Binance Coin, Monero, Compound Price Analysis: 25 November

Bitcoin Dominance hit 62% after a bounce from 61.5% over the past 36 hours. While it is not a perfect metric, altcoins need this number to continue to drop to enjoy further gains. Compound showed a bearish divergence between buying volume and price, while Monero still had bullish momentum on its side. Binance Coin bulls would look to keep the price above $32, in order to spring toward $35 over the coming days.

Binance Coin [BNB]

Source: BNB/USDT on TradingView

The region of support at $32 can be expected to be defended by BNB bulls if the price drops toward it. The RSI showed an uptrend in progress and notable bullish momentum remained for BNB.

This could change over the coming hours, and a trading session close beneath $32.75 could be an early sign of more selling to come.

The price recently hit the 62% Fibonacci extension level and could be set for a drop in the coming days. But in the near-term, the losses were yet to begin as BNB traded sideways over the past couple of days.

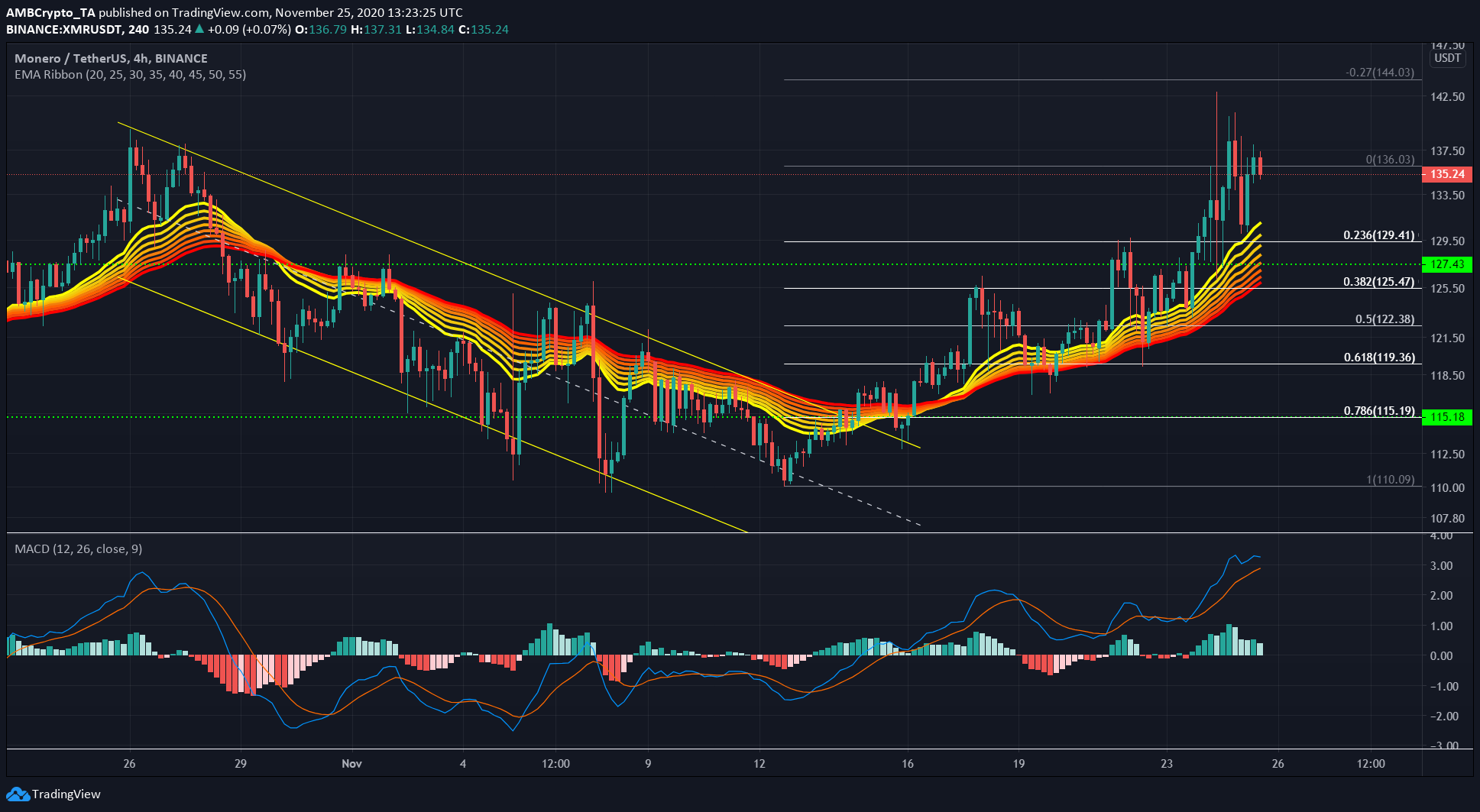

Monero [XMR]

Source: XMR/USDT on TradingView

The EMA ribbons showed that XMR is yet to slow down on its upward trajectory, although the turn to the downside could be right around the corner.

The price can expect to find some support from the ribbons, as well as the horizontal support at $127. A drop below this support level could give bears a foothold in the market.

The MACD also showed bullish momentum for XMR, and had not yet formed a bearish crossover between MACD and signal lines.

Compound [COMP]

Source: COMP/USDT on TradingView

The lending protocol has $1.7 billion in TVL, a number that has been rising steadily over the past eight weeks. However, over the past few days, the buying volume for COMP has been overwhelmed by the selling volume even as the price posted gains.

This divergence was unlikely to last very long, and a strong correction could be seen if COMP closed a trading session below the $125 support level.

The 20 SMA (white) could act as support for COMP but sellers have been deceptively stronger, a fact that could be brought to the fore in the coming days.