Binance dominates stablecoin holdings as BUSD’s market cap shoots up

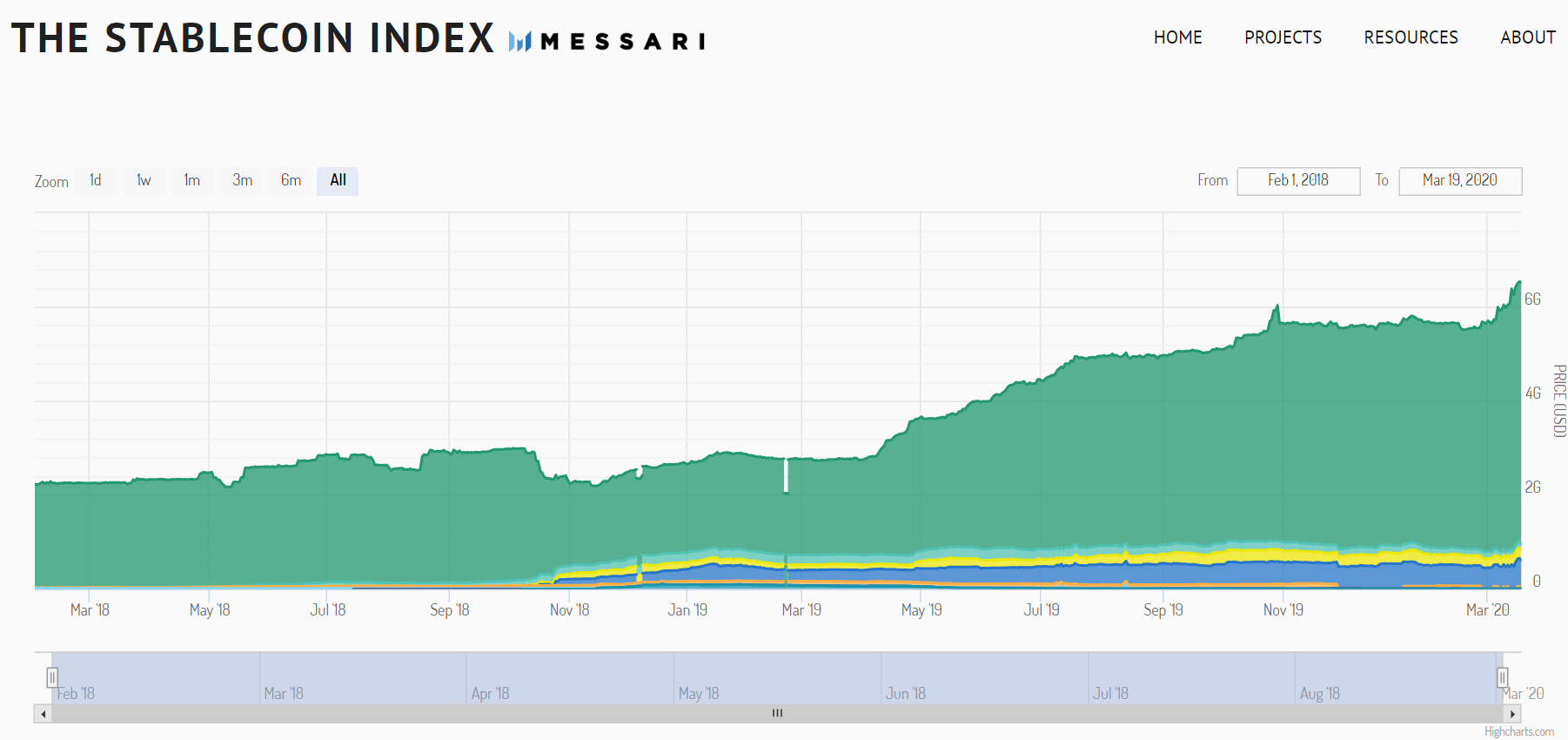

The impact of the recent crypto-market crash has been significant and far-reaching, with the collective market capitalization falling from $294.93 billion on 19 February to $153.76 billion on 19 March, a fall of over 48% in a month. However, on the contrary, the crash doesn’t seem to have adversely affected the stablecoin market at all. In fact, their market capitalization rose to an all-time high level of close to $6 billion.

Source: Messari

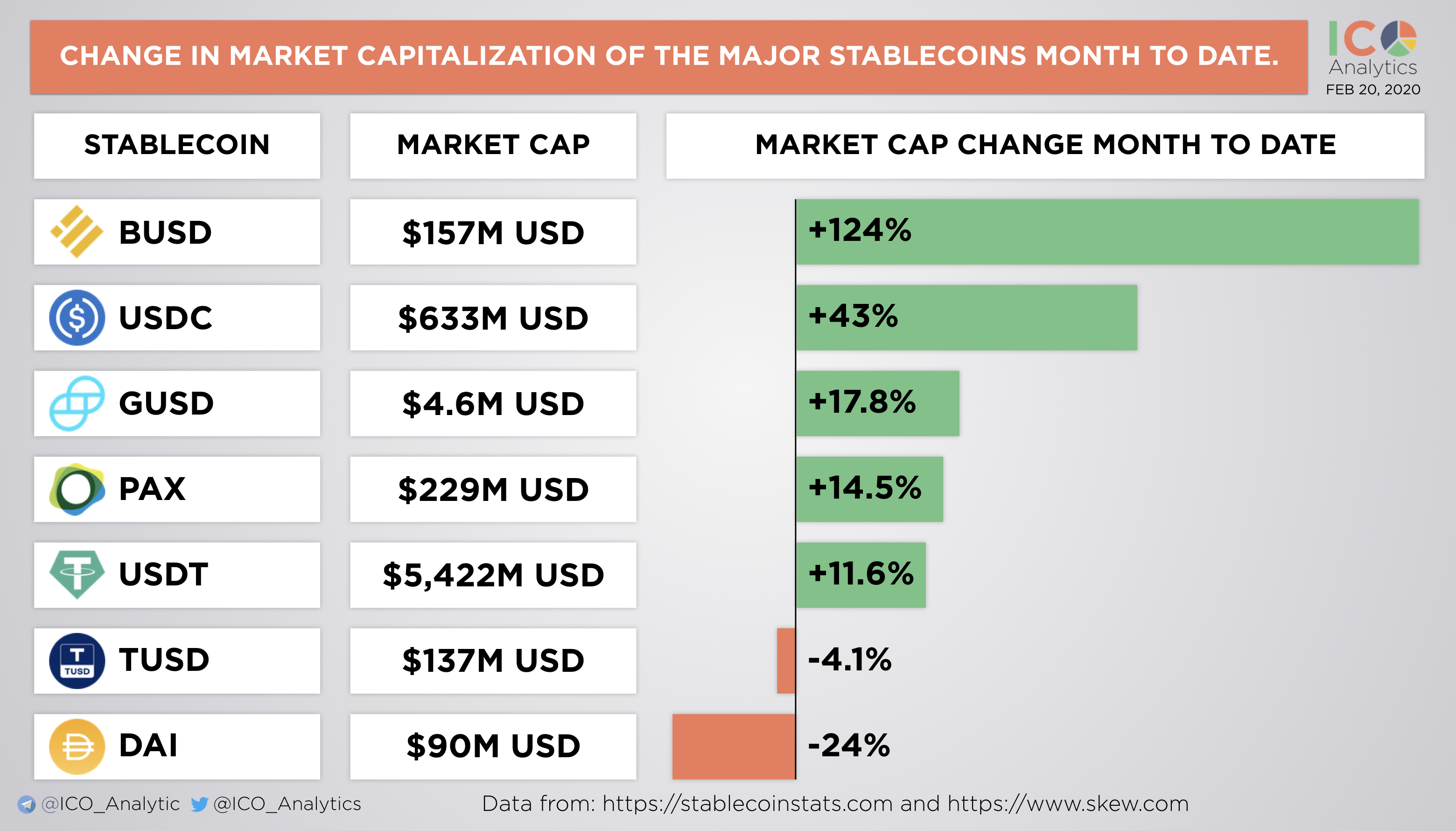

As the market cap of stablecoins rose, few stablecoins contributed to this more than the others. Considering month to date market capitalization of stablecoins, BUSD’s market cap was reported to be $157 million with a 124% rise, the only stablecoin to note triple-digit growth in its market capitalization.

USDC followed with a 43% increase, reaching $633 million, whereas GUSD, PAX, and USDT reported a rise of 17.8%, 14.5%, and 11.6%, respectively. Despite relatively restricted growth, however, USDT’s market cap remained the highest at $5.42 billion.

Source: ICO Analytics

On the other hand, TUSD and DAI were reporting a loss in their market cap. DAI, for instance, lost its standing due to the forced CDP liquidations that took place on 12 March.

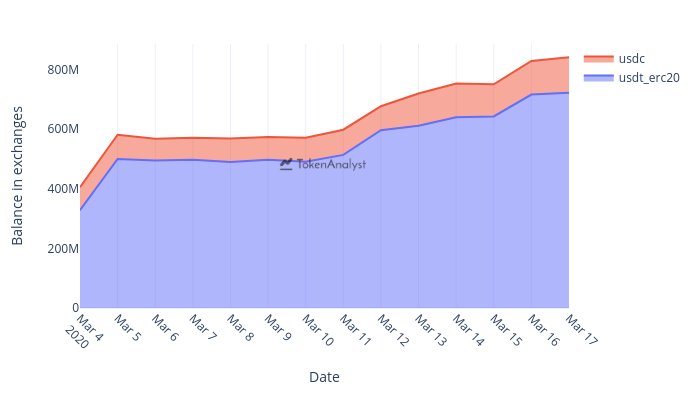

The rise in the market cap of stablecoins is indicative of the market hodling more in stablecoins that in cryptos to avoid any sudden movements in the market. The users, according to a report, have been holding their cryptos in exchanges, causing the stablecoin balances within exchanges to double.

In fact, according to a researcher at Token Analyst, the exchange balance in stablecoins over the past two weeks rose from $405 million to $840 million.

As per data collated by the researcher, $720 million USDT and $120 million USDC are available on exchanges in order to buy crypto.

Source: Token Analyst

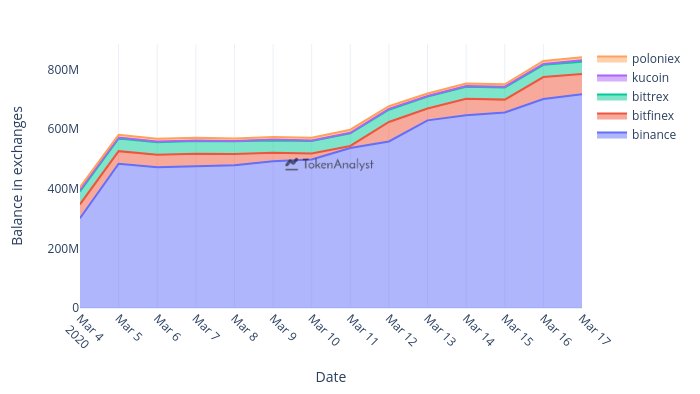

Out of the many prominent exchanges, Binance held 85% of the total stablecoins, whereas Bitfinex held only 8.3%.

Source: Token Analyst

While the market hodls more crypto-equivalents of cash, there has been an increased minting of these coins as well. As AMBCrypto reported previously, on 18 March, nearly 225 million stablecoins were minted in a 24-hour period.

However, stablecoins are not the only currencies being minted.

Treasury and Central Bank printing presses around the globe are working overtime in an attempt to save users from an on-setting recession. Central banks are pumping billions of dollars in the market with the Federal Reserve announcing the printing of more than $700 billion to stimulate the market.