Ethereum short-term Price Analysis: 23 October

A profitable past few days for Ethereum witnessed the largest altcoin jumped by more than $50 since October 20th. Rising from $361 to $416 at press time, Ethereum has managed to rally behind Bitcoin in the charts, taking a position above $400 for the first time since September 1st week. However, the excitement can be stopped-short as a period of correction might ensue over the next few days.

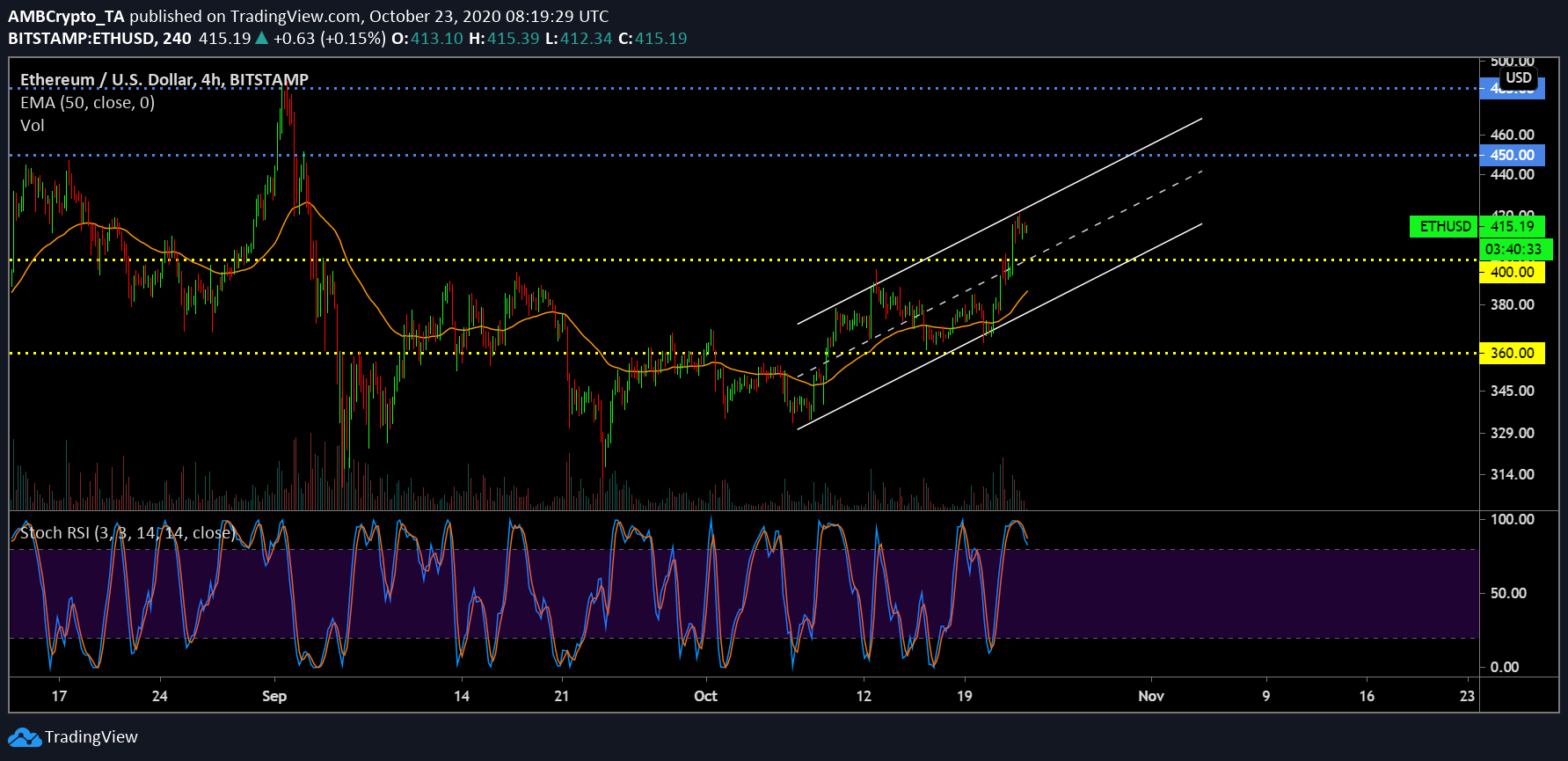

Ethereum 4-hour chart

Source: ETH/USD on Trading View

Ethereum’s 4-hour chart suggested that the token is currently oscillating within the trend lines of an ascending channel. While an ascending channel carries bearish implications, the drop over the next few hours might not breach the pattern. However, it is unlikely for Ethereum to re-test the next resistance at $450 without a period of correction.

Attaining back to back breach above resistance $380 and $400, Ethereum is valued at $415 at press time. Keeping that in mind, a possible re-test might surface until immediate support at $400. Stochastic RSI suggested a similar trend where a bearish crossover has already taken place in the overbought zone. While the 50-Moving Average continued to hover under the candles, the inconsistent volume suggested that a reversal is definitely possible.

Ethereum 1-hour chart

Source: ETH/USD on Trading View

Although shorts during a bullish rally is always a risky affair, a small window of opportunity can be available in the current market. A small-short trade can be entered at $420 with Ethereum, while profits can be taken at the $400 resistance. A close stop-loss should be kept at $430, completing the Risk/Reward ratio of 2x for the trade.

Awesome Oscillator or AO indicated that presence of bearish momentum but the grip was seen dwindling as the red candles started to diminish.

Relative Strength Index or RSI strongly indicated a sell-out in the short-term with the marker registering a position in the overbought zone a couple of times in the past 24-hours.