Bitcoin CME OI rises, but carries this potential price threat

The beginning of October was not pleasant for Bitcoin but Q4 2020 is beginning to soften up to the crypto asset. Listing a valuation above $13,000 for the 1st time in 2020, its price rise was impacting other market factors as well; notably the derivatives market.

Source: Twitter

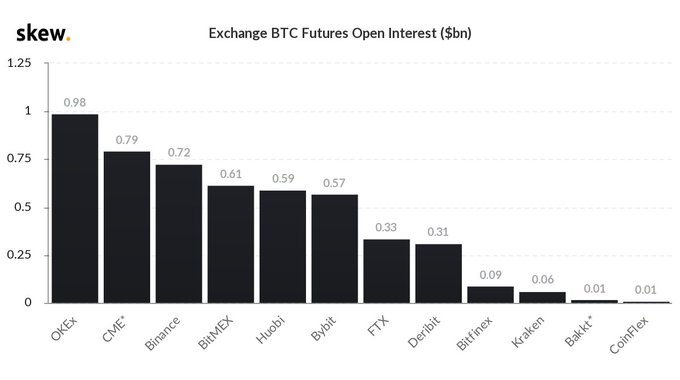

According to a recent Skew Chart, the Open-Interest for CME Bitcoin futures clocked in at 798 million, only behind OKEx BTC futures at the moment. It is an important development as earlier, CME’s OI would not be under comparable levels with respect to other exchanges such as Binance, Huobi, and OKEx.

CME Bitcoin Futures is the 2nd largest market at the moment so what?

The importance can be understood by keeping the past OIs in mind. Earlier in 2020, exchanges such as Binance, Huobi, OKEx, and even BitMEX also demonstrated a huge difference between their Open-Interest and CME’s OI.

Source: Skew

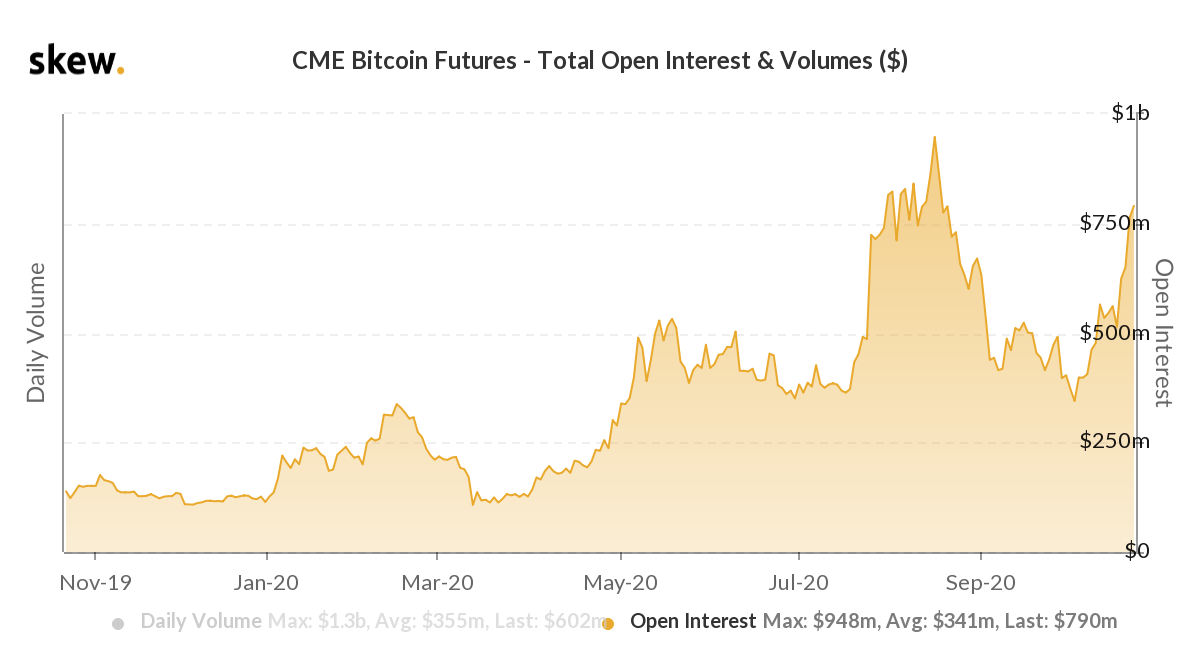

As observed in the above chart, until July end, CME OI rarely registered activity above the $500 million mark, while the likes of Binance and Huobi clocked in over $800 million consistently during the same period. The retail investors on these exchanges were absorbing the majority of the market but now, accredited investors were making their presence felt.

CME’s OI boost is a clear indication of heightened institutional involvement, but there might be a bear trap amidst all this if the trend shifts south.

CME OI dictated Bitcoin’s price in August-September

During BTC’s last peak on August 17th, CME OI was at a high of $948 million. Right after, CME’s OI was down to $633 million during th1 end of August, but Bitcoin continued to hold a high position above $12,000. However, 2-days later, BTC faced its collapse below $10,000. CME’s depreciating OI possibly restricted BTC’s recovery and a similar impact might unfold yet again.

According to OI analysis, high Open Interest in a bull market can be a dangerous signal. When a rising trend of Open Interest begins to reverse, expect a bear trend to get underway.

A price breakout can be much stronger if the OI continues to rise during price consolidation because more often than not, investors are caught between and are on the wrong side of the market when the breakout takes place.

Keeping these observations in mind, it will be critical to observe Bitcoin’s valuation and CME’s OI over the next few days.