Binance futures continues to dominate trading volume as spot trails

The crypto futures market is growing. Prior to the launch of the Chicago Board Options Exchange’s [CBOE] BTC-based futures contracts on 11th December 2017, spot trading was the primary option available for crypto traders. There has been a significant change in this trend.

One of the prominent players in the space has been the Malta-based exchange, Binance. The platform had witnessed a strong start with the roll-out of its first BTC/USDT perpetual futures contract recording $5.4 billion worth of contracts traded (or 653,630) BTC in the very first month.

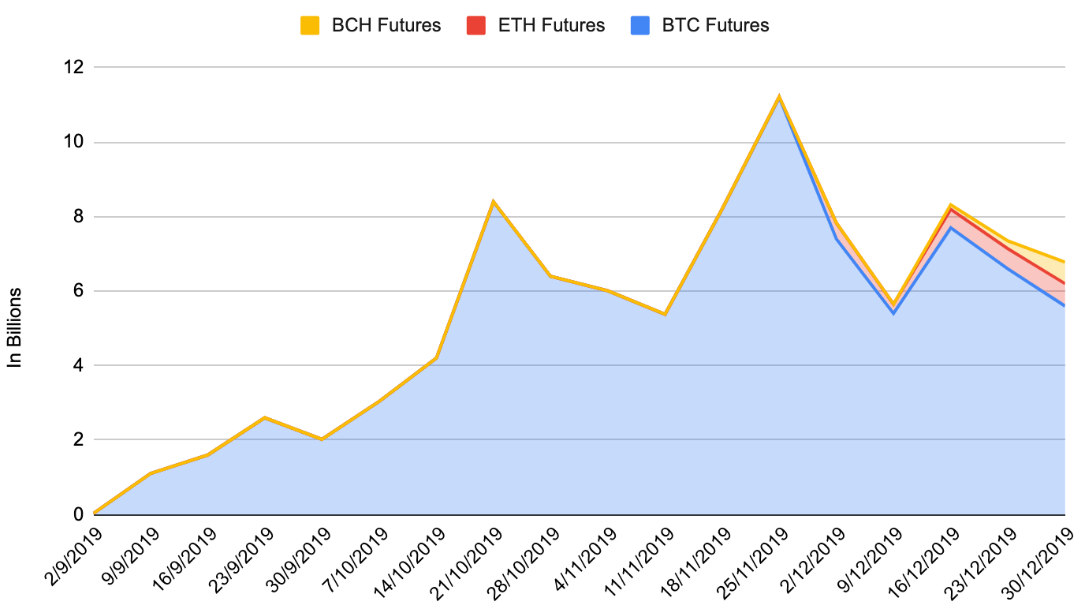

Source: Binance Futures | Weekly Binance Futures volume since launch

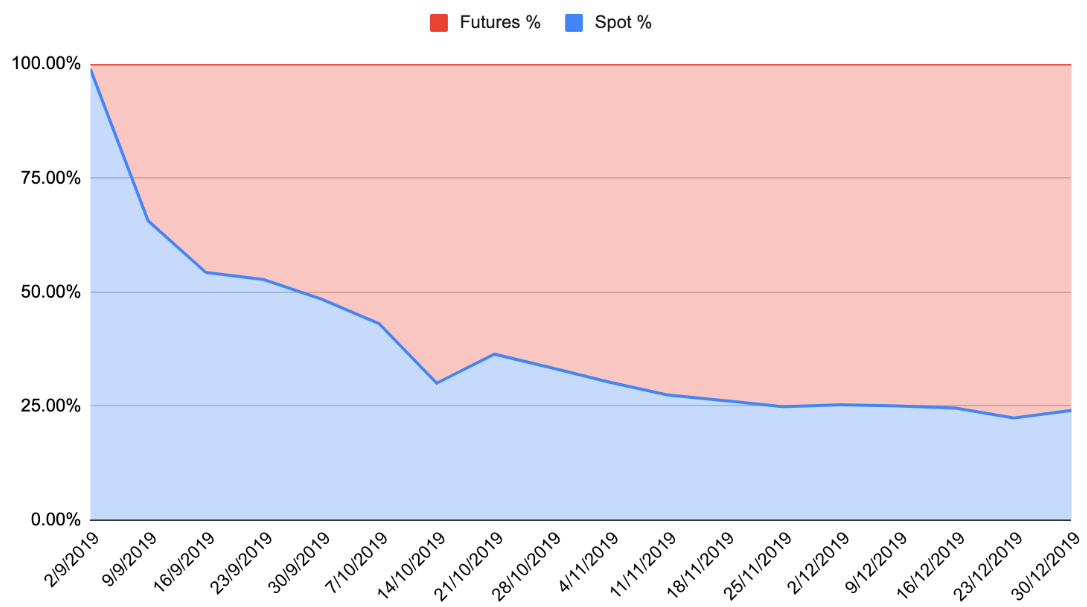

The crypto futures market undeniably gained momentum in 2019. Initially, 99% of Binance’s business came from spot clients. But soon after the futures came into the picture, there has been a change in this paradigm.

Following the launch of 125x leverage on BTC/USDT, Binance Futures climbed to 70% of the total volume traded. This was the first time Bitcoin Futures trading volume surpassed that of Bitcoin’s spot in less than a month of its launch. And since then, futures have continued to dominate the trade volume.

Source: Binance Research | Spot Bitcoin vs Futures Bitcoin

The latest Binance Research noted,

“Since mid-November, Binance Futures continued to dominate 75% of volumes on Binance its position as investors’ appetite for derivatives trading grows.”

This latest trend has been seen in the case of Ethereum as well as Bitcoin Cash spot and futures trading volume. In terms of Ethereum, the futures trading volume rose substantially when leverage on ETH/USDT futures was increased from 50x to 75x.

In December, Binance Futures platform launched BCH futures with 75x leverage. And since the very first day, spot trading registered a significant decline. As per Binance’s latest report, BCH spot markets registered only $10.1 million worth of volume traded on the same day.