Ethereum’s hashrate complements rise in 32 ETH addresses

The ongoing developments associated with Ethereum 2.0 are real and significant.

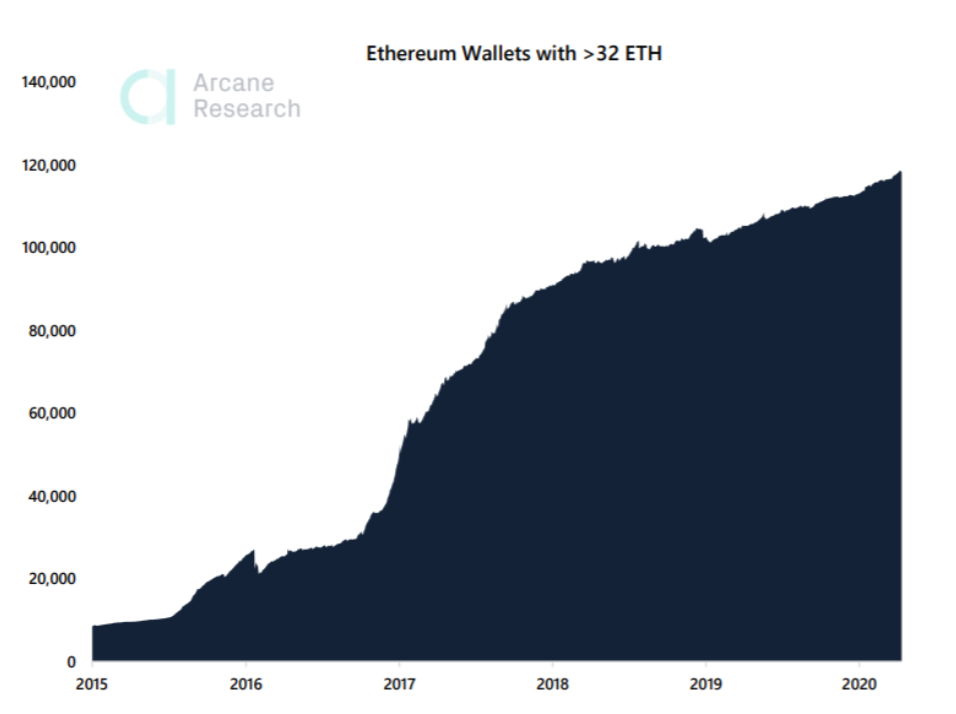

The 2.0 testnet which was introduced back in April 2020 received a lot of reception off the bat as the number of addresses with 32 ETH spiked, evidence of the rush to become validators on the Ethereum 2.0 network.

Consistent rewards of 4.6% to 10.3% on an annual basis seemed too good to be given a pass as the number of validators in the first week spiked over 18,000. Such a popular sentiment hasn’t slowed down over the last couple of months.

Source: Arcane Research

According to Arcane Research’s latest weekly update, the number of Ethereum wallets with more than 32 ETH has steadily improved over the course of 2020, with now close to 120,000 addresses eligible to be validators to utilize the functionality of staking. In fact, the number has spiked by 13 percent since the turn of last year.

However, the report was quick to highlight that there is a continuing lack of clarity with respect to wallet owners. The report added,

“There is not a 1:1 relationship between humans and wallets, so it is challenging to define how many people that are actually ready for staking.”

Ethereum 2.o Beacon chain Testnet data

To attain more transparency, we identified the number of present active validators on the testnet. Data from etherscan.io suggested that the number of active validators currently on the Beacon chain is 39653, backed by a total of 1,267,947 eligible Ether.

Now, although these validators may not be independent individuals per se, it is important to note their active status.

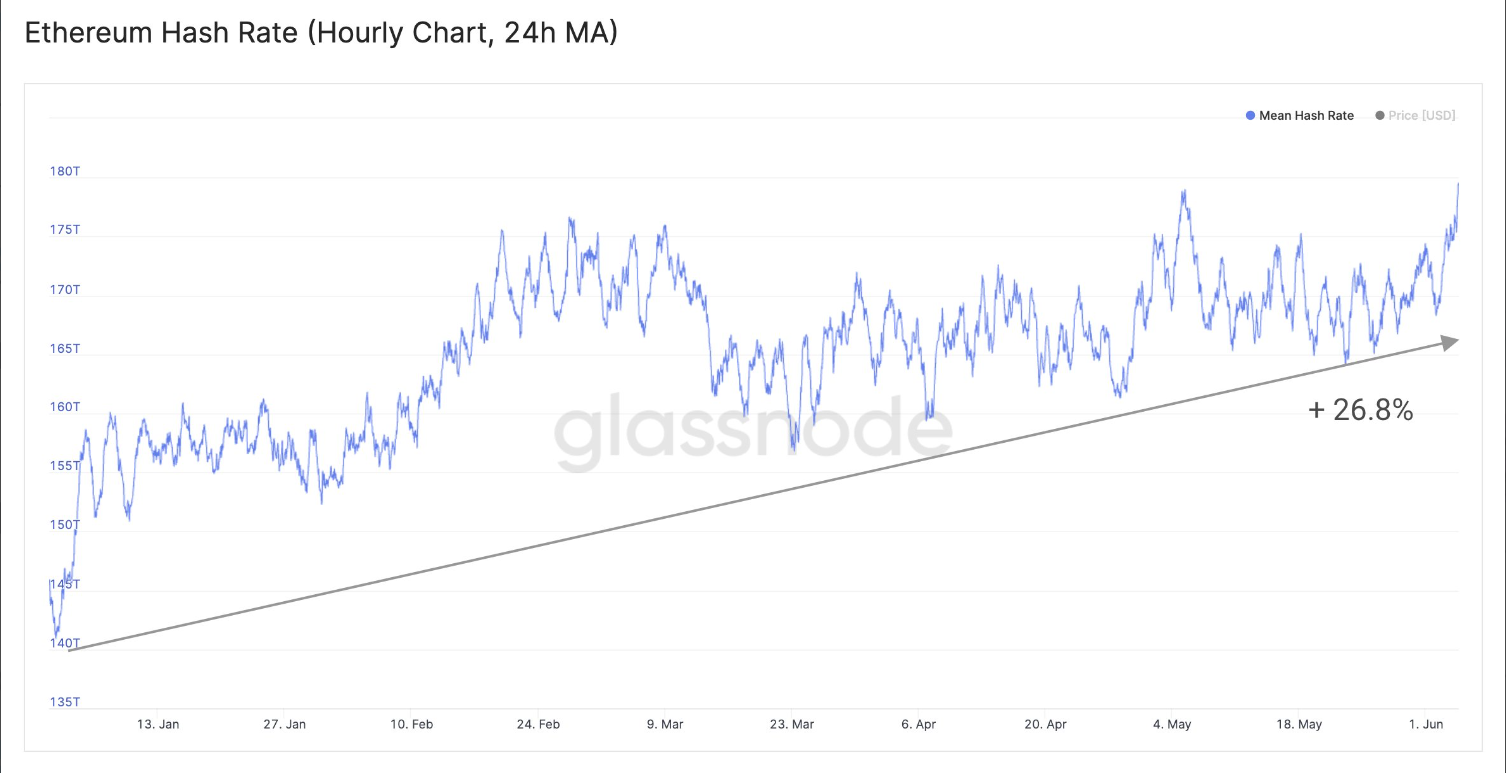

Source: Twitter

Ethereum’s blockchain isn’t complaining as well. A recent Glassnode tweet suggested that ETH’s hashrate had risen by 26.8 percent since the beginning of the year, with the same, at the time of writing, at its highest level in 7 months. The higher hashrate is a clear indication of a strong network, which in turn, is evidence of the present relevancy and strength of the token’s blockchain.

Ethereum 2.0 will improve Ether’s store-of-value?

From a very speculative point of view, Osho Jha, a blockchain enthusiast, had recently argued that staking would convert Ether into a positive carry asset. He expected the staking model to broaden ETH’s investor base by bringing about a higher level of price stability. These factors might improve its Store-of-Value credentials as investors would be eligible for consistent yields and assist in improving the scalability of the network.