Bitcoin

A look into the effect weekends have on Bitcoin prices

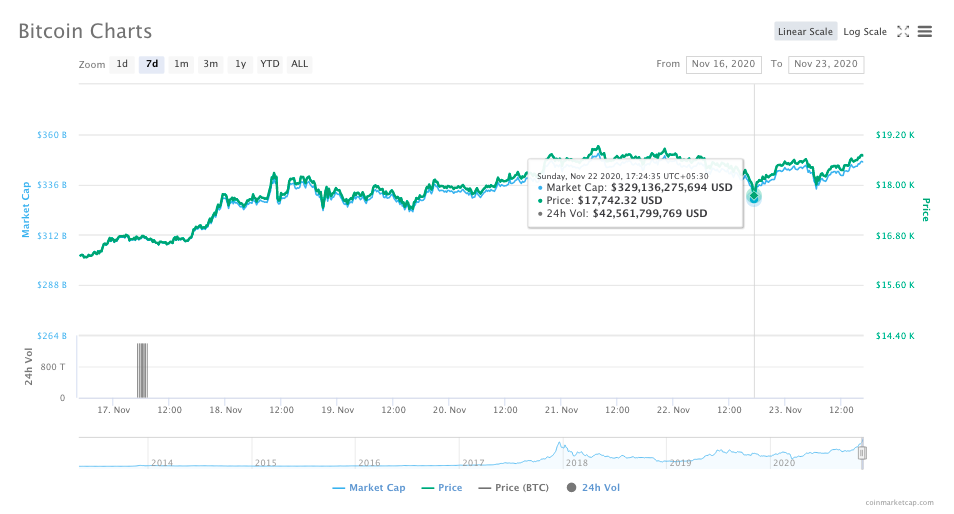

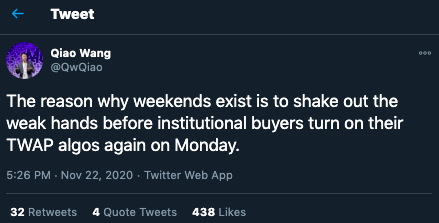

After shaking off the slow weekend, Bitcoin’s price is back above $18600. Bitcoin traded above the $18500 level for nearly 3 days before the weekend and then dropped to $18200, even lower on some spot exchanges. However, according to Entrepreneur Qiao Wang, Weekends exist for shaking off weak hands before institutions turn their algos back on, on Monday.

Bitcoin weekly price chart || Source: Coinmarketcap.com

Bitcoin’s price is experiencing a shake off even at the current price level above $18000. Rather than looking at this as a sign of correction or an upcoming price drop, Qiao’s perspective urges retail to look at Bitcoin’s price action rather optimistically, or like a maximalist.

Source: Twitter

Though there isn’t enough evidence to link the drop in volatility and price to institutional traders, they are notoriously popular for running their algos and trading bots to boosting liquidity and trade volume on spot exchanges. Institutional traders require ultra-low latency, and HFT is a lucrative option for them. Interestingly, the mainstream media has covered several stories of bot trading on top exchanges and this has even led to speculation of trade volume manipulation.

In his tweet, Qiao talks about weak hands, and he may be pointing to the fear of retail investors, seeing the 24-h return in red and the selling that follows after. One weekend is enough for a change of hands in a volatile asset like Bitcoin.

Crypto Twitter acknowledges this and even predicts the post-weekend price!

Source: Twitter

@MartiniGuyYT predicted this over the weekend on a Sunday, and Bitcoin is already trading above $18600. Based on the historical price data from coinmarketcap.com, Bitcoin has experienced some wild swings over the weekends.

The most significant and popular one was the all-time high of around $19600 on a Saturday in December 2017. A recent low of $15955 on a Sunday on November 15 was a weekend shake off after trading above $16000 for over 3 days. Since December 2019, around 82% of the weekends have seen a minimum of 3% move in either direction in Bitcoin prices and around 60% of the weekends have had a 5% or higher price move over a weekend. Wild price swings are common, and one on a weekend is no coincidence. It is recognized as a pattern by most traders now. Weekends may be the best time to stack them Bitcoins, next time you see a dip.