Assessing Chainlink’s state as it squares up against bears

- Whale started accumulating LINK as prices dropped.

- The derivatives market revealed a gloomy picture.

Decentralized oracle network Chainlink [LINK] also felt the ripples generated by the shock resignation of Binance [BNB] CEO Changpeng Zhao (CZ).

The crypto asset plunged to $13.44 during U.S. trading hours, losing more than 7% of its value, according to CoinMarketCap.

However, as prices fell, opportunistic players went into accumulation mode, leading to a retracement. LINK recovered to $14.17 at the time of publication.

Whales pick up LINK at discount

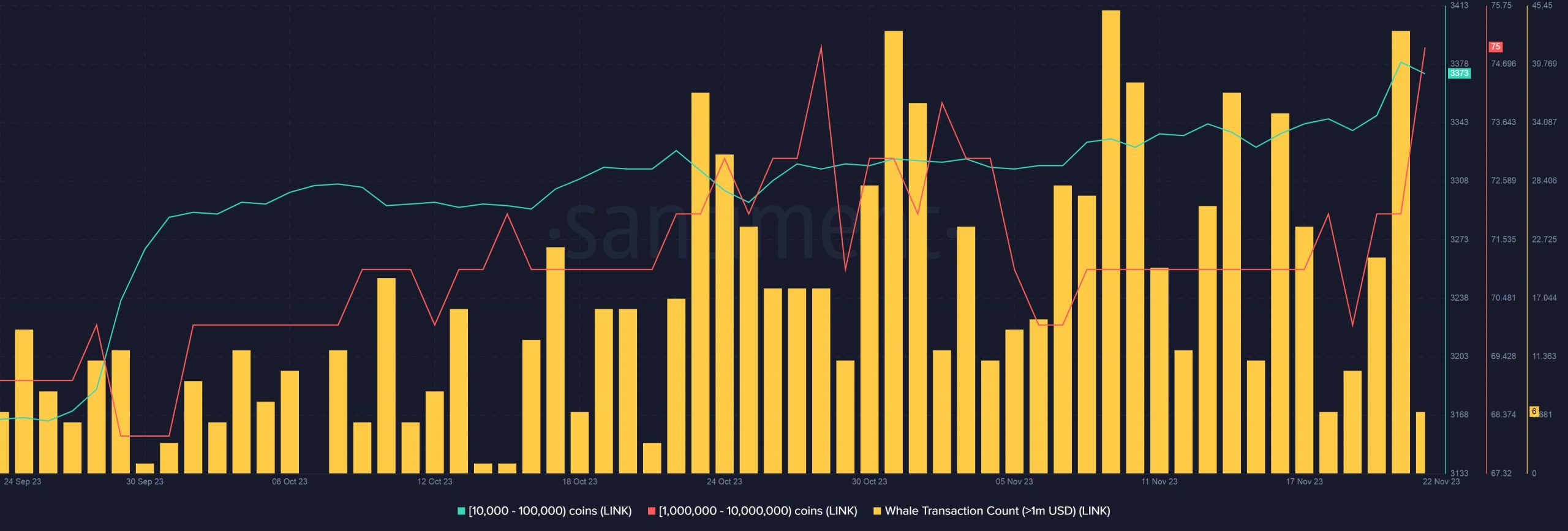

AMBCrypto examined the behavior of whale investors using Santiment’s data and found the aforesaid observation to be accurate. Transactions worth more than $1 million surged dramatically in the last 24 hours.

The transactions resulted in a significant increase in holdings of specific user cohorts. The addresses owning 10,000-100,000 tokens and 1 million — 10 million tokens climbed sharply in the last 24 hours.

The buying frenzy indicated that there was optimism about the near-term outlook of LINK. Having said that, this is not investment advice, and readers should conduct their own research.

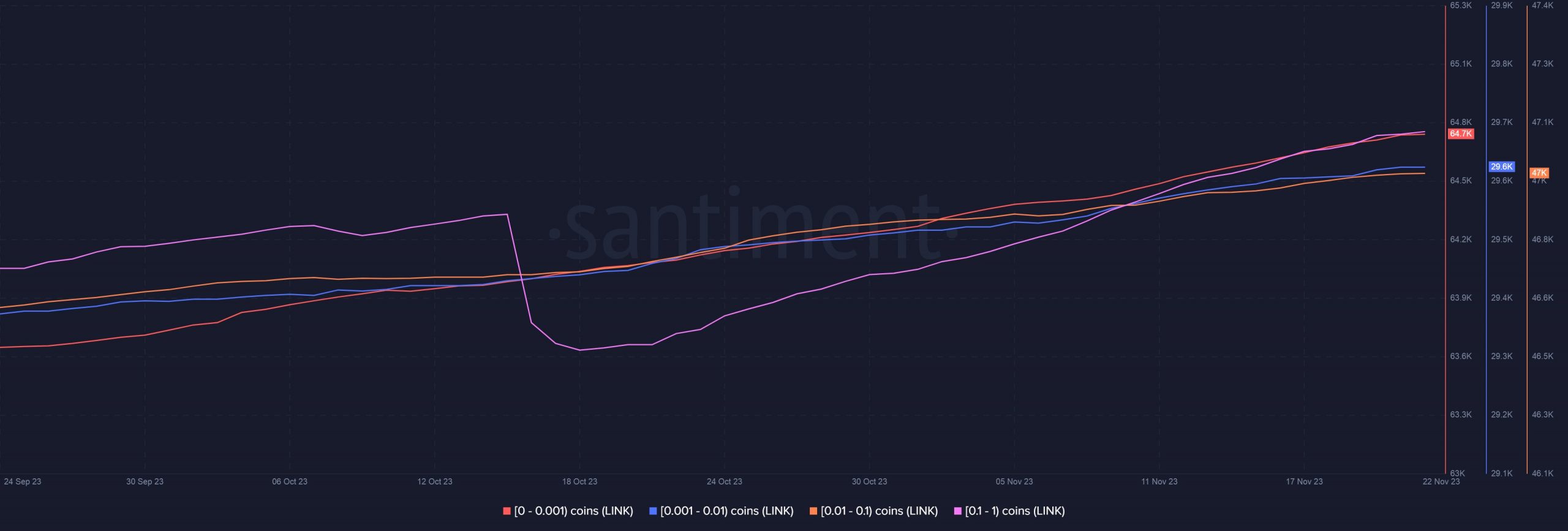

Additionally, retail investors, who hold a tiny fraction of whales’ holdings, were also seen opening their bags. This underscored that LINK’s demand was not restricted to any particular user base.

What do analysts say?

LINK’s upside potential was also examined by popular on-chain analysts. Ali Martinez noted that LINK entered a “key demand zone” between $13.8 and $14.20. This was because as many as 11,470 wallets accumulated LINK tokens in this range.

Martinez predicted that there was a strong likelihood of LINK attaining yearly peaks if it succeeds in staying above the range.

Realistic or not, here’s LINK’s market cap in BTC’s terms

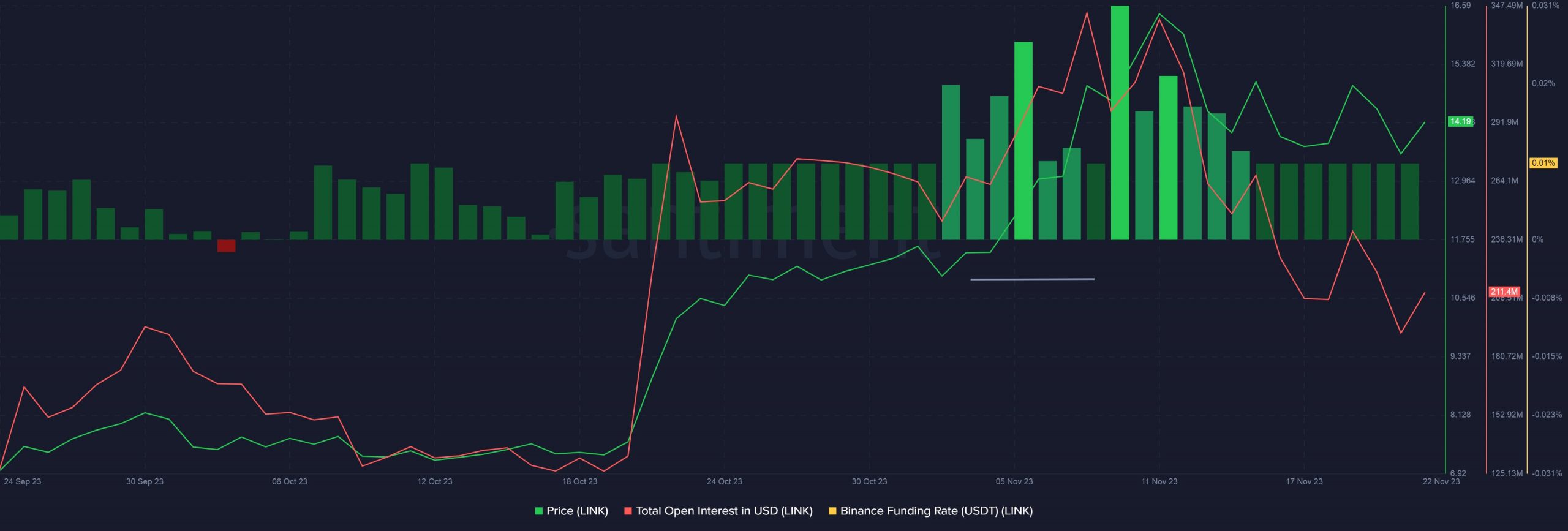

LINK’s Open Interest falls sharply

LINK’s price dip also caused a decline in the dollar value locked in active futures contracts. As per AMBCrypto’s analysis of Santiment’s derivatives market data, the Open Interest (OI) fell 38% over the last 10 days.

While the funding rates were still positive, the lighter shade of green implied that the bullish sentiment wasn’t strong as of this writing.