Altcoins under pressure as report suggests 2019’s performance is lagging behind 2018’s

2019 started slowly for altcoins, before exhibiting a major surge over April – June. However soon, the valuation for most of them all went south.

Most top altcoins performed relatively well against the US dollar. However, the year was slowly turning sour for many of them. Bitcoin faced a similar situation, but the world’s largest cryptocurrency did not suffer as much, and consolidated little lower than its yearly-high of $13,800. On the other hand, some of the alts were down by more than 60 percent from their year-to-date high.

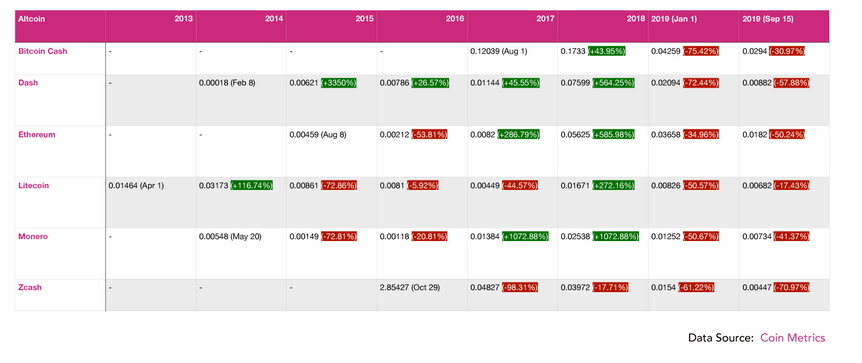

Longhash recently studied the performance of altcoins over the last two years, revealing to much of the crypto-community many interesting observations. The analysis included only those alts that have been around for a few years with Bitcoin, omitting the likes of EOS and Tron in the report. The price movements of the alts were denominated in terms of Bitcoin.

Altcoin Markets over the years, Source: Longhash

According to the chart, it can be seen that altcoins’ performance in 2019 has been very poor, when compared to 2018.

The top ‘popular’ alts registered a real trading volume of $16 million [Dash], $11 million [Bitcoin Cash], and $76 million [Litecoin], whereas Bitcoin recorded over $500 million [$768 million to be exact] over the last 24 hours.

The distinctions were even more high when Bitcoin’s on-chain transaction volume was compared to the alts. Bitcoin reported activities worth $1.3 billion, whereas Litecoin, supposedly BTC’s silvercounterpart, recorded only $20 million.

Speaking of one of the oldest trading altcoins, Litecoin was down by 66.73 percent, in comparison to Bitcoin over the last 6 years, at press time. With respect to mass popularity and adoption, Litecoin has not narrowed the gap between Bitcoin and itself.

The Bitcoin Dominance Index was measured to be 33 percent in January 2018 and at press time, it was 67.6 percent. Earlier last month, the dominance was around 70.6 percent, but due to Ethereum’s recent exploits and price pump, the dominance index had gone down.

The poor performance of these altcoins may suggest that the market is finally getting itself rid of coins it does not deem necessary to the market.