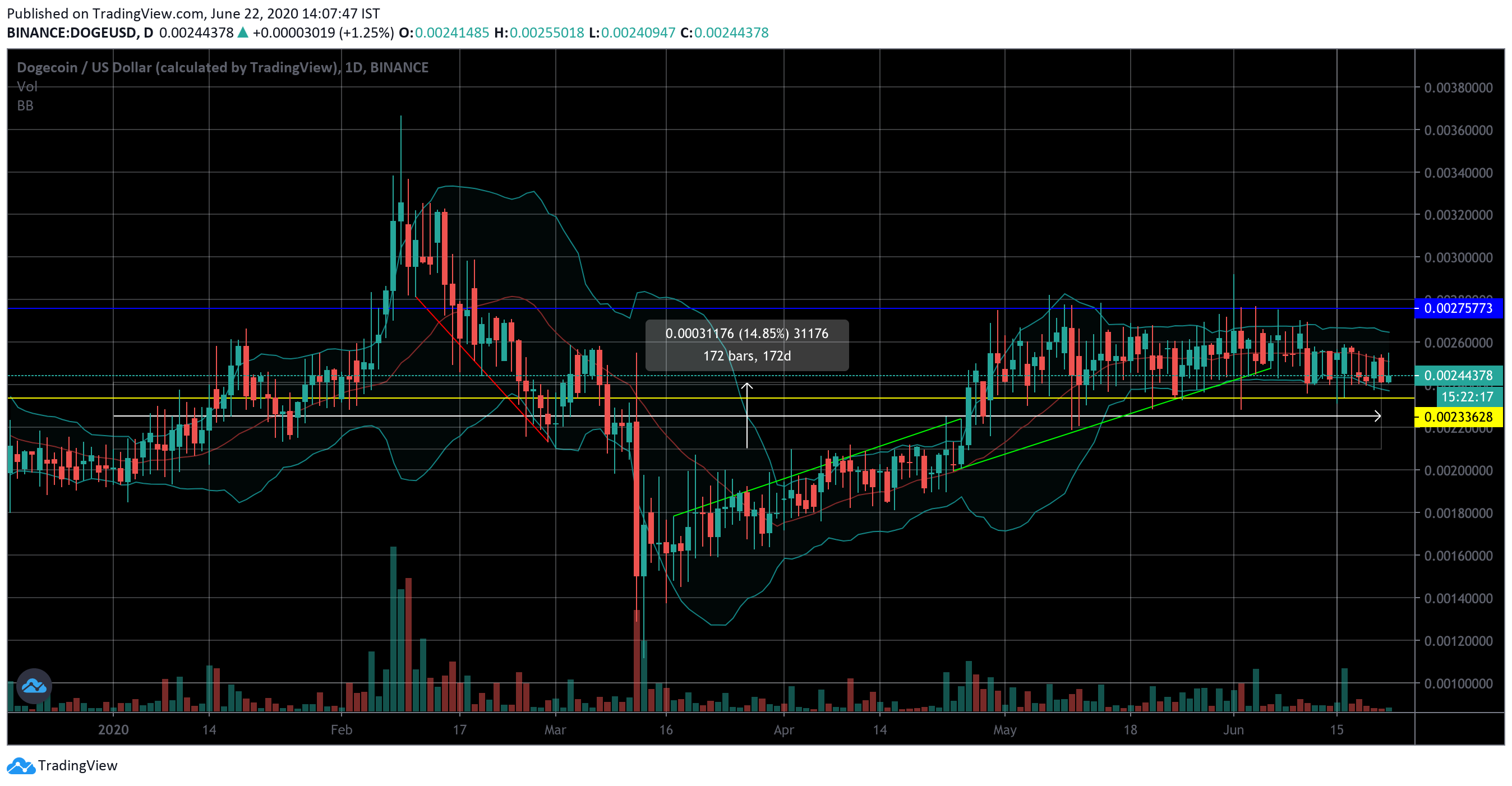

Dogecoin [DOGE]

As the market actively participated in the Doge market, the coin’s performance was also struck with great volatility in 2020. As its YTD remained at 14.85%, Doge’s price noted a 5.92% boost, at press time. It was being traded at $0.00254, while the support was market at $0.00233 and resistance remained high at $0.00275.

The market was still volatile according to the Bollinger Bands indicator, as the bands remained diverged. Whereas the signal line that was above the candlesticks might be moving downwards due to the change in the price action. However, the bullishness can only be confirmed once the signal line moved under the candlesticks.