Bitcoin an investment tool; not just a means of exchange: BlockFi CEO

Cryptocurrencies have had to battle conflicting narratives regarding their purpose for a long time now. While cryptocurrencies were conceived as instruments that would eventually make traditional currencies obsolete, the technical challenges surrounding crypto have posited many cryptocurrencies to become more functional as ‘stores of value’. The example of Bitcoin in this regard is apt as the king coin has recently emerged as a leading store of value and investment, making adoption easier. These aspects were addressed by BlockFi’s Prince in a recent podcast.

On the latest episode of the Off the Chain podcast, BlockFi CEO Zac Prince spoke about Bitcoin, the rising popularity of crypto-asset based loans and the collateralization of crypto-assets for credit and how it can lead to the greater adoption of cryptocurrencies.

In fact, these are sectors BlockFi is a major player in, with its product offerings including crypto-trading using crypto-assets as collateral for credit and earning interest from crypto-holdings. When asked about adoption and the growth of BlockFi, Prince said that the underlying trends in the market right now, along with the Bitcoin bull run, are a sign of greater adoption by both retail and institutional investors.

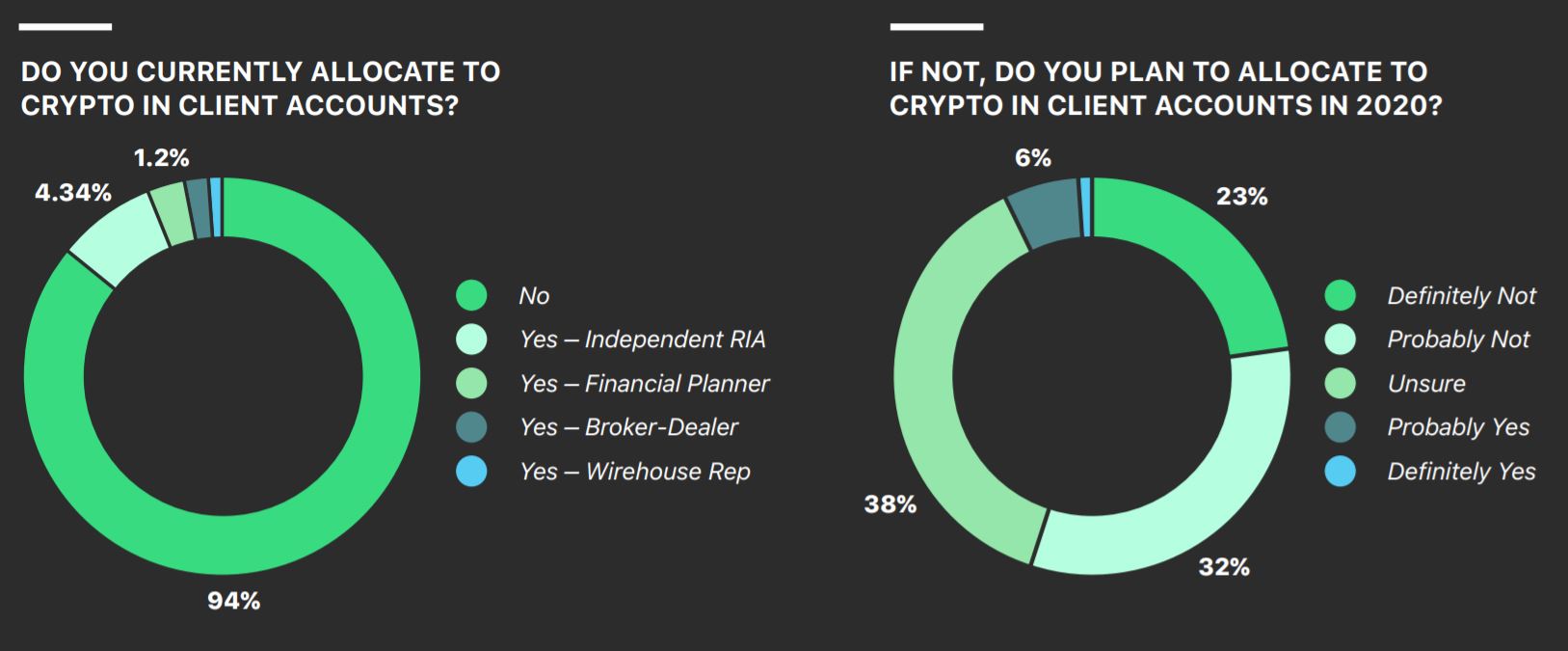

This is an interesting observation to make as for long, institutional investors have been cautious with regard to cryptocurrencies and their volatile nature. In fact, a recent Bitwise survey highlighted a similar sentiment as well.

During the podcast, Prince also spoke about the credit card BlockFi plans to launch. According to Prince,

“We think of the BlockFi Bitcoin rewards card as something that’s competing more with, you know, Chase Sapphire Reserve or your airline mile card.”

The aforementioned card is being positioned by BlockFi as a gateway to onboard new customers into the crypto-asset ecosystem by making the experience akin to traditional banking, in an attempt to make the transition easier. The intent reflected here by Prince may be crucial towards resolving a problem highlighted by Grayscale Investments’ Sonnenshein a while back.

Managing Director of Grayscale Investments, Michael Sonnenshein, had recently suggested that the technical knowledge required to work with cryptocurrencies like Bitcoin is a huge barrier for new users. He said,

“You will also need to have the technological know-how to be able to move the bitcoin to a wallet, to be able to keep your password secure and be able to safe-keep it on a longterm basis. And for most investors, that is a new and unfamiliar experience.”

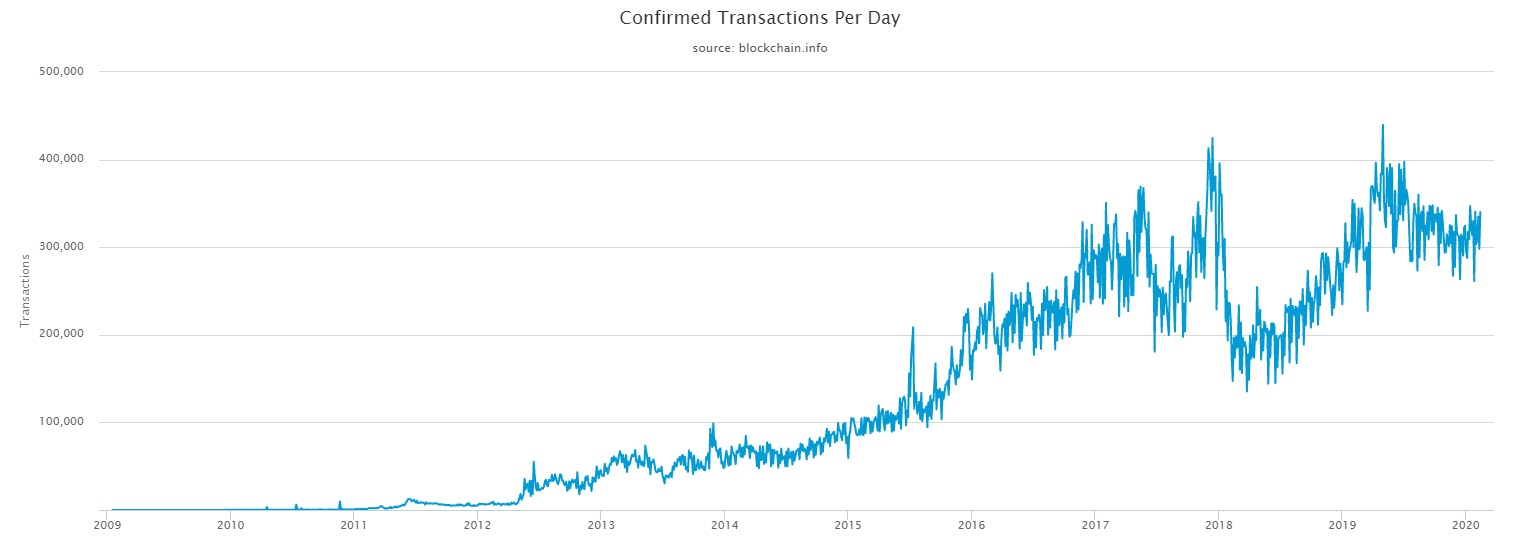

While this may be the case for new investors, data also shows that the number of transactions on the blockchain for cryptocurrencies like Bitcoin has been on the rise. Data from 2019 and 2020 also indicate that while there have been drops in transactions, the blockchain today is a lot less volatile as Bitcoin is no longer a new asset class and the market has matured substantially.

BlockFi’s new product seeks to take advantage of this, while ensuring that Bitcoin’s adoption rates receive a significant boost by making it easier to embrace for the average user. According to Prince, Bitcoin today represents an investment tool and not just a means of exchange. This is a sentiment he shared during a recent CNBC interview as well when he said that most people today buy into Bitcoin not to spend it, but because the price is likely to go up.

However, BlockFi’s Prince was quick to concede that hurdles persist. He said,

“Cryptocurrency digital asset blockchain sector does not have access to the same types of capital that traditional markets do.”

BlockFi’s new product offerings come on the back of the firm announcing that it has secured $30 million in Series B funding to help expand its operations and attract more retail customers.